UALA

LUMPUR (Oct 18): Bursa Malaysia extended Tuesday's gains to end at an

intraday high on Wednesday, after recouping earlier losses.

However,

the broader market was negative with decliners trumping gainers 616 to

265, while 438 counters were unchanged, 1,031 untraded and 10 suspended.

Regional

bourses were mixed after China registered better-than-expected

third-quarter (3Q) gross domestic product (GDP) at 4.9%, while the

Middle East conflict continues to weigh on sentiment, dealers said.

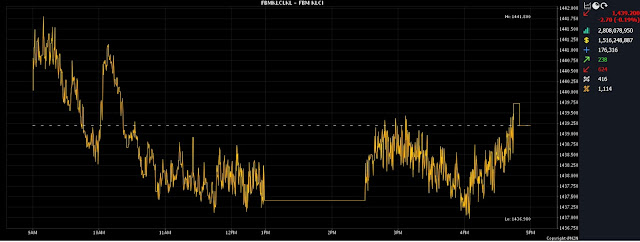

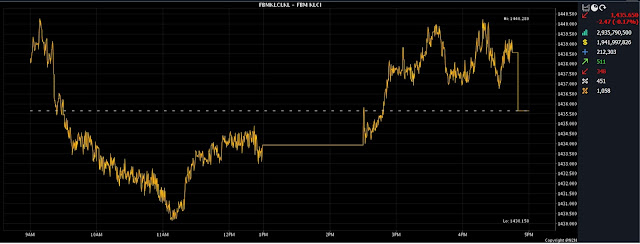

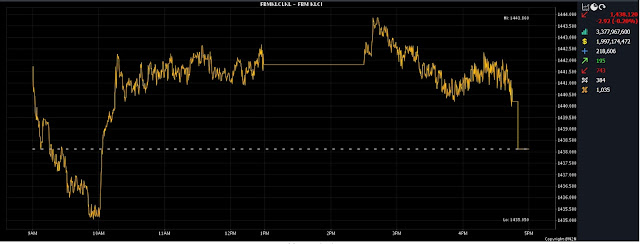

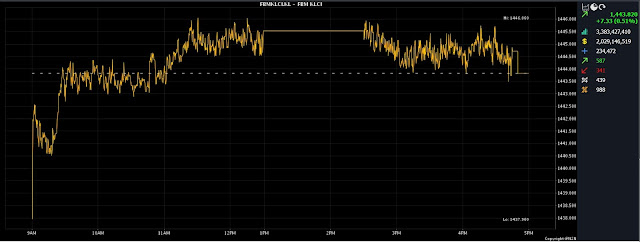

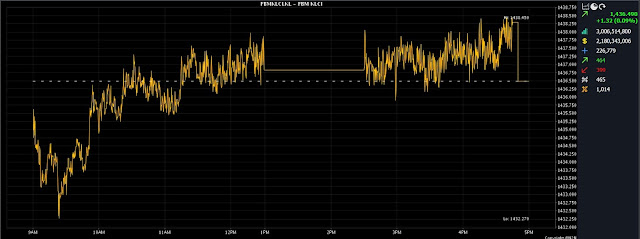

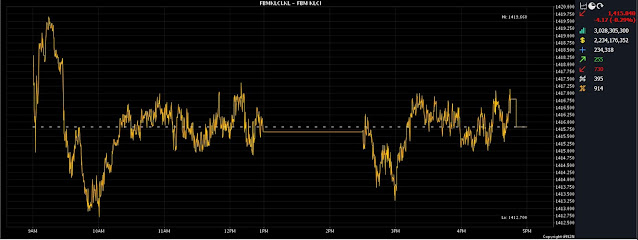

At

5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 2.41 points to end at

an intraday high of 1,446.54 from Tuesday’s closing of 1,444.13.

The

index, which opened 0.9 of-a-point easier at 1,443.23, hit a low of

1,441.06 in the mid-morning session before gaining momentum to move

upwards in the late session.

Turnover increased to 3.41 billion units worth RM2.71 billion from 2.67 billion units worth RM1.92 billion on Tuesday.

Rakuten

Trade Sdn Bhd equity research vice-president Thong Pak Leng said the FBM

KLCI reversed earlier losses and ended in positive territory due to

late buying on commodity-related stocks while the key regional indices

pared losses and closed mixed on the back of China's positive 3Q GDP,

which surpassed expectations of 4.4%, but slowed from 6.3% in the

preceding quarter.

"Back

home, we anticipate market sentiment to remain jittery given the ongoing

geopolitical conflict in the West Asia region, which has created a

wait-and-see sentiment, subsequently impacting market performance

negatively.

"Taking

the current situation into account, we project the benchmark index to

continue its sideways trajectory, and anticipate the FBM KLCI to trend

within the 1,435 to 1,450 range for the rest of the week with immediate

resistance at 1,460 and support at 1,430," he told Bernama.

Regionally,

Singapore's Straits Times Index fell 1.11% to 3,136.62, Hong Kong’s

Hang Seng Index trimmed 0.23% to 17,732.52 and China’s SSE Composite

slipped 0.8% to 3,058.71.

Japan’s Nikkei 225 edged up 0.01% to 32,042.25 and South Korea’s Kospi added 0.1% to 2,462.60.

On the

local bourse, heavyweights Malayan Banking Bhd slipped five sen to

RM8.95, Public Bank Bhd slid one sen to RM4.17 and CIMB Group Holdings

Bhd dipped four sen to RM5.94.

Petronas Chemicals Group Bhd rose 15 sen to RM7.65 while Tenaga Nasional Bhd gained four sen to RM10.02.

Of the

actives, KNM Group Bhd eased one sen to 10 sen, Minox International

Group Bhd fell 3.5 sen to 33.5 sen, Ekovest Bhd declined 3.5 sen to 47.5

sen, UEM Sunrise Bhd slid four sen to 75 sen, while Eversendai Corp

Bhd's warrant added five sen to 10.5 sen.

On the

index board, the FBM Emas Index declined 19.13 points to 10,673.75, the

FBMT 100 Index shed 11.02 points to 10,346.56, the FBM 70 Index dropped

138.53 points to 14,079.15, and the FBM ACE Index lost 71.74 points to

5,081.40.

The FBM Emas Shariah Index gained 18.51 points to 10,948.07.

Sector-wise,

the Plantation Index rose 39.14 points to 6,928.38, the Industrial

Products and Services Index edged up 0.87 of-a-point to 176.54, the

Financial Services Index fell 78.78 points to 16,165.84, and the Energy

Index slipped by 3.48 points to 878.69.

The Main

Market volume increased to 2.34 billion units worth RM2.44 billion from

1.40 billion units worth RM1.58 billion on Tuesday.

Warrants

turnover expanded to 337.33 million units valued at RM42.81 million

against 305.12 million units valued at RM36.0 million.

The ACE

Market volume tumbled to 716.30 million shares worth RM230.41 million

from 972.12 million shares worth RM304.17 million previously.

Consumer

products and services counters accounted for 290.89 million shares

traded on the Main Market, industrial products and services (446.88

million), construction (325.44 million), technology (202.13 million),

SPAC (nil), financial services (156.88 million), property (327.62

million), plantation (46.75 million), REITs (24.77 million), closed/fund

(178,400), energy (207.47 million), healthcare (61.83 million),

telecommunications and media (77.14 million), transportation and

logistics (64.97 million), and utilities (109.43 million).

Source: The Edge