KUALA LUMPUR (Feb 28): Bursa Malaysia ended trading at an intraday low on Wednesday due to profit-taking activities following Tuesday's strong gains, in tandem with the downbeat performance in the regional markets.

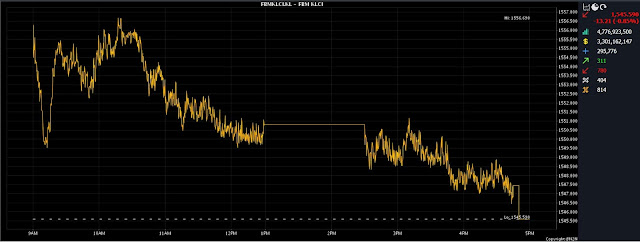

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) shed 13.21 points to close at 1,545.59 from the previous day’s close of 1,558.8.

The benchmark index opened 2.5 points weaker at 1,556.3 and hit an intraday high of 1,556.69 earlier in the day.

On the broader market, losers outpaced gainers 780 to 311, while 404 counters were unchanged, 814 untraded and 77 others suspended.

Turnover expanded to 4.78 billion units worth RM3.30 billion versus Tuesday's 3.88 billion units worth RM3.09 billion.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said local stocks traded in a narrow range amid ongoing concerns about the prolonged higher US interest rates.

"We view the profit-taking as a healthy correction as it allows the market to digest the recent rally and provides a stronger base for a more sustainable uptrend.

"We anticipate the FBM KLCI to trend within the range of 1,540-1,570 for the rest of the week," he told Bernama.

Meanwhile, head of wealth research & advisory, designated portfolio manager at UOB Kay Hian Wealth Advisors, Mohd Sedek Jantan said Bursa Malaysia experienced a modest decline on Wednesday, awaiting fresh domestic drivers to bolster equities.

"The drop aligned with the regional markets that show investors maintained a cautious stance, opting for prudence ahead of the forthcoming release of key US economic indicators later this week, notably a pivotal inflation report.

"The outcome of this data holds significant implications for interest rate expectations, as the US Federal Reserve officials emphasise the necessity of assured signs of inflation deceleration before considering rate adjustments," he said.

Bursa Malaysia heavyweights, Public Bank Bhd fell four sen to RM4.43, CIMB Group Holdings Bhd was two sen lower at RM6.43, Tenaga Nasional Bhd slid 46 sen to RM10.96, Petronas Chemicals Group Bhd edged down nine sen to RM6.85, and Malayan Banking Bhd was flat at RM9.51.

As for the actives, Velesto Energy Bhd rose 1.5 sen to 28 sen, Fitters Diversified Bhd put on half-a-sen to five sen, Hong Seng Consolidated Bhd lost half-a-sen to 1.5 sen, Bumi Armada Bhd shrank 6.5 sen to 52 sen, and TWL Holdings Bhd was flat at 3.5 sen.

On the index board, the FBM Emas Index dipped 91.00 points to 11,463.63, the FBMT 100 Index sank 84.25 points to 11,125.34, the FBM Emas Shariah Index tumbled 98.13 points to 11,482.96, the FBM 70 Index shed 72.17 points to 15,438.63, and the FBM ACE Index fell 39.71 points at 4,765.24.

Sector-wise, the Financial Services Index slid 42.52 points to 17,299.63, the Plantation Index was 27.34 points weaker to 7,155.72, the Utilities Index was down by 41.51 points to 1,566.51, the Industrial Products and Services Index eased 1.85 points to 175.94, and the Energy Index slipped 6.84 points to 924.64.

The Main Market volume increased to 3.47 billion units valued at RM3.07 billion from Tuesday’s 2.45 billion units valued at RM2.78 billion.

Warrants turnover expanded to 752.89 million units worth RM103.81 million from 743.51 million units worth RM119.68 million on Tuesday.

The ACE Market volume dwindled to 533.73 million shares worth RM126.84 million from 669.73 million shares worth RM187.75 million previously.

Consumer products and services counters accounted for 488.96 million shares traded on the Main Market, industrial products and services (598.08 million), construction (105.40 million), technology (667.37 million), SPAC (nil), financial services (152.68 million), property (313.99 million), plantation (43.06 million), REITs (23.43 million), closed/fund (141,700), energy (748.66 million), healthcare (51.15 million), telecommunications and media (87.66 million), transportation and logistics (31.08 million), and utilities (158.50 million).

Source: The Edge

Comments

Post a Comment