KUALA LUMPUR (March 27): Bursa Malaysia closed lower on Wednesday as the short-term market sentiment remains jittery amid the uncertain global performance, said an analyst.

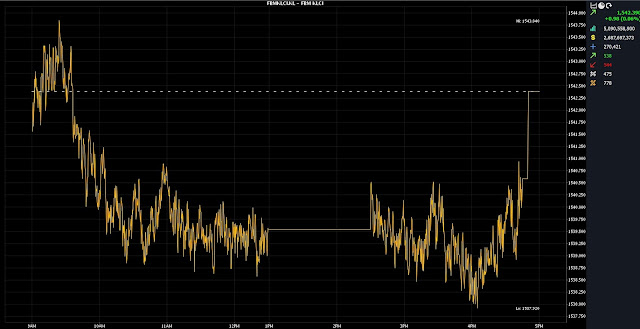

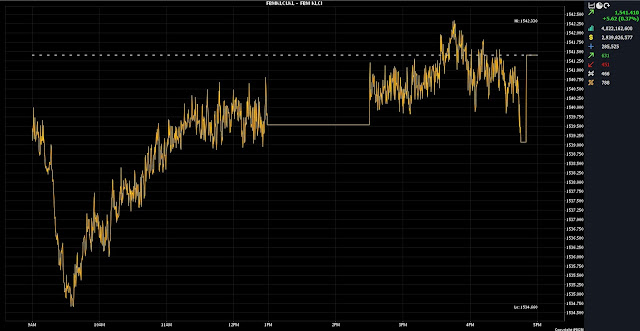

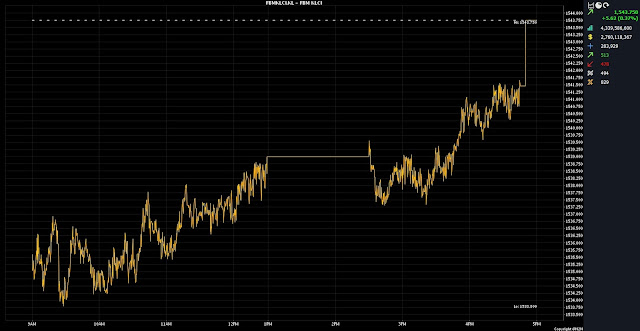

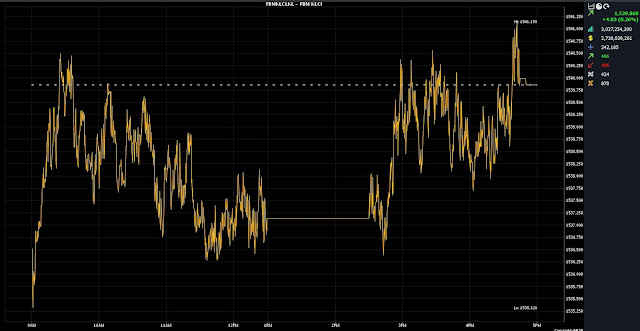

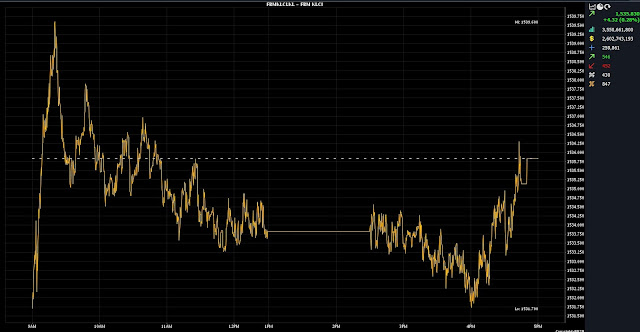

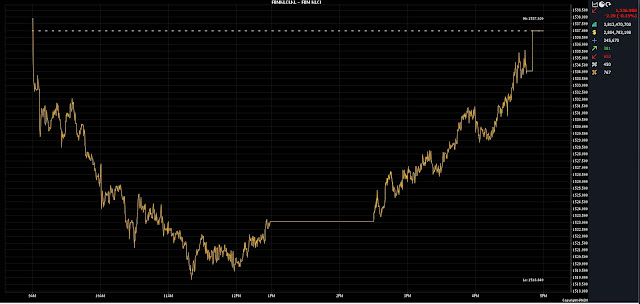

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) slipped 7.82 points to 1,530.6 from Tuesday’s close of 1,538.42.

The benchmark index opened 1.91 points lower at 1,536.51 and moved in a tight range between 1,528.52 and 1,536.58 throughout the day.

On the broader market, losers outpaced gainers 645 to 422, while 450 counters were unchanged, 821 untraded, and 74 others suspended.

Turnover narrowed to 3.75 billion units worth RM3.1 billion from 3.83 billion units worth RM3.04 billion on Tuesday.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said the KLCI closed lower after a lacklustre trading session in line with the regional market performance.

"The key regional indices closed mostly lower ahead of the United States [US] economic data and US Federal Reserve [Fed] chair Jerome Powell's speech, which could influence the US Fed's decision on interest rates.

"Investors are hoping that the Fed will kick off reductions to its main interest rate in June, with some considering a slight possibility of it starting at its meeting next week," he said.

As for the local bourse, Thong advised investors to stay alert for bargain-hunting opportunities.

"We anticipate the benchmark index to trend sideways with an upside bias, within the 1,530-1,540 range towards the weekend," he added.

Among the heavyweights, Maybank Bhd, Public Bank Bhd and Petronas Chemicals Group Bhd declined four sen each to RM9.65, RM4.21 and RM6.79 respectively, while CIMB Group Holdings Bhd added five sen to RM6.55 and Tenaga Nasional Bhd gained four sen to RM11.24.

As for the actives, market debutant Zantat Holdings Bhd rose 12.5 sen to 37.5 sen, SP Setia Bhd and Lambo Group Bhd were flat at RM1.42 and three sen respectively, while Ekovest Bhd added a sen to 49 sen, and Computer Forms (M) Bhd declined a sen to 14 sen.

On the index board, the FBM Emas Index dropped 35.61 points to 11,525.98, the FBMT 100 Index declined by 33.78 points to 11,172.54, the FBM Emas Shariah Index fell 52.32 points to 11,613.44, the FBM ACE Index slid 67.29 points to 4,842.73, while the FBM 70 Index rose by 46.591 points to 16,148.15.