KUALA

LUMPUR (Jan 16): Bursa Malaysia ended marginally lower on Monday (Jan

16) in lacklustre trading, driven by persistent profit-taking against

selected financial services and plantation counters, amid mixed

sentiment on regional markets, dealers said.

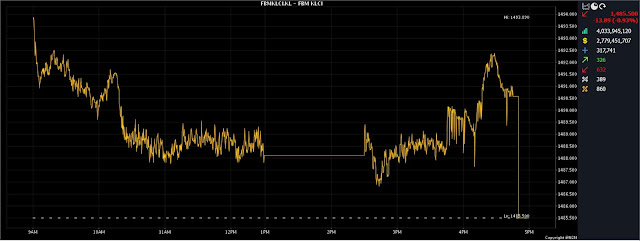

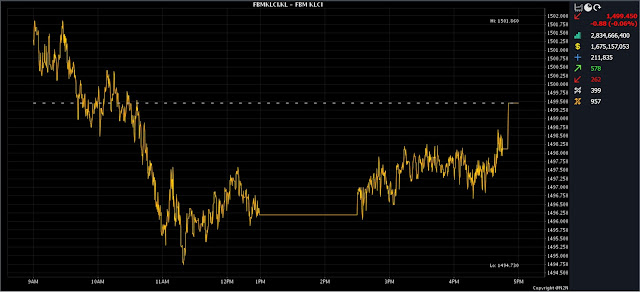

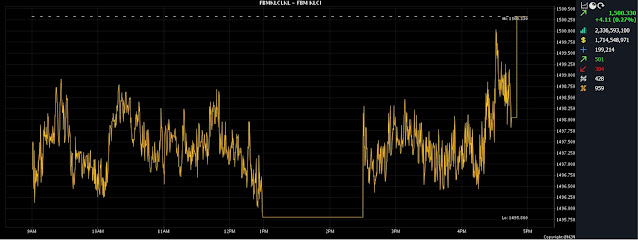

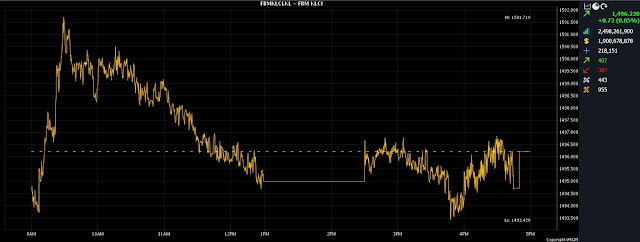

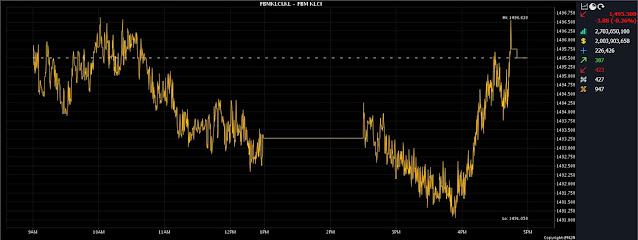

At 5pm, the benchmark FBM KLCI had slipped 1.47 points or 0.10% to 1,493.56, from last Friday's closing at 1,495.03.

The market bellwether opened 0.22 of a point weaker at 1,494.81, and moved between 1,489.0 and 1,496.05 throughout the day.

Turnover increased to 3.92 billion units worth RM2.03 billion, against last Friday's 3.40 billion units worth RM2.02 billion.

Malayan Banking Bhd (Maybank) and Kuala Lumpur Kepong Bhd (KLK) were

the top two losers among the KLCI constituents. Maybank declined eight

sen to RM8.78 a share, while KLK ended 42 sen lower at RM21.76,

contributing a combined 2.36 points in losses in the benchmark index.

Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak

Leng said key regional indices were mixed, as investors were cautiously

awaiting the decision by the Bank of Japan on whether it will defend its

super-sized stimulus policy in a pivotal meeting this week.

“Meanwhile, Shanghai and Hong Kong stocks resumed their uptrend, as

investors expect the Chinese economy to recover eventually this

year after relaxing most of its anti-Covid-19 easures, as the republic

reopened its borders last week.

“As for the local bourse, we expect bargain-hunting to prevail given

the cheap valuations of local stocks, despite the cautious market

undertone. As such, we expect the benchmark index to trend higher, and

anticipate it to retest the 1,500-point mark this week.

“Technically, we see immediate resistance at 1,500, followed by 1,530, and support at 1,470,” he told Bernama on Monday.

Region-wise, Hong Kong's Hang Seng Index inched up 0.04% to

21,746.72, China’s SSE Composite Index added 1.01% to 3,227.59, South

Korea’s Kospi gained 0.58% to 2,399.86, while Singapore's Straits Times

Index declined by 0.31% to 3,283.60, and Japan’s Nikkei 225 slid 1.14%

to 25,822.32.

Among other heavyweights, Public Bank Bhd eased one sen to RM4.32,

CIMB Group Holdings Bhd dropped two sen to RM5.76 and IHH Healthcare Bhd

fell two sen as well to RM5.97, Tenaga Nasional Bhd (TNB) shed three

sen to RM9.45, while Petronas Chemicals Group Bhd rose 10 sen to RM8.50.

As for the actives, Sapura Energy Bhd at five sen and Velesto Energy

Bhd at 18 sen had perked up half a sen each, ACE Market debutant

Wellspire Holdings Bhd jumped 20 sen to 43 sen, while Revenue Group Bhd

surged 26.5 sen to 75 sen.

On the index board, the FBM Emas Index increased 8.69 points to

10,794.49, the FBMT 100 Index climbed 6.78 points to 10,489.35, and the

FBM Emas Shariah Index was 35.63 points firmer at 11,012.35.

The FBM 70 Index was 82.42 points better at 13,463.09, and the FBM ACE Index garnered 44.50 points to 5,499.98.

Sector-wise, the Energy Index slipped 2.05 points to 820.89, the

Technology Index eased 0.08 of a point to 66.88, the Industrial Products

and Services Index ticked up 1.64 points to 186.93, while the Financial

Services Index rose 61.83 points to 16,559.32, and the Plantation Index

fell 23.58 points to 6,899.33.

The Main Market volume expanded to 2.51 billion shares worth RM1.60

billion, compared with last Friday’s 2.09 billion shares worth

RM1.53 billion.

Warrant turnover improved to 323.11 million units worth RM64.50 million, from 317.53 million units worth RM65.01 million.

The ACE Market volume swelled to 1.09 billion shares worth RM366.76

million, from 987.01 million shares worth RM415.28 million previously.

Consumer product and service counters accounted for 254.40 million

shares traded on the Main Market, followed by industrial products and

services (485.16 million), construction (57.10 million), technology

(410.13 million), special purpose acquisition companies (nil), financial

services (51.62 million), property (101.22 million), plantation (22.72

million), real estate investment trusts (6.58 million), closed/funds

(1,000), energy (942.07 million), healthcare (111.06

million), telecommunications and media (26.23 million), transportation

and logistics (36.81 million), and utilities (16.75 million).

Source: The Edge

.jpg)