KUALA LUMPUR (April 6): Bursa Malaysia closed marginally lower for the third consecutive day on Thursday (April 6), dragged by persistent selling across the board due to rising concerns over the global market outlook, an analyst said.

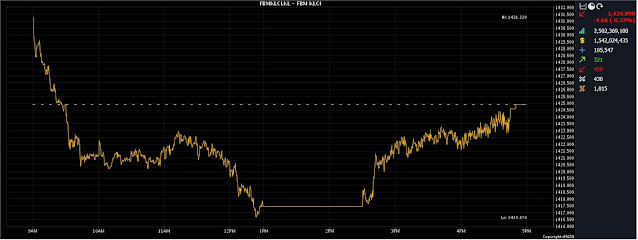

At 5pm, the FBM KLCI had declined by 4.66 points or 0.33% to 1,424.89, from Wednesday's closing at 1,429.55.

The barometer index opened 1.77 points higher at 1,431.32, which was also its intraday high, and then moved downwards to as low as 1,416.67.

Market breadth was negative, as decliners thumped gainers 450 to 321, while 430 counters were unchanged, 1,015 untraded, and 12 others suspended.

Turnover improved to 2.50 billion units worth RM1.54 billion, from 2.33 billion units worth RM1.41 billion on Wednesday.

Bank Muamalat Malaysia Bhd chief economist Dr Mohd Afzanizam Abdul Rashid said trading on the local bourse was weaker on Thursday, as market participants became increasingly anxious about the global outlook.

"While we might cheer if the US Federal Reserve could pause its rate hike campaign, heightened concerns over growth prospects could result in investors seeking shelter in risk-free assets such as bonds," he told Bernama.

Among the local heavyweights, Malayan Banking Bhd (Maybank) at RM8.65 per share and Public Bank Bhd at RM4.01 had fallen one sen each, CIMB Group Holdings Bhd eased five sen to RM5.26, Petronas Chemicals Group Bhd was flat at RM7.25, and Tenaga Nasional Bhd was down one sen to RM9.25.

As for the actives, Computer Forms (Malaysia) Bhd added 1.5 sen to 24 sen, Classita Holdings Bhd gained 5.5 sen to 19.5 sen, and Top Glove Corp Bhd gained one sen to RM1.02, while Tanco Holdings Bhd trimmed 4.5 sen to 46 sen, and VinVest Capital Holdings Bhd shed half a sen to 20 sen.

On the index board, the FBM Emas Index decreased 34.32 points to 10,455.14, the FBMT 100 Index shed 33.0 points to 10,140.55, and the FBM Emas Shariah Index slipped 29.39 points to 10,762.68.

The FBM 70 Index shaved off 43.64 points to 13,589.65, and the FBM ACE Index was 8.97 points lower at 5,328.21.

Sector-wise, the Financial Services Index dropped 46.60 points to 15,745.95, the Plantation Index gave up 8.09 points to 6,723.60, and the Energy Index slid 7.52 points to 861.65, while the Industrial Products and Services Index rose 0.32 of a point to 173.08.

The Main Market volume widened to 1.78 billion units worth RM1.34 billion, from 1.74 billion units worth RM1.22 billion on Wednesday.

Warrant turnover surged to 259.45 million units worth RM48.86 million, against 81.67 million units worth RM9.2 million previously.

The ACE Market volume declined to 463.04 million shares worth RM147.98 million, versus 501.76 million shares worth RM178.31 million.

Consumer products and services counters accounted for 330.68 million shares traded on the Main Market, followed by industrial products and services (602.33 million), construction (53.60 million), technology (161.71 million), special purpose acquisition companies (nil), financial services (41.86 million), property (202.51 million), plantation (24.10 million), real estate investment trusts (5.5 million), closed/funds (2,000), energy (108.91 million), healthcare (161.12 million), telecommunications and media (31.77 million), transportation and logistics (26.60 million), and utilities (26.92 million).

Source: The Edge

Comments

Post a Comment