KUALA LUMPUR (Jan 31): Bursa Malaysia’s key index was little changed while the broader market ended mixed on Wednesday, amid cautious sentiment prevailing across the region ahead of the US Federal Reserve’s (Fed) decision on interest rate later in the day, said a dealer.

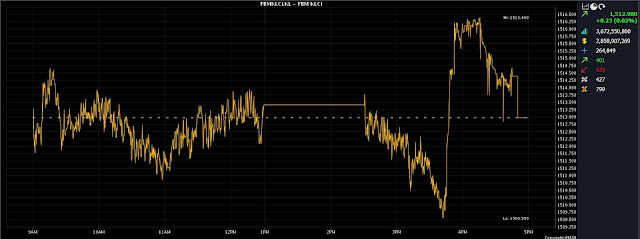

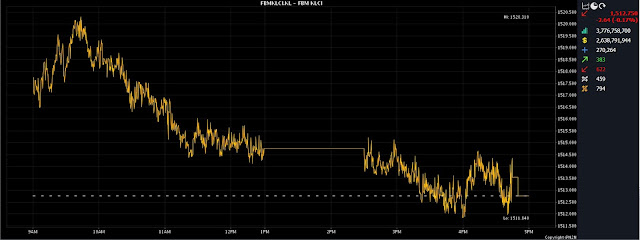

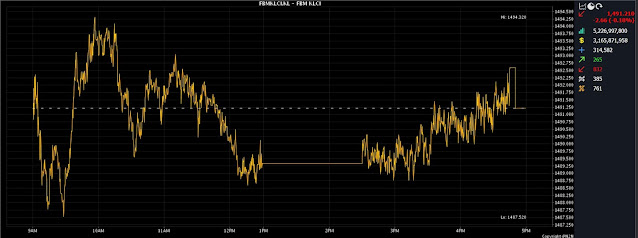

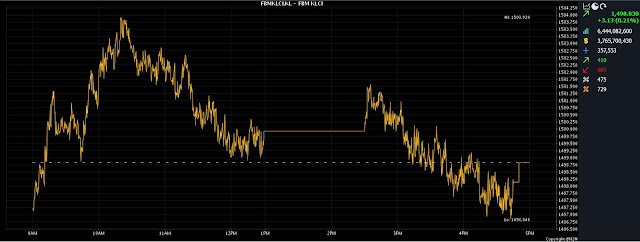

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) inched up 0.23 of a point to end at 1,512.98 from Tuesday's close of 1,512.75.

The barometer index opened 0.15 of a point easier at 1,512.6 and moved between 1,509.55 and 1,516.4 throughout the day.

Decliners led advancers 635 to 401 on the broader market, while 427 counters were unchanged, 799 untraded, and 52 others suspended.

Turnover declined to 3.67 billion units valued at RM2.86 billion from 3.78 billion units worth RM2.64 billion on Tuesday.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said the major regional indices also finished mixed on cautious sentiment as investors are awaiting the US Fed decision on interest rates during its first meeting in 2024.

The Fed is expected to deliberate on its monetary policy and make a decision on interest rates later in the day after its first Federal Open Market Committee meeting for this year.

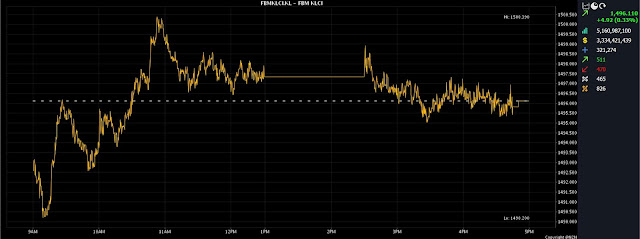

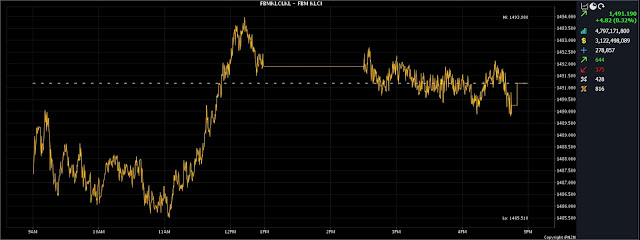

“On the domestic front, we advise investors to remain vigilant despite the benchmark index's upward trend, considering the heightened market volatility and global uncertainties.

“As such, we anticipate the FBM KLCI to trend within the range of 1,500-1,520 towards the weekend, with immediate resistance at 1,527 and support at 1,500,” he told Bernama.

Among the heavyweights, Maybank Bhd added two sen to RM9.26, CIMB Group Holdings Bhd edged up a sen to RM6.23, Tenaga Nasional Bhd gained 24 sen to RM10.72, while Public Bank Bhd slid a sen to RM4.39, and Petronas Chemicals Group Bhd lost six sen to RM6.77.

As for the actives, Reneuco Bhd shed seven sen to 8.5 sen, Perdana Petroleum Bhd, Velestro Energy Bhd, and Sapura Energy Bhd eased half a sen each to 26.5 sen, 26 sen and 4.5 sen, respectively, while TWL Holdings Bhd was flat at four sen.

On the index board, the FBM Emas Index was 13.51 points lower at 11,243.33, the FBMT 100 Index dropped 13.04 points to 10,903.82, the FBM 70 Index decreased 78.62 points to 15,185.92, the FBM Emas Shariah Index slipped 2.76 points to 11,278.09, and the FBM ACE Index fell 30.27 points to 4,755.03.

Sector-wise, the Property Index shed 5.19 points to 920.88, the Financial Services Index slid 7.68 points to 16,942.99, the Industrial Products and Services Index dipped 0.91 of a point to 173.11, while the Plantation Index declined 37.51 points to 7,170.86.

Meanwhile, the Energy Index climbed 15.92 points to 895.1.