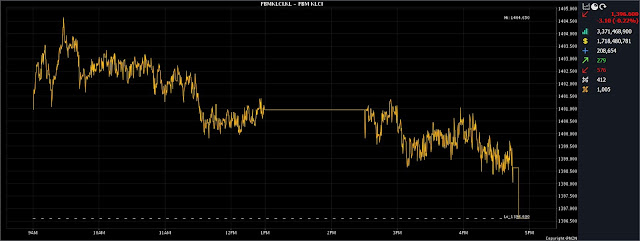

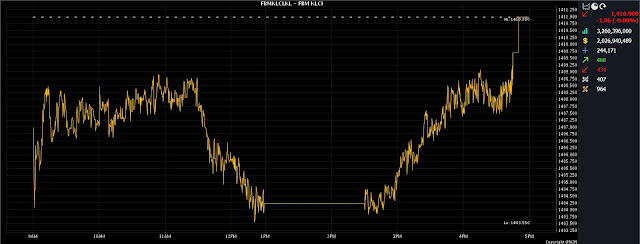

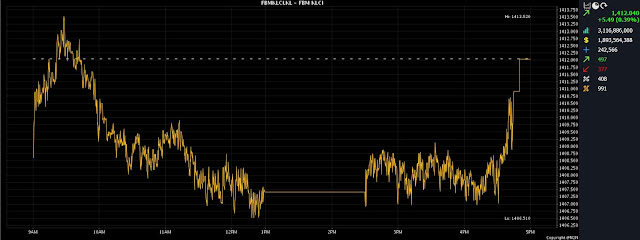

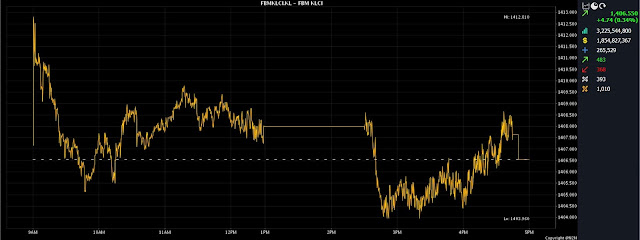

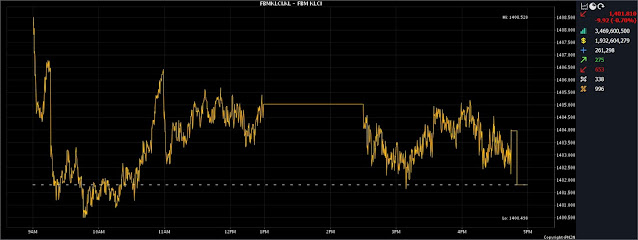

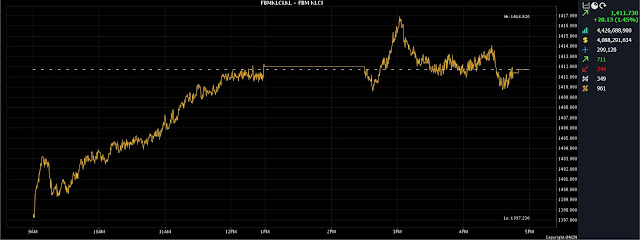

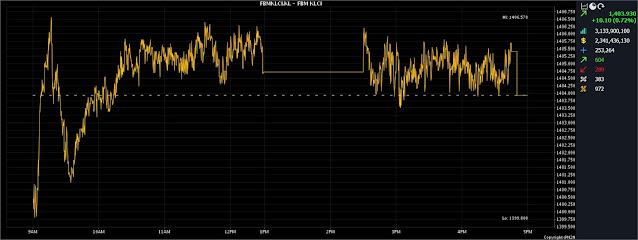

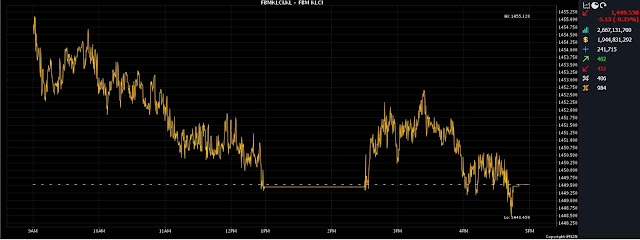

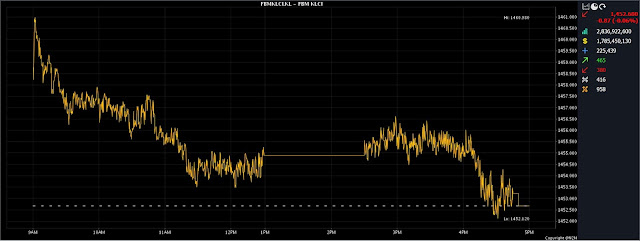

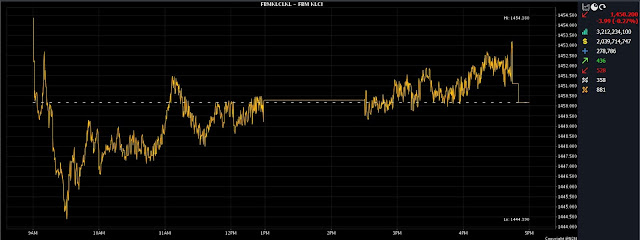

At 5pm, the benchmark FBM KLCI had fallen 12.33 points, or 0.88%, to 1,391.60, from Wednesday's close at 1,403.93.

The key index opened 3.11 points lower at 1,400.82, and moved between 1,391.04 and 1,403.93 throughout the day.

Turnover amounted to 3.52 billion units worth RM2.22 billion.

Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak

Leng said Wall Street fell overnight, as Credit Suisse Group AG

shares sank, reigniting worries about a possible global banking crisis.

Investors were also uncertain about the US Federal Reserve's action with regard to interest rates, he added.

"As for the local bourse, we believe that the sell-off was

unwarranted, as the Malaysian banking system is highly regulated and has

well-contained asset quality risks compared to the US.

"However, due to the uncertain global and regional conditions, we

expect short-term market sentiment to remain nervous," he told Bernama.

Thong is anticipating that the KLCI would trend between 1,390 and 1,400 points towards the weekend.

Among the heavyweight stocks, Malayan Banking Bhd (Maybank) lost nine

sen to RM8.26 a share, Public Bank Bhd dropped two sen to RM3.93, and

Petronas Chemicals Group Bhd inched down one sen to RM6.99.

CIMB Group Holdings Bhd shed eight sen to RM5.15, and Tenaga Nasional Bhd weakened seven sen to RM9.35.

Among the actives, Top Glove Corp Bhd rallied 13.5 sen to 83.5 sen,

