KUALA LUMPUR (April 5): Bursa Malaysia's main index pared most of its earlier losses to close almost flat on Wednesday (April 5), due to a lack of buying catalysts, amid cautious sentiment on the back of mixed signals from global markets, a dealer said.

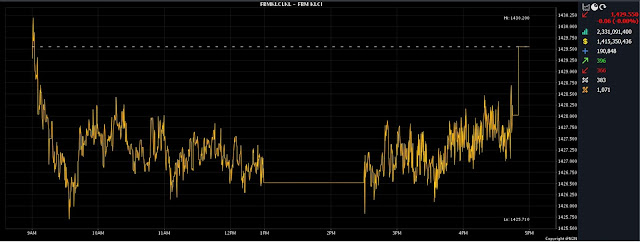

At 5pm, the FBM KLCI had eased 0.06 of a point to 1,429.55, from Tuesday's closing at 1,429.61.

The barometer index opened 0.32 of a point lower at 1,429.29, and moved between 1,425.71 and 1,430.20 throughout the day.

Turnover narrowed to 2.33 billion units worth RM1.41 billion, from 2.62 billion units worth RM1.73 billion on Tuesday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the local bourse trended in a narrow and bumpy session with a low volume, as investors were reluctant to make significant moves.

"While the local benchmark index was still in an oversold position, we advise investors to accumulate on weakness, especially blue-chips stocks.

"Additionally, we expect the overall outlook in the midterm to be positive, supported by improving economic conditions and corporate earnings," he told Bernama.

Among the heavyweights, Malayan Banking Bhd (Maybank) was unchanged at RM8.66 a share, Public Bank Bhd gained two sen to RM4.02, Petronas Chemicals Group Bhd added three sen to RM7.25, and Tenaga Nasional Bhd perked up one sen to RM9.26, while CIMB Group Holdings Bhd lost two sen to RM5.31.

As for the actives, Top Glove Corp Bhd rose three sen to RM1.01, Revenue Group Bhd added one sen to 26.5 sen, Jade Marvel Group Bhd grew half a sen to 31.5 sen, Tanco Holdings Bhd rose 3.5 sen to 50.5 sen, while Fitters Diversified Bhd lost half a sen to 7.5 sen.

On the index board, the FBM Emas Index decreased 3.18 points to 10,489.46, the FBMT 100 Index declined 2.45 points to 10,173.55, and the FBM Emas Shariah Index eased 2.54 points to 10,792.07.

The FBM 70 Index shaved off 11.59 points to 13,633.29, and the FBM ACE Index was 7.25 points better at 5,337.18.

Sector-wise, the Financial Services Index rose 13.06 points to 15,792.56, the Plantation Index gained 24.11 points to 6,731.69, while the Industrial Products and Services Index eased 0.40 of a point to 172.74, and the Energy Index shed 6.53 points to 869.17.

The Main Market volume fell to 1.74 billion units worth RM1.22 billion, against 1.87 billion units worth RM1.49 billion on Tuesday.

Warrant turnover tumbled to 81.67 million units worth RM9.2 million, from 245.32 million units worth RM46.46 million previously.

The ACE Market volume slipped to 501.76 million shares worth RM178.31 million, from 507.12 million shares worth RM194.12 million on Tuesday.

Consumer products and services counters accounted for 222.52 million shares traded on the Main Market, followed by industrial products and services (530.17 million), construction (93.71 million), technology (178.11 million), special purpose acquisition companies (nil), financial services (31.17 million), property (229.04 million), plantation (21.56 million), real estate investment trusts (4.4 million), closed/funds (2,000), energy (129.68 million), healthcare (212.94 million), telecommunications and media (32.85 million), transportation and logistics (28.06 million), and utilities (32.51 million).

Source: The Edge

Comments

Post a Comment