KUALA LUMPUR (April 7): Bursa Malaysia snapped a three-day losing streak to end the week slightly higher on Friday (April 7), with the main index inching up 0.15% on bargain hunting, a dealer said.

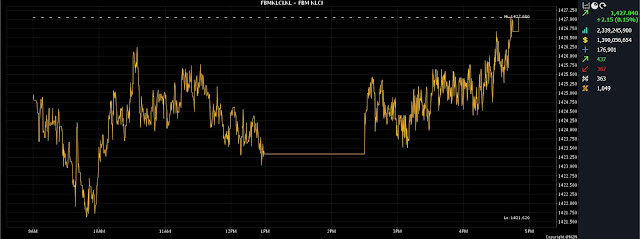

At 5pm, the FBM KLCI had risen 2.15 points to 1,427.04, from Thursday's closing at 1,424.89.

The barometer index opened 0.03 of a point lower at 1,424.86, and traded sideways during the morning session, but was lifted up towards the end of trading hours. It moved between 1,421.62 and 1,427.08 during the day.

Market breadth was positive, as gainers beat decliners 437 to 367, while 363 counters were unchanged, 1,049 untraded, and 13 others suspended.

Turnover narrowed to 2.33 billion units worth RM1.39 billion, versus 2.50 billion units worth RM1.54 billion on Thursday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the KLCI’s rise was in tandem with the positive regional performance following Wall Street’s advance overnight.

"Key regional indices trended mostly higher, as investors took the opportunity to bargain hunt stocks at lower levels following Thursday's selldown," he told Bernama.

Among the heavyweight counters, Malayan Banking Bhd (Maybank) gained one sen to RM8.66 a share, Public Bank Bhd fell two sen to RM3.99, and Petronas Chemicals Group Bhd jumped 25 sen, or 3.45%, to RM7.40.

CIMB Group Holdings Bhd lost 10 sen to RM5.16, and Tenaga Nasional Bhd trimmed two sen to RM9.23.

As for the actives, Top Glove Corp Bhd edged up five sen to RM1.07, Sunsuria Bhd rose 2.5 sen to 64 sen, and Careplus Group Bhd increased 1.5 sen to 35.5 sen.

Techna-X Bhd gained half a sen to two sen, while Computer Forms (Malaysia) Bhd eased 1.5 sen to 22.5 sen.

On the index board, the FBM Emas Index rose 23.30 points to 10,478.44, the FBMT 100 Index gained 20.49 points to 10,161.04, and the FBM Emas Shariah Index added 59.98 points to 10,822.66.

The FBM 70 Index went up 49.09 points to 13,638.74, while the FBM ACE Index was 1.53 points lower at 5,326.68.

Sector-wise, the Financial Services Index dipped 44.68 points to 15,701.27, the Industrial Products and Services Index inched up 1.67 points to 174.75, and the Energy Index added 1.86 points to 863.51.

The Plantation Index advanced 8.07 points to 6,731.67.

The Main Market volume slipped to 1.74 billion units worth RM1.23 billion, from 1.78 billion units worth RM1.34 billion on Thursday.

Warrant turnover narrowed to 133.69 million units worth RM11.30 million, against 259.45 million units worth RM48.86 million previously.

The ACE Market volume eased to 460.49 million shares worth RM142.29 million, versus 463.04 million shares worth RM147.98 million.

Consumer products and services counters accounted for 241.69 million shares traded on the Main Market, followed by industrial products and services (452.55 million), construction (90.92 million), technology (113.16 million), special purpose acquisition companies (nil), financial services (40.90 million), property (297.82 million), plantation (20.76 million), real estate investment trusts (2.78 million), closed/funds (13,100), energy (155.35 million), healthcare (245.62 million), telecommunications and media (34.04 million), transportation and logistics (16.87 million), and utilities (31.75 million).

Source: The Edge

Comments

Post a Comment