KUALA LUMPUR (April 14): Bursa Malaysia closed flat on Friday (April 14), with the key index rising marginally by 0.1% on late bargain hunting, in line with the positive regional performance.

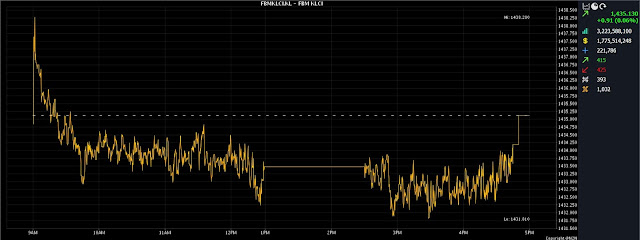

At 5pm, the FBM KLCI had edged up by 0.91 of a point to 1,435.13, from Thursday's close at 1,434.22.

The barometer index opened 0.62 point higher at 1,434.84, and moved between 1,431.81 and 1,438.28 throughout the day.

Turnover stood at 3.22 billion units worth RM1.75 billion.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng noted that key regional indices were also in positive territory following positive cues from Wall Street overnight.

“Investors are hoping that the weakening inflation rate in the US might prompt the US Federal Reserve and the European Central Bank to postpone or scale back plans for interest rate hikes,” he told Bernama.

Among the heavyweight counters, CIMB Group Holdings Bhd added three sen to RM5.23 a share, and Tenaga Nasional Bhd rose by six sen to RM9.21.

Malayan Banking Bhd (Maybank) at RM8.71, Public Bank Bhd at RM3.99, and Petronas Chemicals Group Bhd at RM7.40 were all flat.

As for the actives, Revenue Group Bhd rallied 8.5 sen to 40.5 sen, Hong Seng Consolidated Bhd gained half a sen to 13.5 sen, while CSH Alliance Bhd at 4.5 sen and TWL Holdings Bhd at five sen were both flat.

MyEG Services Bhd retreated two sen to 85.5 sen.

On the index board, the FBM Emas Index dropped 2.51 points to 10,568.91, the FBMT 100 Index trimmed 4.88 points to 10,246.77, and the FBM 70 index contracted by 53.80 points to 13,870.04.

The FBM ACE Index was 1.01 points lower at 5,368.18, while the FBM Emas Shariah Index earned 2.56 points to 10,942.84.

Sector-wise, the Plantation Index slid 26.21 points to 6,851.13, the Financial Services Index gave up 53.08 points to 15,734.20, and the Energy Index eased 8.53 points to 877.79.

The Industrial Products and Services Index inched up 0.16 of a point to 175.65.

The Main Market volume climbed to 2.17 billion units worth RM1.45 billion, from 2.15 billion units worth RM1.77 billion on Thursday.

Warrant turnover weakened to 263.79 million units worth RM46.42 million, against 334.62 million units worth RM53.38 million previously.

The ACE Market volume advanced to 779.03 million shares worth RM268.73 million, versus 576.09 million shares worth RM204.63 million.

Consumer products and services counters accounted for 230.91 million shares traded on the Main Market, followed by industrial products and services (468.06 million), construction (75.28 million), technology (627.52 million), special purpose acquisition companies (nil), financial services (54.26 million), property (311.75 million), plantation (26.39 million), real estate investment trusts (9.54 million), closed/funds (11,900), energy (52.37 million), healthcare (125.09 million), telecommunications and media (62.98 million), transportation and logistics (38.63 million), and utilities (50.80 million).

Source: The Edge

Comments

Post a Comment