KUALA LUMPUR (April 24): Bursa Malaysia closed at a two-year high on Wednesday with the key index rising 0.63%, driven by a positive outlook on the local bourse and amid an upbeat performance by regional peers.

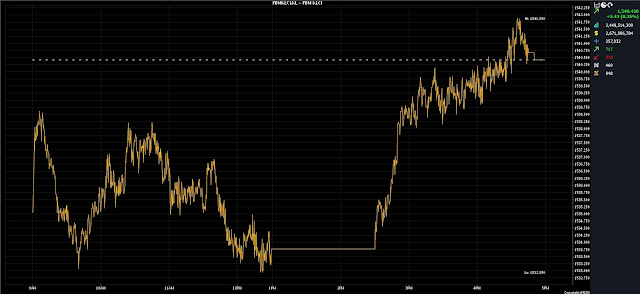

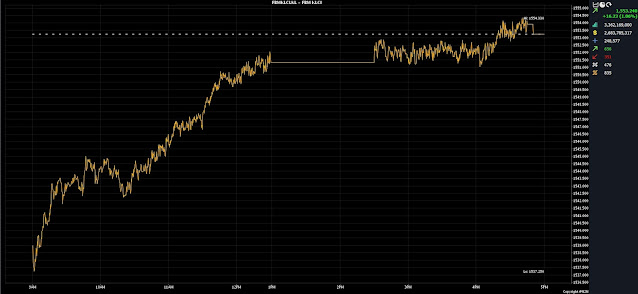

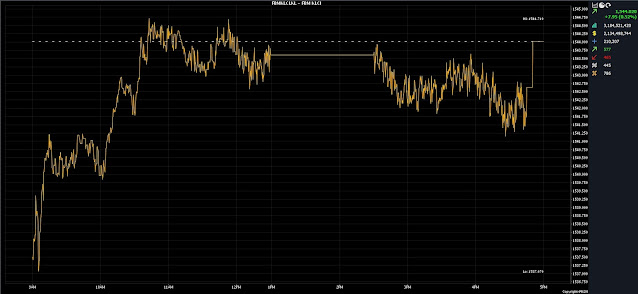

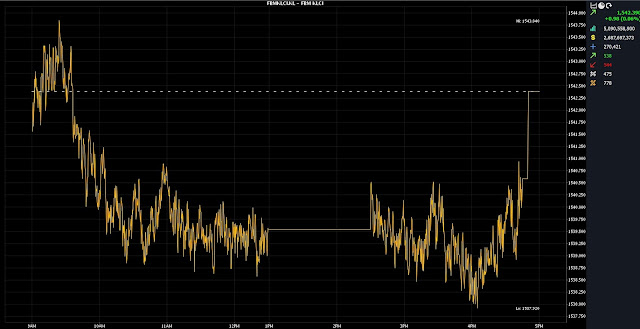

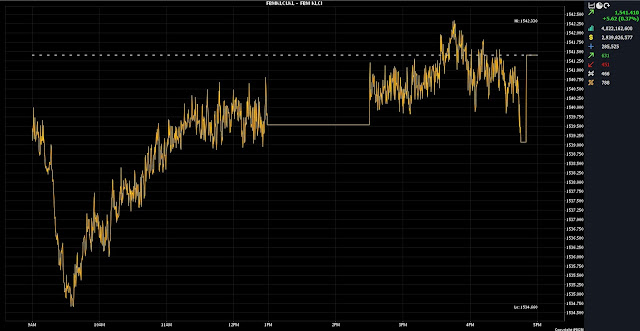

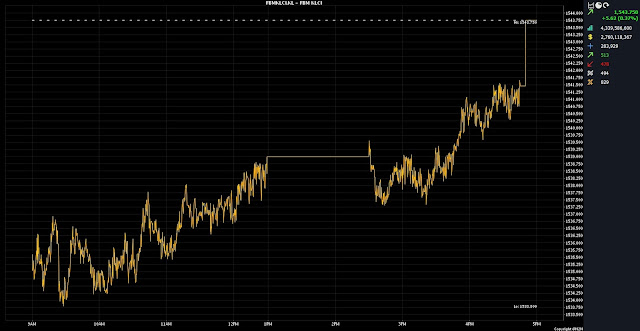

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 9.84 points to 1,571.48 from Tuesday's close of 1,561.64. The benchmark index, which opened 3.85 points higher at 1,565.49, moved between 1,564.89 and 1,572.48 throughout the trading session.

On the broader market, gainers surpassed decliners 777 to 327 while 480 counters were unchanged, 780 untraded and 21 others suspended.

Turnover improved to 4.25 billion units worth RM3.03 billion from 3.73 billion units worth RM2.79 billion on Tuesday.

Mohd Sedek Jantan, head of wealth research and advisory and designated portfolio manager at UOB Kay Hian Wealth Advisors, said the KLCI was driven by a positive outlook on the Malaysian market.

“This upsurge was primarily propelled by optimism towards the technology and semiconductor sectors, catalysed by Tesla's announcement of an earlier launch for its more affordable model in the first half of 2025, rather than the second half previously,” he said.

He said the accelerated schedule alleviated concerns regarding potential stagnation in the advancement of artificial intelligence (AI) and autonomous vehicles.

“In addition, the introduction of the more affordable model is anticipated to bolster the automotive industry and facilitate the scaling of AI training through augmented data from a larger vehicle fleet.

“Consequently, Malaysia stands poised to benefit from heightened semiconductor demand, leveraging its extensive expertise in the final stages of semiconductor manufacturing,” he said, adding that the conclusion of the KL20 Summit 2024 has outlined a definitive trajectory for Malaysia to emerge as a prominent chip powerhouse within Southeast Asia.