KUALA LUMPUR (Aug 30): Bursa Malaysia ended mixed, with the local benchmark index hitting an intraday low at the close on Wednesday, driven by late profit-taking from selected telecommunications and media counters.

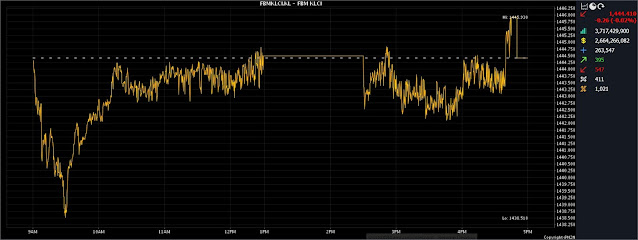

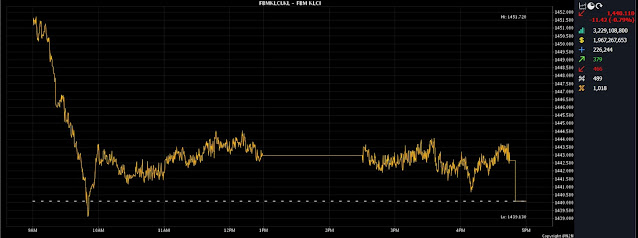

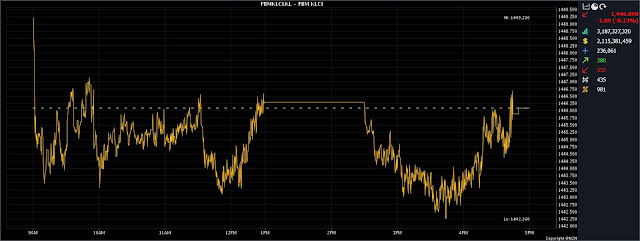

At 5pm, the FBM KLCI had fallen 2.50 points to 1,451.94, from 1,454.44 at Tuesday’s close.

The barometer index opened 1.79 points firmer at 1,456.23, and moved slightly up to 1,462.80 during the day, before the decline.

On the broader market, gainers and decliners were equal at 499, 423 counters were unchanged, 957 were untraded, and 70 others were suspended.

Bursa and its subsidiaries will be closed on Thursday for National Day, and will resume operations on Friday.

Turnover advanced to 4.90 billion units worth RM4.75 billion, against Tuesday’s 4.02 billion units worth RM2.85 billion.

Axiata Group Bhd and CelcomDigi Bhd were the top two contributors towards the local benchmark index’s downtrend.

Axiata lost 22 sen to RM2.36. CelcomDigi dropped five sen to RM4.38.

The two counters dragged down the composite index by a combined 4.25 points.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the key regional indices trended higher, following a positive cue from Wall Street overnight.

“The improved performance on Wall Street followed the release of new US economic data, which played a role in alleviating apprehensions regarding upcoming interest rate scenarios.

“Meanwhile, in an effort directed by the state to bolster growth in the world’s second-largest economy, China’s largest banks are preparing to reduce interest rates of existing mortgages and deposits,” he told Bernama.

On the domestic front, Thong remains optimistic in the midterm, given the strong support from foreign funds, but he expects trading to be muted towards the weekend, in conjunction with National Day.

Hence, he sees the KLCI to likely trend within the 1,455-1,465 range.

Among other heavyweights, Petronas Chemicals Group Bhd eased seven sen to RM7.12, Maxis Bhd shed six sen to RM4.01, Tenaga Nasional Bhd slipped eight sen to RM9.84, while Public Bank Bhd went up nine sen to RM4.23, and Mr DIY Group (M) Bhd put on six sen to RM1.55.

Of the actives, Ekovest Bhd edged up four sen to 54 sen, Iskandar Waterfront City Bhd recovered half a sen to 76.5 sen, Capital A Bhd was 1.5 sen higher to 97 sen, Top Glove Corp Bhd decreased 2.5 sen to 76.5 sen, and YTL Corp Bhd gave up seven sen to RM1.57.

On the index board, the FBM Emas Index lost 7.11 points to 10,740.70, the FBMT 100 Index weakened 10.50 points to 10,412.03, the FBM Emas Shariah Index was down by 33.32 points to 10,920.64, the FBM ACE Index went down 38.50 points to 5,217.97, while the FBM 70 Index improved by 16.96 points to 14,283.07.