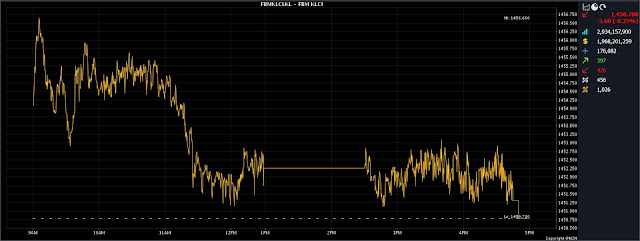

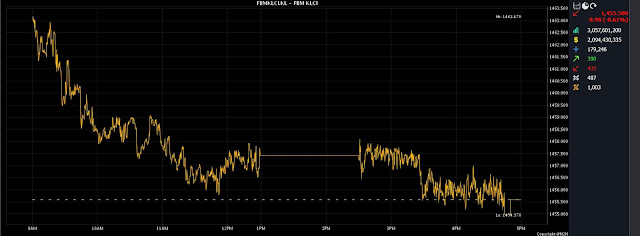

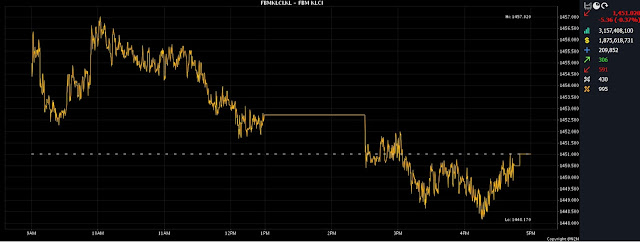

KUALA LUMPUR (Dec 29): Bursa Malaysia wrapped up 2023 to close at its intraday low at 1,454,66 on Friday compared with the first-day opening this year at 1,488.54, weighed by persistent selling pressure throughout most part the year due to outflow of funds as a result of various rate hikes in the US, a dealer said.

Consequently, Rakuten Trade equity research vice president Thong Pak Leng said the FTSE Bursa Malaysia KLCI (FBM KLCI) fell to its year low of 1,374.64 on June 8, 2023, but the situation improved when foreign funds returned to the country at the beginning of July.

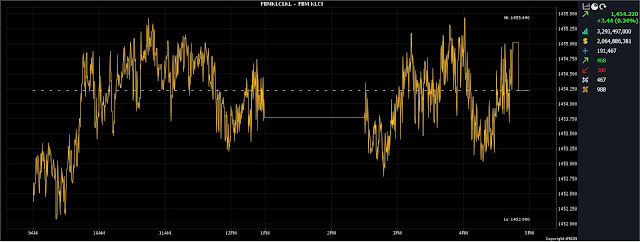

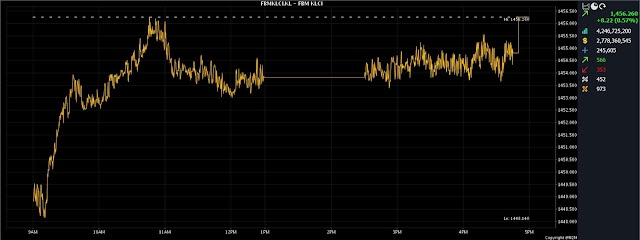

At 5pm, the KLCI closed 2.75 points or 0.18% lower to 1,454.66 from Thursday’s close of 1,457.41.

The key index opened 0.16 of a point better at 1,457.57 and thereafter moved to a high of 1,461.4 during the early morning session.

In the broader market, losers surpassed gainers 486 to 431, while 453 counters were unchanged, 890 untraded and 45 others suspended.

Turnover went up to 4.67 billion units worth RM2.96 billion from 4.24 billion units worth RM2.39 billion on Thursday.

Thong said the KLCI reversed earlier gains and ended the year on a negative note due to profit taking while trading activities were subdued as some traders sought a head start on the New Year's festivities.

"Japan and Hong Kong also closed lower due to profit-taking activities. Meanwhile, investors are simultaneously assessing the prospects of electric-vehicle (EV) companies after China’s Xiaomi unveiled its first EV," he said.

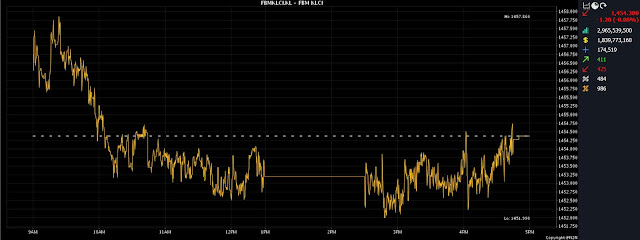

On the domestic front, he said the benchmark index bounced off the 20-day Exponential Moving Average (EMA) line on Friday.

"With the 20-day EMA beginning to turn upward and the index moving away from all EMA lines, we believe there is upward momentum in the near term," he explained.

To recap 2023, Thong said the first half was a bad period because of the poor performance in the region as a result of the outflow of funds to the US when the interest rate was increased several times.

"The performance in the second half was better as the FBM KLCI tested the 1,465 level several times, supported by buying from foreign and institutional funds," he added.

Among the heavyweights, Maybank Bhd lost two sen to RM8.89, Petronas Chemicals Group Bhd fell five sen to RM7.16, while Public Bank Bhd and CIMB Group Holdings Bhd added a sen each to RM4.29 and RM5.85 respectively, and Tenaga Nasional Bhd gained four sen to RM10.04.