KUALA LUMPUR (April 20): Bursa Malaysia closed lower on Thursday (April 20) amid muted trading, as investors retreated to the sidelines ahead of the extended weekend Hari Raya Aidilfitri festive break, an analyst said.

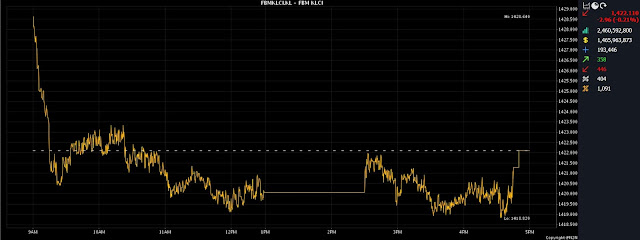

At 5pm, the FBM KLCI had slipped 2.96 points, or 0.21% lower, to 1,422.11, from Wednesday's close at 1,425.07.

The barometer index opened 3.57 points firmer at 1,428.64, its intraday day. It hit an intraday low of 1,418.82, before paring losses.

Market breadth was negative, as decliners surpassed gainers 446 to 358, while 404 counters were unchanged, 1,091 untraded, and 18 others suspended.

Turnover narrowed to 2.46 billion units valued at RM1.46 billion, from 3.14 billion units valued at RM1.76 billion on Wednesday.

Malacca Securities Sdn Bhd senior analyst Kenneth Leong said the flattish performance was also due to caution over US recessionary risks, after the US Federal Reserve warned recently that access to credit had become tougher since last month's banking crisis in the US.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said investors were also taking a wait-and-see approach ahead of the domestic earnings season, with a mixed performance from Wall Street overnight contributing to the downbeat sentiment in Malaysia and elsewhere in the region.

"Investors seemed reluctant to make more significant moves, ahead of the long Aidilfitri holiday break," he told Bernama.

Heavyweight stocks Malayan Banking Bhd (Maybank) gained one sen to RM8.70 a share, Public Bank Bhd shed four sen to RM3.93, and Petronas Chemicals Group Bhd lost one sen to RM7.20.

CIMB Group Holdings Bhd slid three to RM5.19, and CelcomDigi Bhd reduced five sen to RM4.38.

Among the actives, MyEG Services Bhd slipped four sen to 78 sen, and Salutica Bhd plunged 34.5 sen to 81.5 sen.

Supermax Corp Bhd fell 4.5 sen to 85.5 sen, while Revenue Group Bhd added half a sen to 40.5 sen, and SMRT Holdings Bhd rose five sen to 66.5 sen.

On the index board, the FBM Emas Index declined 24.84 points to 10,450.96, the FBMT 100 Index lost 24.31 points to 10,135.71, and the FBM Emas Shariah Index pulled down 31.01 points to 10,775.32.

The FBM ACE Index was 9.10 points weaker at 5,343.49, and the FBM 70 index gave up 45.90 points to 13,645.22.

Sector-wise, the Industrial Products and Services Index ticked up 0.79 of a point to 173.16, while the Plantation Index dropped 18.20 points to 6,833.52.

The Financial Services Index declined 24.72 points to 15,665.86, and the Energy Index shrank 5.20 points to 854.99.

The Main Market volume narrowed to 1.76 billion units valued at RM1.25 billion, from 2.12 billion units valued at RM1.45 billion on Wednesday.

Warrant turnover fell to 226.20 million units worth RM27.28 million, against 367.83 million units worth RM52.82 million previously.

The ACE Market volume reduced to 463.53 million shares worth RM186.69 million, versus 650.69 million shares worth RM258.92 million.

Consumer products and services counters accounted for 287.91 million shares traded on the Main Market, industrial products and services (517.86 million), construction (46.72 million), technology (362.59 million), special purpose acquisition companies (nil), financial services (50.92 million), property (166.15 million), plantation (20.80 million), real estate investment trusts (6.89 million), closed/funds (30,900), energy (66.33 million), healthcare (130.48 million), telecommunications and media (51.59 million), transportation and logistics (16.51 million), and utilities (44.82 million).

Bursa and its subsidiaries will be closed on Friday (April 21) and next Monday (April 24), in conjunction with the additional Aidilfitri holiday.

Trading will resume next Tuesday (April 25).

Source: The Edge

Comments

Post a Comment