KUALA LUMPUR (Nov 30): The FTSE Bursa Malaysia KLCI (FBM KLCI) recouped after a weak opening and finished in positive territory on Thursday thanks to late buying on Dialog Group Bhd, CelcomDigi Bhd and Nestle (M) Bhd stocks, a dealer said.

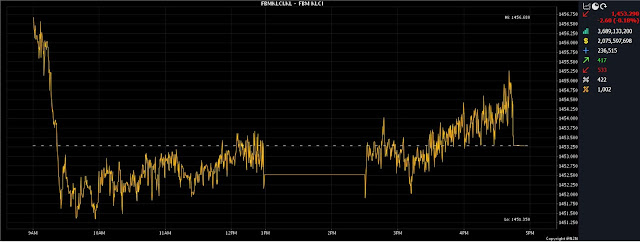

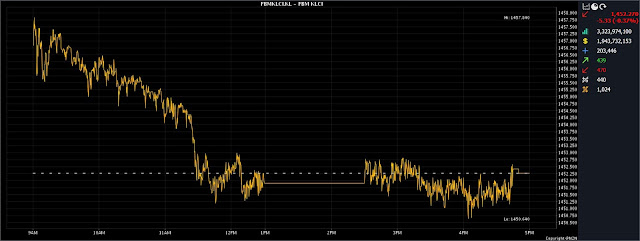

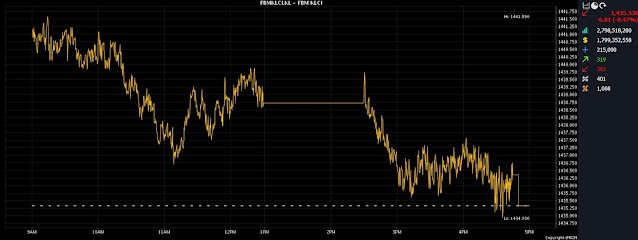

At 5pm, the FBM KLCI gained 0.46% or 6.67 points to an intra-day high of 1,452.74 from Wednesday’s close of 1,446.07.

The benchmark index opened 1.73 points weaker at 1,444.34 and moved between 1,440.62 and 1,452.74 throughout the trading session.

However, market breadth remained negative, with decliners outpacing gainers by 626 to 328, while 419 counters were unchanged, 995 untraded and 63 others suspended.

Turnover expanded to 4.25 billion units worth RM4.97 billion from 3.28 billion units valued at RM2.27 billion on Wednesday.

Rakuten Trade equity research vice-president Thong Pak Leng said the regional markets closed mostly higher, driven by late buying activity, with investors anticipating a potential interest rate cut by the US Federal Reserve (Fed) next year.

The latest US data underscores a resilient economy in the third quarter of 2023 and a simultaneous decline in inflation, heightening the likelihood that the Fed might consider implementing interest rate cuts earlier than originally projected.

Sentiment was further buoyed by China's lacklustre economic data, suggesting more government support is needed to help shore up growth in the world's second-largest economy.

“As for the local bourse, we expect bargain hunting to continue, spurred by the benchmark index's comparatively lower valuations against its regional counterparts accompanied by continuous inflow of foreign funds.

"Hence, we foresee the FBM KLCI trending higher, likely within the range of 1,450-1,460 towards the weekend,” Thong told Bernama.

Among heavyweights, CelcomDigi rose 21 sen to RM4.34, Petronas Chemicals Group Bhd advanced 14 sen to RM7.22, Dialog went up 14 sen to RM2.21, Nestle increased RM3.70 to RM125.40, Tenaga Nasional Bhd gained 11 sen to RM9.99 and Public Bank Bhd added three sen to RM4.27.