KUALA LUMPUR (Feb 7): Bursa Malaysia ended mixed on a lack of fresh leads on Wednesday amid a quiet market ahead of the Chinese New Year long weekend.

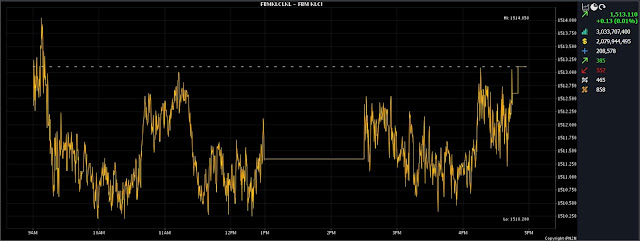

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) inched up 0.13 of a point to end at 1,513.11 from Tuesday’s close of 1,512.98.

The barometer index opened 0.47 of a point easier at 1,512.51 and moved between 1,510.2 and 1,514.05 throughout the day.

Decliners led advancers 554 to 384 on the broader market, while 465 counters were unchanged, 857 untraded and 10 others suspended.

Turnover declined to 3.04 billion units valued at RM2.08 billion from 3.09 billion units valued at RM2.17 billion on Tuesday.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said the KLCI edged slightly higher due to late buying on utilities and gaming stocks.

He noted that the ongoing rebound of China's stock market, which was fuelled by expectations of increased government support, has boosted the performance of regional markets.

“Additionally, a robust close on Wall Street overnight provided a positive lead for regional markets. Moreover, China's rally is strengthened by the commitment of Central Huijin, a sovereign fund, to boost its acquisitions of local exchange-traded funds, supporting the domestic stock market,” he said.

As for the local bourse, Rakuten expects the buying support to continue given the cheap valuation of the benchmark index and continuous support from foreign funds.

“As such, we anticipate the benchmark index to trend within the 1,510-1,520 range for the rest of the week,” he added.

Among the heavyweights, Tenaga Nasional Bhd increased four sen to RM10.82, CelcomDigi Bhd advanced five sen to RM4.24, YTL Power Bhd jumped 17 sen to RM4.04, Public Bank Bhd was flat at RM4.39, Maybank Bhd fell two sen to RM9.29, CIMB Group Holdings Bhd eased one sen to RM6.20 and IHH Healthcare Bhd gave up three sen to RM6.14.

As for the actives, ACE Market debutant AGX Group Bhd gained a sen to 36 sen, Velesto Energy Bhd and TWL Holdings Bhd were flat at 25.5 sen and four sen, Reneuco Bhd trimmed three sen to five sen, Minetech Resources Bhd went down a sen to 13 sen and Widad Group Bhd dwindled half a sen to 11 sen.

On the index board, the FBM Emas Index was 10.99 points easier at 11,223.98, the FBMT 100 Index eased 7.02 points to 10,892.2, the FBM 70 Index shed 42.7 points to 15,117.83, the FBM Emas Shariah Index dipped 28.57 points to 11,240.11, and the FBM ACE Index appreciated 13.54 points to 4,721.6.

Sector-wise, the Property Index fell 8.22 points to 899.42, the Plantation Index slipped 7.06 points to 7,167.28 and the Energy Index erased 5.69 points to 872.96.

The Financial Services Index depreciated 13.24 points to 16,948.07 and the Industrial Products and Services Index eased 0.76 of a point to 171.74.

The Main Market volume increased to 1.89 billion units worth RM1.85 billion from 1.67 billion units worth RM1.90 billion on Tuesday.

Warrants turnover swelled to 681.68 million units valued at RM107.78 million versus 652.13 million units valued at RM97.66 million the previous day.

The ACE Market volume declined to 466.52 million shares worth RM124.55 million compared with Tuesday’s 748.17 million shares worth RM173.48 million.

Consumer products and services counters accounted for 431.28 million shares traded on the Main Market, industrial products and services (338.91 million); construction (115.92 million); technology (115.41 million); SPAC (nil); financial services (70.61 million); property (337.29 million); plantation (9.7 million); REITs (16.92 million), closed/fund (2,000); energy (185.95 million); healthcare (96.66 million); telecommunications and media (34.79 million); transportation and logistics (36.72 million); and utilities (101.7 million).

Source: The Edge

Comments

Post a Comment