KUALA LUMPUR (July 31): Bursa Malaysia recouped last week's losses to close in positive territory on Monday (July 31), in line with the strong performance of regional peers, amid improved regional market sentiment, an analyst said.

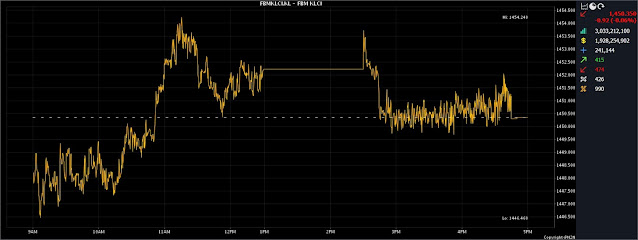

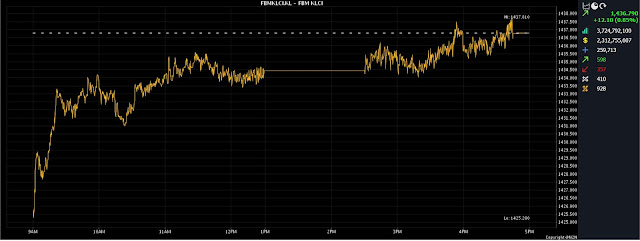

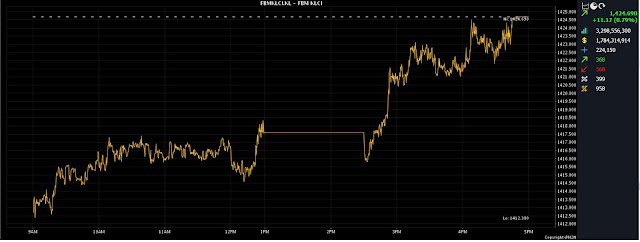

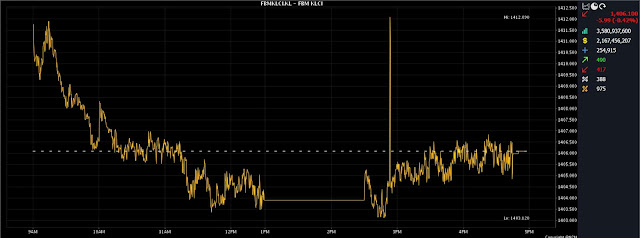

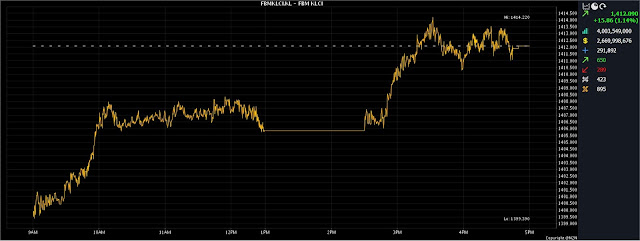

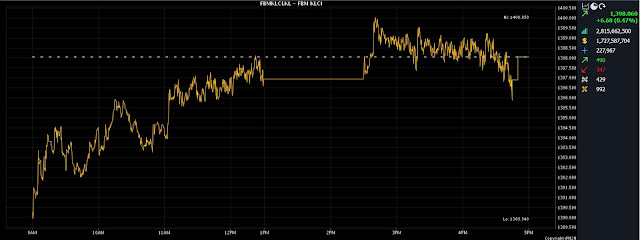

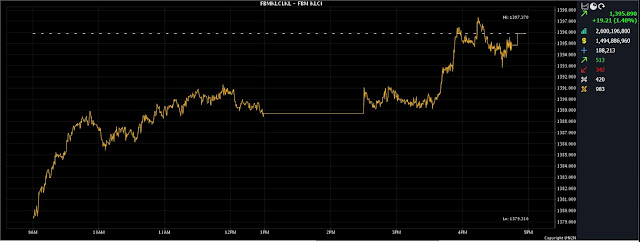

At 5pm, the FBM KLCI had improved by 9.08 points or 0.63% to 1,459.43, from 1,450.35 at last Friday’s close.

The market bellwether opened 0.72 of a point higher at 1,451.07, its intraday low, and hit an intraday high of 1,464.70.

The broader market was also positive, with gainers beating losers 545 to 405, while 452 counters were unchanged, 902 untraded, and 53 others suspended.

Turnover stood at 3.29 billion units worth RM2.49 billion.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the KLCI delivered an impressive performance, thanks to the strong backing of local institutions and continuous buying by foreign funds.

He said the strong showing was in tandem with the splendid performance across the region.

In China, the National Bureau of Statistics reported that the manufacturing purchasing managers index increased to 49.3 in July, improving from 49.0 in June and the market's estimate of 49.2.

Meanwhile in Japan, investors were still assessing the Bank of Japan's monetary policy decision to lift the cap on bond yields and possible adjustment to its ultra-easy monetary policies.

On the domestic front, he is optimistic about the mid-term outlook of the market given the improvement in local market sentiment and foreign support, but investors may stay alert on increasing market volatility and external uncertainties.

“Based on the current analysis, it is expected that the KLCI will hover slightly higher, oscillating between 1,460 and 1,475 for the entire week.

“Having broken the 1,460 resistance, we shall see the next resistance level at 1,490, with support at 1,440,” he told Bernama.

Among the heavyweights, Malayan Banking Bhd (Maybank) at RM9.02, Public Bank Bhd at RM4.17 and Tenaga Nasional Bhd at RM9.60 had increased three sen each, CIMB Group Holdings Bhd added five sen to RM5.55 a share, and Petronas Chemicals Group Bhd went up 10 sen to RM6.95.

Of the actives, Top Glove Corp Bhd gained 2.5 sen to 92 sen, KNM Group Bhd was half a sen firmer at 9.5 sen, while Sarawak Consolidated Industries Bhd was flat at 43.5 sen.

Hong Seng Consolidated Bhd at 6.5 sen and UEM Sunrise Bhd at 48 sen had fallen one sen each.