KUALA LUMPUR (April 25): Bursa Malaysia ended the day higher due to bargain-hunting activities for selected plantation heavyweights during the final hour of trading, said an analyst.

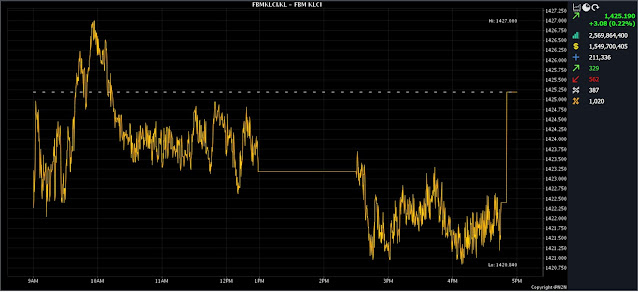

At 5pm on Tuesday (April 25), the FBM KLCI had climbed 3.08 points to 1,425.19, from last Thursday’s close at 1,422.11.

The barometer index opened 0.16 of a point higher at 1,422.27, and moved between 1,420.84 and 1,427.00 throughout the day.

Market breadth, however, was negative, with decliners outnumbering gainers 562 to 329, while 387 counters were unchanged, 1,020 untraded, and 19 others suspended.

Turnover stood at 2.57 billion units worth RM1.55 billion.

Plantation stocks were higher as investors reacted positively to the news of cooperation with China, after the recent signing of a memorandum of understanding (MOU) in Beijing.

The MOU inked between the Malaysian Palm Oil Board (MPOB) and the China Chamber of Commerce for Import and Export of Foodstuffs, Native Produce and Animal By-Products further broadened cooperation between the two countries in the trade of palm oil, apart from strengthening Malaysia’s position and market share in the Chinese market.

The MPOB said Malaysia’s exports of palm oil and palm-based products to China are expected to increase this year following the cooperation.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said key regional indices ended mostly lower due to heavy selling in the technology sector amid concerns over a slowdown in earnings.

Meanwhile, investors also fear the increasing impact of high interest rates and tightening economic conditions, which would have negative impact on earnings broadly, he said.

“As for the local bourse, we expect trading to be muted this week due to the Hari Raya Aidilfitri festivities.

“Nonetheless, investors are alert to bargain-hunting opportunities given the cheap valuations of the benchmark index,” he told Bernama.

As such, Thong said Rakuten Trade anticipates the KLCI to trend within the 1,420-1,435 range for the week.

“From a technical point of view, we spot immediate resistance at 1,440, with support at 1,415,” he added.

Among the heavyweight counters, Malayan Banking Bhd (Maybank) eased five sen to RM8.65 a share, while CIMB Group Holdings Bhd was three sen lower at RM5.16.

Public Bank Bhd at RM3.93 and Petronas Chemicals Group Bhd at RM7.20 were both flat.

CelcomDigi Bhd at RM4.41 and Tenaga Nasional Bhd at RM8.93 had gained three sen each.

As for the actives, Jade Marvel Group Bhd fell one sen to 26.5 sen, Salutica Bhd rose 23.5 sen to RM1.05, and SMRT Holdings Bhd inched up half sen to 67 sen. while BSL Corp Bhd was flat at five sen.

On the index board, the FBM Emas Index gained 12.14 points to 10,463.10, the FBMT 100 Index was 13.74 points higher at 10,149.45, and the FBM Emas Shariah Index increased 31.21 points to 10,806.53.

The FBM ACE Index was 23.85 points lower at 5,319.64, and the FBM 70 index fell 15.60 points to 13,629.61.

Sector-wise, the Industrial Products and Services Index shaved 1.20 points to 171.96, the Financial Services Index shrank 42.02 points to 15,623.84, while the Plantation Index climbed 95.09 points to 6,928.61.

The Main Market volume slid to 1.72 billion units valued at RM1.30 billion, from 1.76 billion units valued at RM1.25 billion last Thursday.

Warrant turnover rose to 330.86 million units worth RM46.15 million, against 226.20 million units worth RM27.28 million previously.

The ACE Market volume increased to 517.91 million shares worth RM197.01 million, versus 463.53 million shares worth RM186.69 million last Thursday.

Consumer products and services counters accounted for 302.32 million shares traded on the Main Market, followed by industrial products and services (568.18 million), construction (33.62 million), technology (194.27 million), special purpose acquisition companies (nil), financial services (54.16 million), property (130.39 million), plantation (20.41 million), real estate investment trusts (4.79 million), closed/funds (69,300), energy (112.20 million), healthcare (150.66 million), telecommunications and media (51.68 million), transportation and logistics (33.04 million), and utilities (61.26 million).

Bursa and its subsidiaries were closed from last Friday to Monday, in conjunction with the Hari Raya Aidilfitri holidays.

Source: The Edge

Comments

Post a Comment