KUALA LUMPUR (April 17): Bursa Malaysia closed lower on Monday (April 17), with the key index moving in a tight range ahead of the release of China's first-quarter gross domestic product (GDP) data on Tuesday, an analyst said.

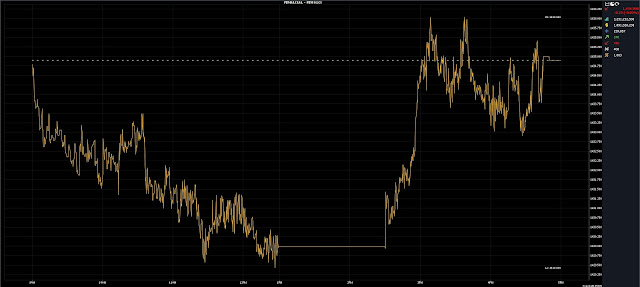

At 5pm, the FBM KLCI had eased by 0.23 of a point to 1,434.90, from last Friday's close at 1,435.13.

The barometer index opened 0.34 of a point lower at 1,434.79, and moved between 1,429.43 and 1,436.04 throughout the day.

Turnover stood at 3.25 billion units worth RM1.89 billion.

SPI Asset Management managing partner Stephen Innes said the market is likely to rally on Tuesday once the data has been released.

Nevertheless, Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said key regional markets closed higher on Monday, as China's central bank had promised a prudent monetary policy to boost domestic demand.

"Inflation in China has been softening over the past few months, despite the reopening of the economy, after the rollback of pandemic controls,” he told Bernama.

Back home, he reckoned the outlook for local equities to remain steady, despite the lacklustre performance on Monday, as cheap valuations, accompanied by strong fundamentals of the local economy, would drive the market going forward.

"As such, we expect the KLCI to show a more positive performance, and expect it to hover within the 1,430-1,445 range for the week.

"Technically, we spot immediate resistance at 1,440, followed by 1,460, with support at 1,415," he added.

Among the heavyweight counters, Malayan Banking Bhd (Maybank) eased one sen to RM8.70 a share, Public Bank Bhd lost two sen to RM3.97, and Tenaga Nasional Bhd fell three sen to RM9.18, while Petronas Chemicals Group Bhd was unchanged at RM7.40, and CIMB Group Holdings Bhd rose three sen to RM5.26.

As for the actives, Hong Seng Consolidated Bhd added half a sen to 14 sen, Revenue Group Bhd grew four sen to 44.5 sen, SMRT Holdings Bhd earned 11.5 sen to 64.5 sen, Dataprep Holdings Bhd gained five sen to 23 sen, and Top Glove Corp Bhd shed six sen to RM1.05.

On the index board, the FBM Emas Index dropped 5.15 points to 10,563.76, the FBMT 100 Index trimmed 3.40 points to 10,243.37, and the FBM 70 index contracted by 11.74 points to 13,858.30.

The FBM Emas Shariah Index weakened 18.68 points to 10,924.16, while the FBM ACE Index was 1.14 points higher at 5,369.32.

Sector-wise, the Plantation Index slid 31.13 points to 6,820.0, the Industrial Products and Services Index inched down 0.49 of a point to 175.16, the Financial Services Index increased 31.39 points to 15,765.59, and the Energy Index perked 0.40 of a point to 878.19.

The Main Market volume reduced to 2.13 billion units worth RM1.55 billion, from 2.17 billion units worth RM1.45 billion last Friday.

Warrant turnover widened to 403.87 million units worth RM66.38 million, against 263.79 million units worth RM46.42 million previously.

The ACE Market volume slid to 712.71 million shares worth RM273.92 million, versus 779.03 million shares worth RM268.73 million.

Consumer products and services counters accounted for 270.21 million shares traded on the Main Market, followed by industrial products and services (500.32 million), construction (59.16 million), technology (496.77 million), special purpose acquisition companies (nil), financial services (96.64 million), property (201.62 million), plantation (23.47 million), real estate investment trusts (15.08 million), closed/funds (nil), energy (87.72 million), healthcare (160.94 million), telecommunications and media (65.42 million), transportation and logistics (31.25 million), and utilities (124.84 million).

Source: The Edge

Comments

Post a Comment