Zen Tech International Bhd edged up half a sen to two sen, and Careplus

Group Bhd climbed 2.5 sen to 27 sen.

Hartalega Holdings Bhd surged 21 sen to RM1.78, and Sapura Energy Bhd trimmed half a sen to 4.5 sen.

On the index board, the FBM Emas Index gave up 80.20 points to

10,181.17, the FBMT 100 Index dropped 73.42 points to 9,878.14, and the

FBM ACE Index lost 85.58 points to 5,190.77.

The FBM Emas Shariah Index went down 78.09 points to 10,481.27, and the FBM 70 Index contracted 37.51 points to 13,131.53.

Sector-wise, the Financial Services Index dropped 128.56 points to

15,353.89, the Energy Index lost 24.63 points to 813.37, and the

Plantation Index decreased 40.93 points to 6,681.38.

The Industrial Products and Services Index eased 1.88 points to 167.68.

The Main Market volume widened to 2.15 billion shares worth RM1.85

billion, from Wednesday's 2.04 billion shares worth RM1.63 billion.

Warrant turnover expanded to 511.37 million units worth RM76.38

million, from 373.03 million units worth RM59.59 million previously.

The ACE Market volume rose to 865.90 million shares worth RM292.68 million, from 718.55 million shares worth RM646.99 million.

Consumer product and service counters accounted for 316.88 million

shares traded on the Main Market, followed by industrial products and

services (470.98 million), construction (47.72 million), technology

(188.82 million), special purpose acquisition companies (nil), financial

services (74.17 million), property (86.38 million), plantation (25.92

million), real estate investment trusts (4.47 million), closed/funds

(2,000), energy (400.54 million), healthcare (436.63

million), telecommunications and media (35.06 million), transportation

and logistics (33.91 million), and utilities (23.64 million).

Source: The Edge