KUALA LUMPUR (Feb 26): Bursa Malaysia pared earlier losses on Monday to settle marginally lower as buying activities emerged towards the end of the trading session, amid the downbeat regional market performance.

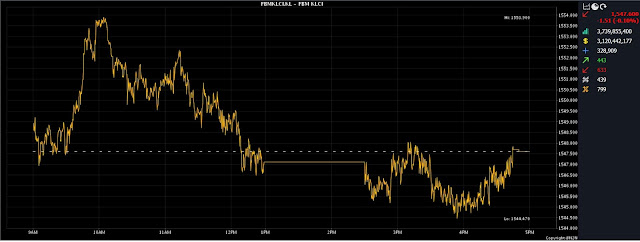

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) slid 1.51 points to 1,547.6 from Friday’s close of 1,549.11.

The benchmark index opened 0.18 of a point lower at 1,548.93 and moved between 1,544.47 and 1,553.9 throughout the session.

In the broader market, losers beat gainers 634 to 442, while 439 counters were unchanged, 799 untraded and 29 others suspended.

Turnover declined to 3.74 billion units worth RM3.12 billion versus Friday's 4.07 billion units worth RM3.21 billion.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said the key regional indices ended broadly lower with profit taking on technology stocks following last week's strong gains.

"Meanwhile, investors are anticipating a series of important economic reports this week, particularly related to US inflation and interest rates. This has, in turn, kept risk appetite largely muted," he said.

On the home front, Thong believes that the outlook for Malaysian equities remains positive, driven by strong corporate earnings, cheap valuations and substantial support from foreign investors.

"We advise investors to exercise caution in the current environment, taking into account external factors such as increasing market risks and elevated volatility in global markets.

"We anticipate the FBM KLCI to trend within the 1,540-1,570 range for the week," he added.

Meanwhile, head of wealth research & advisory, designated portfolio manager at UOB Kay Hian Wealth Advisors, Mohd Sedek Jantan said Bursa Malaysia’s benchmark index concluded Monday's trading session with a decline in value and was influenced by Wall Street's mixed performance last Friday, which left investors cautious.

"Investors await with anticipation the upcoming releases of inflation data from key economies such as the United States, Japan, and Europe, as these are expected to offer valuable insights into the direction of global interest rates.

"Amid this climate of uncertainty, some traders opted to take profits following recent market upswings," he said.

Mohd Sedek said, however, that despite the cautious sentiment, foreign investors continued to demonstrate a net buying stance.

"Notably, foreign investment in Malaysian equities experienced a substantial increase, more than doubling from RM352.9 million to RM786.1 million in just one week.

"Looking ahead, there is an expectation of sustained buying interest. This sentiment is bolstered by the commencement of the full-blown corporate earnings season this week, which typically is a catalyst for market activity," he said.

Additionally, he said overall, while market movements may be influenced by cautious sentiment and profit-taking activities, the outlook remains positive, with foreign investors showing confidence in Malaysian equities.

Bursa Malaysia heavyweights Maybank Bhd and Public Bank Bhd eased two sen each to RM9.51 and RM4.46 respectively, CIMB Group Holdings Bhd perked two sen to RM6.43, Tenaga Nasional Bhd rose eight sen to RM11.36, and Petronas Chemicals Group Bhd was four sen higher at RM6.99.

As for the actives, YTL Corp Bhd edged up three sen to RM2.50, YTL Power International Bhd rose four sen to RM4.06, TWL Holdings Bhd inched down half a sen to 3.5 sen, Ekovest Bhd erased one sen to 48.5 sen, and Hong Seng Consolidated Bhd was flat at two sen.

On the index board, the FBM Emas Index lost 22.08 points to 11,497.28, the FBMT 100 Index shed 23.48 points to 11,148.69, the FBM Emas Shariah Index slipped 31.86 points to 11,529.92, the FBM 70 Index dipped 84.79 points to 15,507.73, and the FBM ACE Index was 40.09 points lower at 4,845.8.

Sector-wise, the Financial Services Index slipped 25.98 points to 17,319.41, the Plantation Index decreased 88.14 points to 7,159.69, the Utilities Index gained 4.17 points to 1,580.21, the Industrial Products and Services Index improved by 0.08 of a point to 177.93, and the Energy Index increased 6.34 points to 936.23.

The Main Market volume expanded to 2.61 billion units valued at RM2.87 billion from Friday’s 2.59 billion units valued at RM2.88 billion.

Warrants turnover declined to 717.03 million units worth RM100.59 million from 791.40 million units worth RM123.85 million last Friday.

The ACE Market volume tumbled to 412.27 million shares worth RM144.75 million from 665.94 million shares worth RM202.09 million previously.

Consumer products and services counters accounted for 422.91 million shares traded on the Main Market, industrial products and services (361.18 million); construction (166.77 million); technology (615.2 million); SPAC (nil); financial services (101.7 million); property (387.21 million); plantation (35.22 million); REITs (16.15 million), closed/fund (45,700); energy (174.85 million); healthcare (90.17 million); telecommunications and media (46.94 million); transportation and logistics (33.92 million); and utilities (157.43 million).

Source: The Edge

Comments

Post a Comment