KUALA LUMPUR (April 19): Bursa Malaysia closed lower for the third consecutive day due to profit-taking activities, ahead of the Hari Raya Aidilfitri holidays, amid weaker regional market performances, an analyst said.

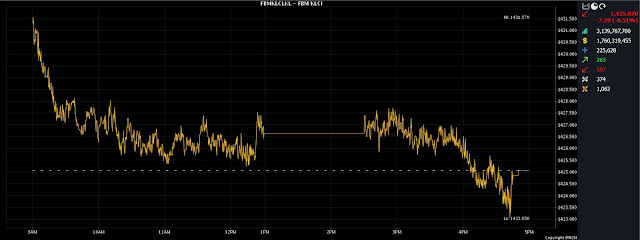

At 5pm on Wednesday (April 19), the FBM KLCI was 7.29 points or 0.51% lower at 1,425.07, from Tuesday's close at 1,432.36.

The barometer index opened 0.79 of a point weaker at 1,431.57, its intraday high, and moved between 1,423.05 and 1,431.57 throughout the day.

Turnover narrowed to 3.14 billion units valued at RM1.76 billion, from 3.17 billion units worth RM1.85 billion on Tuesday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said key regional markets ended mostly lower, as investors were cautiously awaiting earnings reports and possible moves on interest rate hikes by central banks.

“On the domestic front, we expect trading to be muted moving forward,” he told Bernama.

He also foresees the KLCI trending sideways within the range of 1,420-1,430 towards the weekend.

Heavyweights Malayan Banking Bhd (Maybank) at RM8.69 a share and Public Bank Bhd at RM3.97 had eased one sen each. Petronas Chemicals Group Bhd lost 19 sen to RM7.21. CIMB Group Holdings Bhd at RM5.22 and CelcomDigi Bhd at RM4.43 had shed three sen each.

Among the actives, Fitters Diversified Bhd was unchanged at five sen, Pharmaniaga Bhd gained 1.5 sen to 39 sen, and VinVest Capital Holdings Bhd rose one sen to 20 sen, while Hong Seng Consolidated Bhd eased half sen to 12.5 sen, and MyEG Services Bhd slipped two sen to 82 sen.

On the index board, the FBM Emas Index weakened 64.68 points to 10,475.80, the FBMT 100 Index lost 62.18 points to 10,160.02, and the FBM Emas Shariah Index slipped 83.56 points to 10,806.33.

The FBM ACE Index was 37.12 points weaker at 5,352.59, and the FBM 70 index dipped 125.95 points to 13,691.12.

Sector-wise, the Industrial Products and Services Index eased 2.02 points to 172.37, the Plantation Index slipped 32.92 points to 6,851.72, the Financial Services Index declined 40.89 points to 15,690.58, and the Energy Index fell 7.0 points to 860.19.

The Main Market volume widened to 2.12 billion units valued at RM1.45 billion, from 2.08 billion units valued at RM1.51 billion on Tuesday.

Warrant turnover rose to 367.83 million units worth RM52.82 million, against 277.52 million units worth RM45.34 million previously.

The ACE Market volume shrank to 650.69 million shares worth RM258.92 million, versus 804.49 million shares worth RM288.37 million.

Consumer products and services counters accounted for 259.52 million shares traded on the Main Market, followed by industrial products and services (742.58 million), construction (57.92 million), technology (309.76 million), special purpose acquisition companies (nil), financial services (53.42 million), property (198.06 million), plantation (23.62 million), real estate investment trusts (11.32 million), closed/funds (33,000), energy (55.99 million), healthcare (203.95 million), telecommunications and media (95.70 million), transportation and logistics (44.55 million), and utilities (59.60 million).

Source: The Edge

Comments

Post a Comment