KUALA LUMPUR (April 11): Bursa Malaysia ended at its intraday high on Tuesday (April 11), prompted by improved market sentiment across the region as bargain hunting continued, particularly for industrial products and services as well as financial services counters.

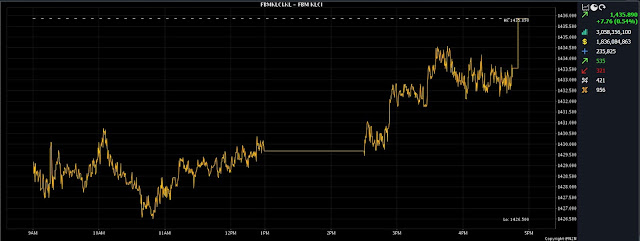

At 5pm, the FBM KLCI had risen 7.76 points to 1,435.89, from Monday's close at 1,428.13.

The barometer index opened 0.99 point higher at 1,429.12, and subsequently hit a low of 1,426.50 during the mid-morning session.

Market breadth was positive, as gainers beat decliners 535 to 321, while 421 counters were unchanged, 956 untraded, and 13 others suspended.

Turnover stood at 3.05 billion units worth RM1.83 billion.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the key regional indices closed mostly higher, after Warren Buffett said he plans to add to his Japanese investments.

Furthermore, the Bank of Korea’s plan to keep the country's interest rate unchanged at 3.5% was well received by investors.

"As for the local bourse, we believe the market undertone will remain positive as investor sentiment improves.

“Hence, we anticipate the KLCI to trend within the range of 1,425-1,445 for the remainder of the week,” he told Bernama.

Region-wise, Japan’s Nikkei 225 rose 1.05% to 27,923.37, South Korea’s Kospi gained 1.42% to 2,547.86, and Hong Kong's Hang Seng climbed 0.76% to 20,485.24, while Singapore's Straits Times Index perked up 0.05% to 3,297.83, and China's SSE Composite Index went down 0.05% to 3,313.57.

Among local heavyweights, Malayan Banking Bhd (Maybank) added eight sen to RM8.73 a share, CIMB Group Holdings Bhd ticked up four sen to RM5.22, Public Bank Bhd was one sen higher at RM3.99, while Petronas Chemicals Group Bhd eased two sen to RM7.38, and Tenaga Nasional Bhd declined five sen to RM9.13.

As for the actives, Hong Seng Consolidated Bhd at 12.5 sen and Revenue Group Bhd at 27 sen had risen one sen each, Cypark Resources Bhd advanced six sen to 87 sen, Top Glove Corp Bhd remained flat at RM1.15, while MyEG Services Bhd was down two sen at 74.5 sen.

On the index board, the FBM Emas Index added 53.70 points to 10,554.79, the FBMT 100 Index rose 50.76 points to 10,235.48, the FBM ACE Index was 42.79 points higher at 5,346.33, and the FBM 70 Index garnered 49.45 points to 13,785.76, while the FBM Emas Shariah Index expanded 54.59 points to 10,911.93.

Sector-wise, the Financial Services Index advanced 79.55 points to 15,783.67, the Energy Index climbed 8.41 points to 872.82, the Plantation Index increased 32.81 points to 6,840.53, and the Industrial Products and Services Index inched up 1.12 points to 175.28.

The Main Market volume improved to 2.14 billion units worth RM1.57 billion, from 2.08 billion units worth RM1.23 billion on Monday.

Warrant turnover widened to 381.61 million units worth RM68.98 million, against 120.21 million units worth RM10.95 million previously.

The ACE Market volume dwindled to 524.51 million shares worth RM188.01 million, versus 868.38 million shares worth RM207.34 million on Monday.

Consumer products and services counters accounted for 241.70 million shares traded on the Main Market, followed by industrial products and services (598.08 million), construction (64.98 million), technology (343.22 million), special purpose acquisition companies (nil), financial services (47.30 million), property (285.93 million), plantation (29.42 million), real estate investment trusts (8.65 million), closed/funds (86,500), energy (191.14 million), healthcare (182.4 million), telecommunications and media (69.38 million), transportation and logistics (44.01 million), and utilities (40.64 million).

Source: The Edge

Comments

Post a Comment