KUALA LUMPUR (April 12): Bursa Malaysia snapped a three-day winning streak to end marginally lower on Wednesday (April 12), dragged by profit-taking, said a dealer.

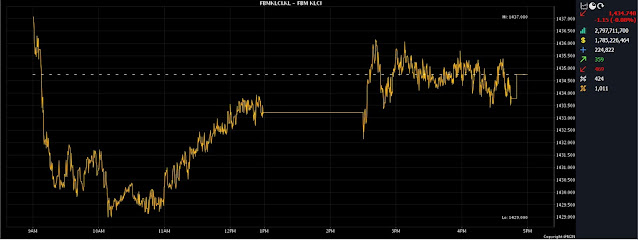

At 5pm, the FBM KLCI had slipped by 1.15 points to 1,434.74, from Tuesday's close at 1,435.89.

The barometer index opened 1.13 points higher at 1,437.02, and moved between 1,429.00 and 1,437.08 throughout the day.

Market breadth was negative, as decliners surpassed gainers 469 to 359, while 424 counters were unchanged, 1,011 untraded, and 23 others suspended.

Turnover stood at 2.79 billion units worth RM1.78 billion.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said that regionally, the key indices closed mixed, following the mixed cue from global equities overnight.

Besides, investors were cautiously awaiting the US Consumer Price Index data to be released on Wednesday night.

“Despite the cautious sentiment in the region, we expect the outlook for the local equity market to remain positive, due to undemanding valuations and improving economic conditions.

“As such, we anticipate the KLCI to trend within the 1,430-1,445 range for the remainder of the week,” he told Bernama.

Among the heavyweights, Malayan Banking Bhd (Maybank) decreased three sen to RM8.70 a share, Tenaga Nasional Bhd slipped 12 sen to RM9.01, CIMB Group Holdings Bhd rose two sen to RM5.24, Public Bank Bhd gained three sen to RM4.02, and Petronas Chemicals Group Bhd increased three sen to RM7.39.

As for the actives, Revenue Group Bhd added six sen to 33 sen, Hong Seng Consolidated Bhd gained half a sen to 13 sen, MyEG Services Bhd perked up 2.5 sen to 77 sen, while Velesto Energy Bhd shed half a sen to 23 sen, and Top Glove Corp Bhd dropped three sen to RM1.12.

On the index board, the FBM Emas Index improved 1.17 points to 10,555.96, the FBM 70 index put on 29.11 points to 13,814.87, the FBMT 100 Index gave up 0.90 of a point to 10,234.58, the FBM Emas Shariah Index fell 8.96 points to 10,902.97, and the FBM ACE Index was 37.43 points lower at 5,308.90.

Sector-wise, the Financial Services Index garnered 1.25 points to 15,784.92, the Energy Index expanded by 9.74 points to 882.56, the Plantation Index rose 17.44 points to 6,857.97, and the Industrial Products and Services Index eased 0.07 of a point to 175.21.

The Main Market volume declined to 1.90 billion units worth RM1.56 billion, from 2.14 billion units worth RM1.57 billion on Tuesday.

Warrant turnover shrank to 316.66 million units worth RM44.99 million, against 381.61 million units worth RM68.98 million previously.

The ACE Market volume advanced to 574.44 million shares worth RM176.68 million, versus 524.51 million shares worth RM188.01 million.

Consumer products and services counters accounted for 282.45 million shares traded on the Main Market, followed by industrial products and services (314.16 million), construction (73.43 million), technology (406.05 million), special purpose acquisition companies (nil), financial services (49.79 million), property (201.58 million), plantation (28.04 million), real estate investment trusts (4.04 million), closed/funds (46,700), energy (182.69 million), healthcare (178.54 million), telecommunications and media (58.59 million), transportation and logistics (81.42 million), and utilities (43.71 million).

Source: The Edge

Comments

Post a Comment