KUALA LUMPUR (May 31): Bursa Malaysia and regional bourses sank into the red on Wednesday (May 31), amid uncertainties over whether the US Congress would resolve the debt ceiling impasse later in the day.

Hong Kong’s Hang Seng Index led the regional decline, losing 1.94% to 18,234.27, Japan’s Nikkei 225 fell 1.41% to 30,887.88, Singapore’s Straits Times Index eased 0.90% to 3,158.80, and China’s SSE Composite Index dipped by 0.61% to 3,204.56.

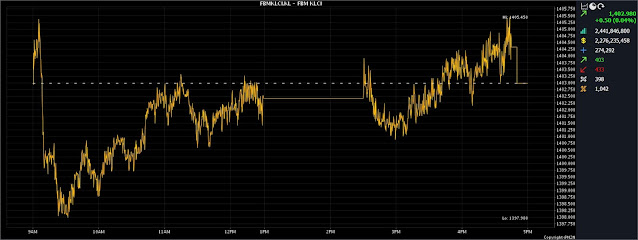

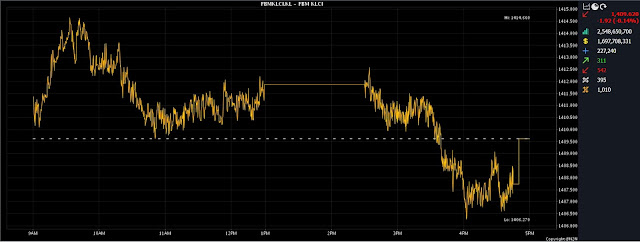

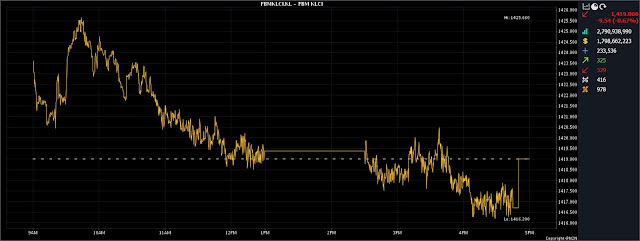

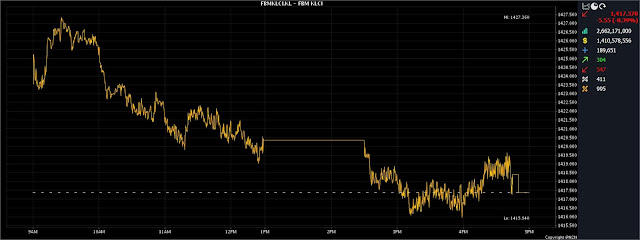

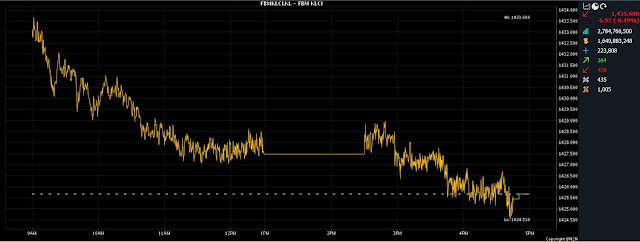

The FBM KLCI, the domestic barometer index, ended the day 9.79 points or 0.70% lower at 1,387.12, from 1,396.91 at Tuesday’s close.

The key index opened 0.23 of a point weaker at 1,396.68, and subsequently fluctuated to an intraday low of 1,380.90, or 1.1% lower, and an intraday high of 1,398.38 in the early morning session.

The broader market was bearish, with decliners thumping advancers 521 to 360, while 387 counters were unchanged, 980 untraded, and 33 others suspended.

Turnover jumped to 3.54 billion units worth RM5.25 billion, versus 2.38 billion units valued at RM2.01 billion on Tuesday.

A major debt ceiling bill negotiated by US President Joe Biden and House Speaker Kevin McCarthy passed through a House Committee on Tuesday, and will now go to the full House for a vote expected later on Wednesday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the focus will remain on developments in the implementation of the US debt deal right up to the June 5 deadline.

Meanwhile, he said the faster-than-expected fall in China's manufacturing print showed that its economic recovery continued to lose steam, further triggering a sour market mood.

It was reported that China’s purchasing managers index slipped to 48.8 this month from 49.2 in April, according to data released by the National Bureau of Statistics on Wednesday. A reading below 50 indicates contraction.

Nevertheless, Thong views the current low valuations in the local equity market to be attractive to entice bargain hunters.

“On the domestic front, sentiments may be cautious in view of external factors. However, we believe the KLCI has been significantly undervalued.

“Hence, we expect the key index to hover within the 1,385-1,395 range for the remainder of the week, with immediate support at 1,370 and resistance at 1,400,” he told Bernama.

Among the heavyweights, Malayan Banking Bhd (Maybank) added six sen to RM8.65 a share, Public Bank Bhd lost three sen to RM3.81, Tenaga Nasional Bhd was 11 sen weaker at RM9.51, Petronas Chemicals Group Bhd dipped 19 sen to RM6.56, while CelcomDigi Bhd eased 10 sen to RM4.47.

CIMB Group Holdings Bhd was down seven sen to RM4.82, and IHH Healthcare Bhd slid one sen to RM5.77.