KUALA LUMPUR (April 10): Bursa Malaysia closed mixed on Monday (April 10) in sync with regional peers.

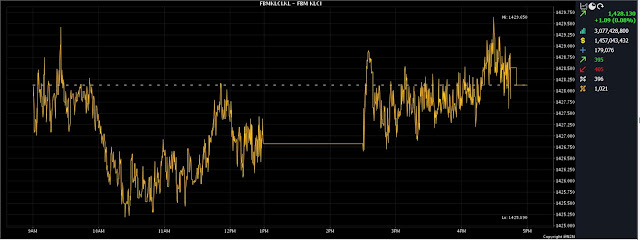

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) inched up 1.09 points to 1,428.13 from last Friday's closing of 1,427.04.

The barometer index opened 0.85 point higher at 1,427.89 and moved between 1,425.19 and 1,429.65 throughout the day.

The market breadth was negative as decliners led gainers 405 to 395, while 396 counters were unchanged, 1,021 untraded and 13 others suspended.

Turnover stood at 3.07 billion units worth RM1.45 billion.

Region-wise, Japan’s Nikkei 225 rose 0.42% to 27,633.66, South Korea’s Kospi gained 0.87% to 2,512.08, Singapore's Straits Times Index fell 0.18% to 3,294.43, while China's SSE Composite Index went down 0.37% to 3,315.36.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng expects bargain hunting in local stocks to continue given the lower valuation of the FBM KLCI.

“At present, the benchmark index is trading at 2023 forward price to earnings ratio of 13 times as compared with its five-year average of 15 times.

“Furthermore, buying support from foreign funds was rather apparent, hence we reckon the index to show a more positive performance and expect it to hover between the 1,425 and 1,440 range for the week,” he told Bernama.

Meanwhile, Thong said traders had increasingly become convinced that the US Federal Reserve will cut rates in the second half to avoid an economic downturn.

Among the heavyweights, CIMB Group Holdings Bhd added two sen to RM5.18, while Malayan Banking Bhd declined one sen to RM8.65, Public Bank Bhd slipped one sen to RM3.98, Petronas Chemicals Group Bhd trimmed 10 sen to RM7.40, and Tenaga Nasional Bhd shed five sen to RM9.18.

As for the actives, Top Glove Corp Bhd advanced eight sen to RM1.15, Aimflex Bhd rose half-a-sen to 17.5 sen, Zen Tech International Bhd was flat at 2.5 sen, and BSL Corp Bhd was unchanged at five sen, while Fitters Diversified Bhd lost two sen to five sen.

On the index board, the FBM Emas Index added 22.64 points to 10,501.09, the FBMT 100 Index put on 23.68 points to 10,184.72, the FBM 70 Index rose 97.56 points to 13,736.31, the FBM Emas Shariah Index perked up 22.649 points to 10,501.09, while the FBM ACE Index was 23.14 points lower at 5,303.54.

Sector-wise, the Financial Services Index edged up 2.85 points to 15,704.12, the Plantation Index increased 76.05 points to 6,807.72, and the Energy Index added 0.9 of-a-point to 864.41, while the Industrial Products and Services Index eased 0.59 of-a-point to 174.16.

The Main Market volume improved to 2.08 billion units worth RM1.23 billion from 1.74 billion units worth RM1.23 billion last Friday.

Warrants turnover slid to 120.21 million units worth RM10.95 million against 133.69 million units worth RM11.3 million previously.

The ACE Market volume jumped to 868.38 million shares worth RM207.34 million versus 460.49 million shares worth RM142.29 million last Friday.

Consumer products and services counters accounted for 266.58 million shares traded on the Main Market, industrial products and services (754.80 million), construction (62.04 million), technology (147.31 million), SPAC (nil), financial services (35.08 million), property (211.26 million), plantation (21.81 million), REITs (5.17 million), closed/fund (49,400), energy (145.38 million), healthcare (299.53 million), telecommunications and media (65.20 million), transportation and logistics (51.15 million), and utilities (21.54 million).

Source: The Edge

Comments

Post a Comment