KUALA

LUMPUR (Sept 27): Bursa Malaysia finished lower on Wednesday amid a

mixed regional market and after a volatile Wall Street overnight, a

dealer said.

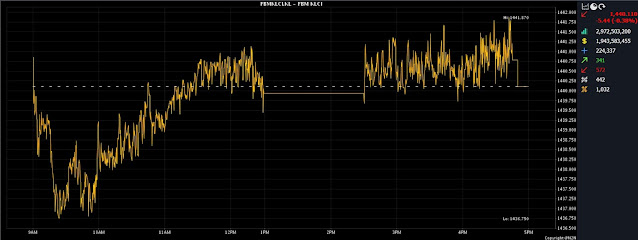

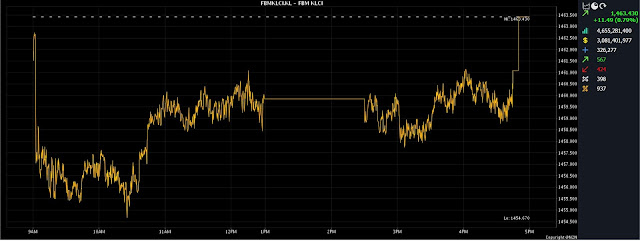

At 5pm,

the FTSE Bursa Malaysia KLCI (FBM KLCI) dropped 5.44 points to 1,440.11

from Tuesday’s close of 1,445.55, after opening 4.69 points easier at

1,440.86.

The benchmark index moved between 1,436.75 and 1,441.87 throughout the session.

On the

broader market, decliners beat gainers 572 to 341 while 442 counters

were unchanged, 1,032 untraded and 100 others suspended.

Turnover dropped to 2.97 billion units worth RM1.94 billion from 3.15 billion units worth RM1.95 billion yesterday.

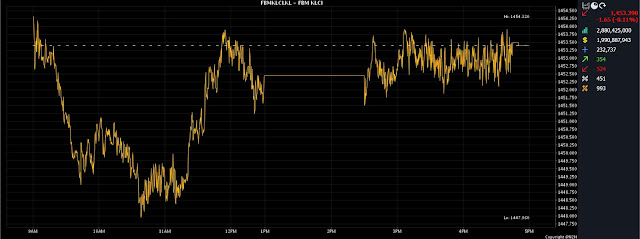

Apex

Securities Bhd head of research Kenneth Leong said investors were also

offloading shares ahead of a public holiday on Thursday. He expects the

downward pressure to be sustained going forward in view of the lack of

fresh leads, coupled with the ongoing concerns over the high-interest

rate environment which may potentially dampen the economic outlook.

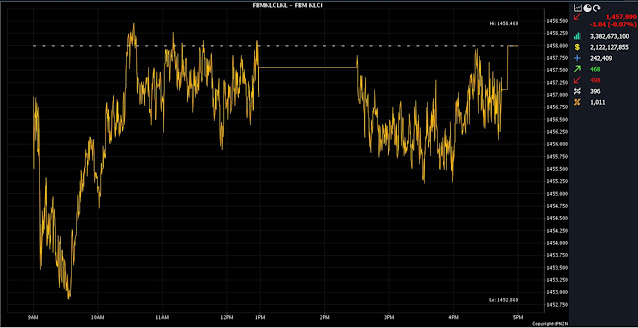

“Technically,

1,433 points will serve as the immediate support. Any recovery may see

gains (capped at) the 1,464 to 1,470 level,” he said.

Bursa

Malaysia Bhd and its subsidiaries will be closed on Thursday in

conjunction with Prophet Muhammad's Birthday (Maulidur Rasul).

Meanwhile,

investors are also keeping a close tab on the US second-quarter gross

domestic product (GDP) data to be released on Wednesday night. On

Tuesday, the S&P 500 tumbled 1.5% for its fifth loss in six days,

closing at 4,273.53. The Dow Jones Industrial Average fell 1.1% to

33,618.88 and the Nasdaq composite lost 1.6% to 13,063.61.

At the

close, Bursa heavyweight counters Maybank Bhd added one sen to RM8.88

and Tenaga Nasional Bhd gained eight sen to RM10.02 while CIMB Group

Holdings Bhd was flat at RM5.55. Public Bank Bhd fell five sen to RM4.14

and Petronas Chemicals Group Bhd lost 11 sen to RM7.22.

Of the

actives, Evergreen Max Cash Capital Bhd increased by 3.5 sen to 35 sen

while Velesto Energy Bhd and KNM Group Bhd were half a sen higher at

25.5 sen and 51 sen, respectively. MyEG Services Bhd eased two sen to 78

sen and Vsolar Group Bhd went down 4.5 sen to 18 sen.

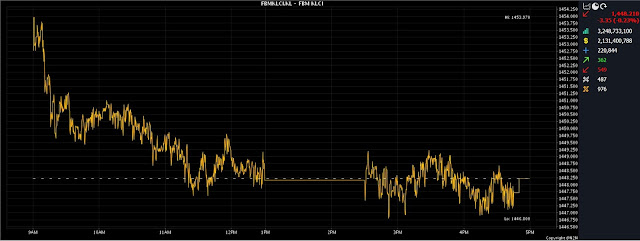

On the

index board, the FBM Emas Index declined by 46.5 points to 10,663.14,

the FBMT 100 Index was 46.65 points easier at 10,326.84 and the FBM Emas

Shariah Index went down 44.34 points to 10,921.8.

The FBM ACE Index weakened by 39.16 points to 5,158.67 and the FBM 70 Index slumped 97.13 points to 14,167.24.