KUALA LUMPUR, May 16 (Bernama) -- Bursa Malaysia ended slightly off its intraday high today on renewed hopes of a possible two interest rate cuts in the United States (US) this year.

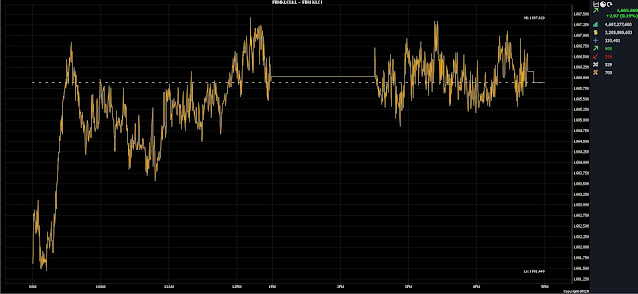

At 5 pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) bagged 7.88 points to 1,611.11 compared to yesterday’s close of 1,603.23, marking its highest level since March 2022.

The barometer index opened 1.15 points better at 1,604.38 and hit a high of 1,611.57 in the afternoon session.

Gainers outnumbered losers 720 to 492, with 456 counters unchanged, 700 untraded and 10 others suspended.

Turnover, however, decreased to 6.04 billion units worth RM4.35 billion from 6.20 billion units worth RM4.69 billion on Wednesday.

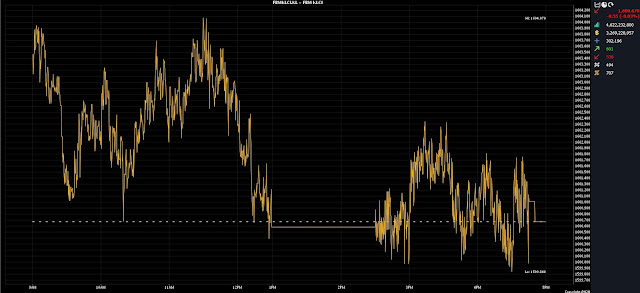

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng told Bernama that bargain hunting also contributed to today's uptrend, following a few sessions of consolidation mode.

"We remain positive about the recovery of global market sentiment.

"Furthermore, we anticipate this bullish momentum to drive the benchmark index towards the next resistance level of 1,615 as the bulls regain strength," he told Bernama.

Consequently, the FBM KLCI is expected to move within the 1,605-1,620 range towards the weekend, with immediate resistance at 1,615 followed by 1,635, and support at 1,600 followed by 1,585.

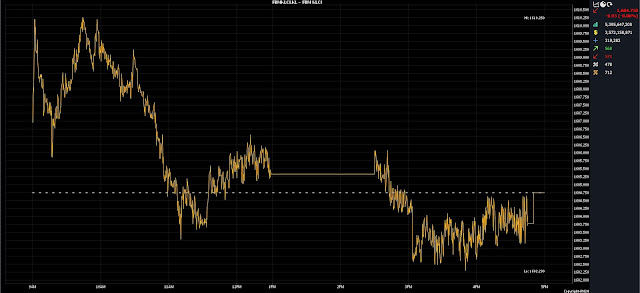

The domestic performance was in tandem with the US stock market, which registered fresh highs on the back of lighter-than-expected consumer price index (CPI) readings.

Additionally, investors also cheered Beijing's move to implement policies to support the purchase of unsold homes from distressed builders.

Back home, investors will be closely monitoring the first-quarter gross domestic product to be announced tomorrow, with markets projecting a higher-than-expected growth.

The Department of Statistics Malaysia (DOSM) recently forecast a growth of 3.9 per cent based on advance estimates.

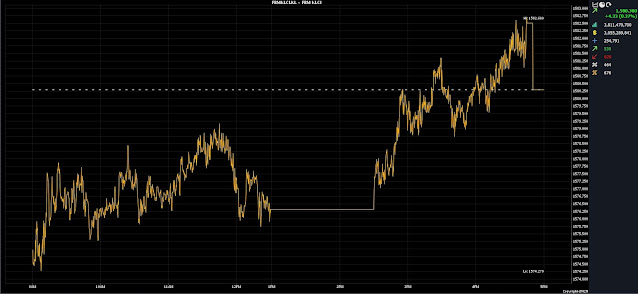

Among the heavyweights, Tenaga Nasional rose 26 sen to RM12.66, while Public Bank, Maybank and YTL Power bagged four sen each to RM4.19, RM9.92 and RM5.18 respectively.

Petronas Chemicals gained nine sen to RM6.90 and PPB climbed 18 sen to RM15.48.