KUALA LUMPUR (Feb 29): Bursa Malaysia’s benchmark FTSE Bursa Malaysia KLCI (FBM KLCI) ended higher on Thursday in tandem with the upbeat performance in most regional markets and ahead of the US personal consumption expenditure (PCE) data due out later in the night.

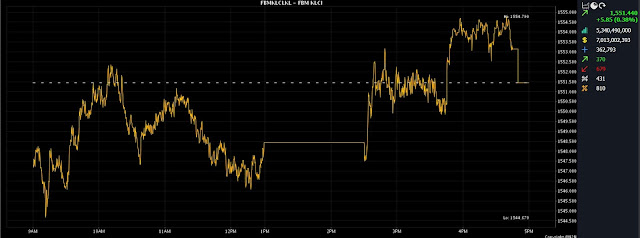

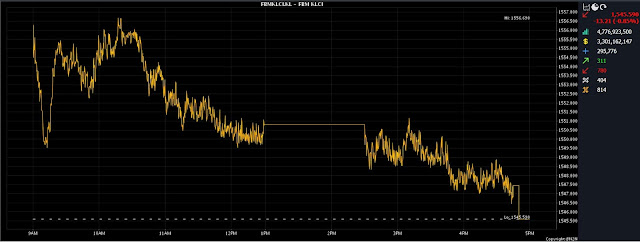

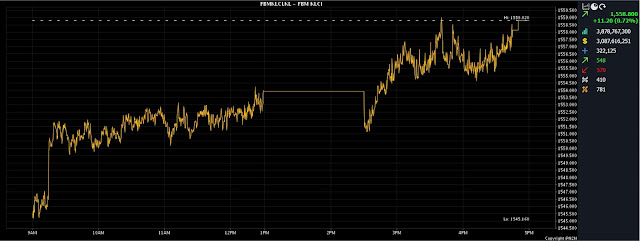

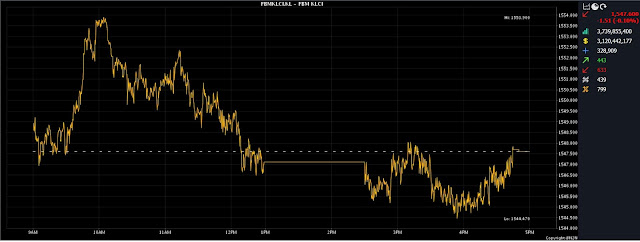

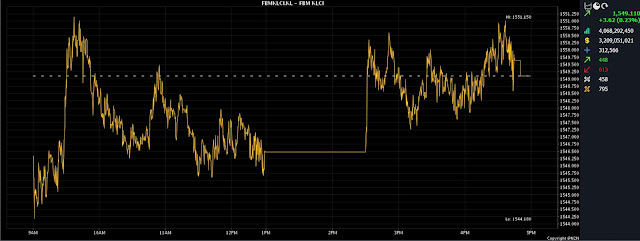

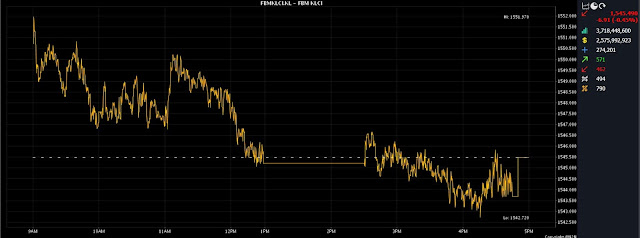

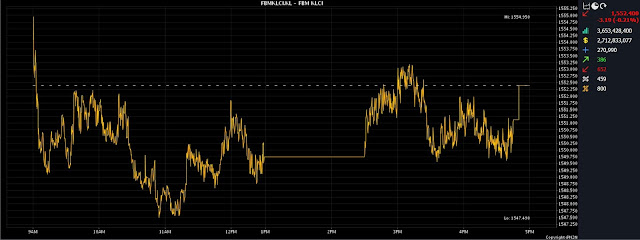

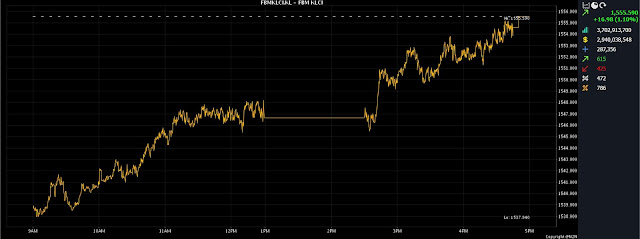

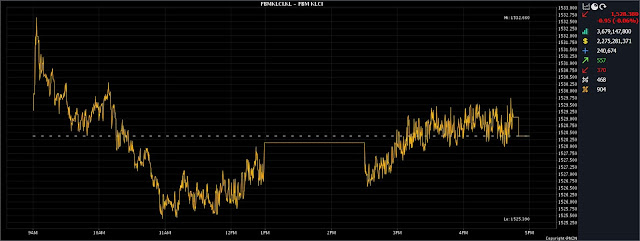

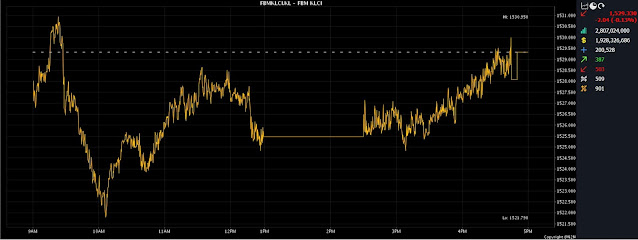

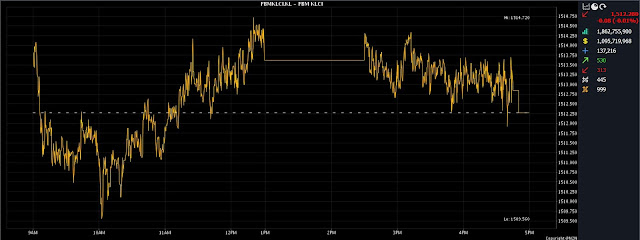

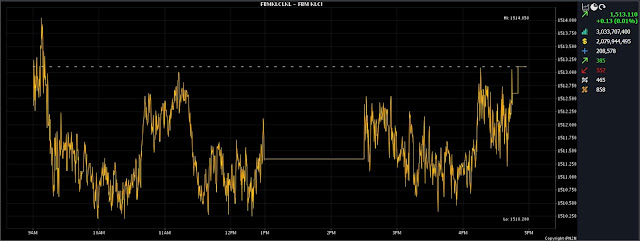

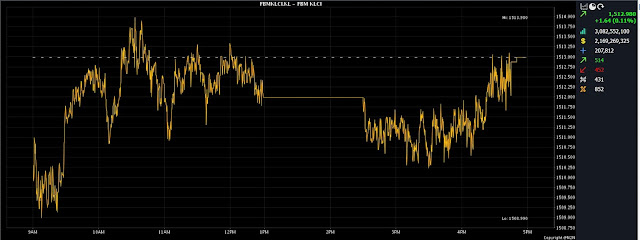

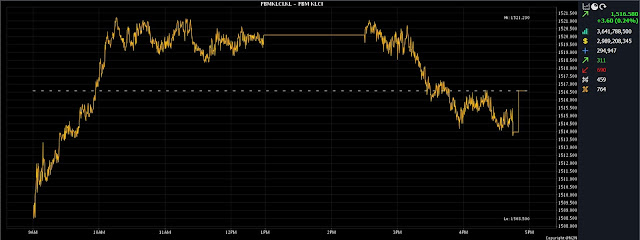

At 5pm, the KLCI added 5.85 points to close at 1,551.44 from Wednesday’s close of 1,545.59.

The benchmark index opened 2.03 points better at 1,547.62 and moved between 1,544.67 and 1,554.79 throughout the session.

However, in the broader market, losers outpaced gainers 679 to 370, while 431 counters were unchanged, 810 untraded and 43 others suspended.

Turnover expanded to 5.34 billion units worth RM7.01 billion versus Wednesday's 4.78 billion units worth RM3.3 billion.

Head of wealth research & advisory, designated portfolio manager at UOB Kay Hian Wealth Advisors, Mohd Sedek Jantan said Malaysian equities experienced a surge, mirroring the positive trend in most regional stock markets.

"Although there was some initial caution among investors awaiting the US inflation data to gauge the Federal Reserve’s interest rate adjustments, the overall market sentiment remained optimistic," he said.

He said notably, the plantation sector emerged as a top performer, benefitting from both anticipated lower output due to the mild El Nino weather phenomenon forecast and increased demand from China, the world’s largest importer of palm oil.

"Malaysia’s significant role in the global palm oil industry, accounting for 23% of total production and nearly 30% of total exports, underscores its position as a key player in this commodity market," he added.

Meanwhile, ActivTrades trader Anderson Alves said investors are now turning their attention to the upcoming release of the US PCE report.

“This report is anticipated to shed light on inflationary pressures and could signal upcoming shifts in monetary policy.

“The consensus forecast for the report suggests a month-on-month increase of 0.4%, closely aligned with the average analysts’ prediction at 0.39%,” he said.

Additionally, he said the core PCE, which excludes volatile items, is expected to show an even more pronounced increase, with some projections reaching 0.55%.

“Should these figures exceed expectations, it could strengthen the US dollar and exert downward pressure on bond markets, potentially affecting global stock markets, particularly in the US,” he added.