KUALA LUMPUR (Feb 2): Bursa Malaysia ended the week on a mixed note on Friday, driven by selling in midsize and small-cap counters, while the key benchmark index maintained a positive trajectory despite reversing some of its earlier gains, dealers said.

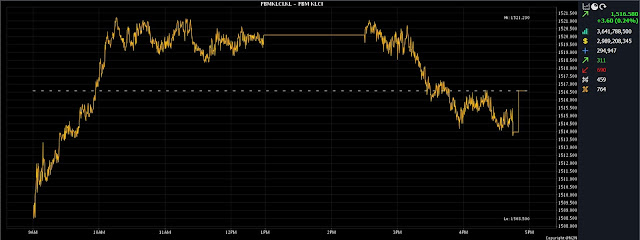

At 5.00pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 3.60 points to end at 1,516.58, from Wednesday's (Jan 31) close of 1,512.98.

The market was closed on Thursday (Feb 1) for the Federal Territory Day public holiday.

The barometer index opened 3.63 points easier at 1,509.35 on Friday, and moved between 1,508.50 and 1,521.23 throughout the day.

Decliners led advancers 654 to 308 on the broader market, while 444 counters were unchanged, 818 untraded and 15 others suspended.

Turnover declined to 3.54 billion units valued at RM2.99 billion, from 3.67 billion units worth RM2.86 billion on Wednesday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said major regional indices also ended in positive territory, as bargain hunting emerged following the recent sell-off.

“Technology stocks in the region were given a positive lead-in from Wall Street, following strong earnings from Amazon and Meta. In the mean time, investors are awaiting the US nonfarm payrolls data due later on Friday.

“On the domestic front, investors are still vigilant on the market undertone, due to the increasing global volatility; nonetheless, the valuation of the FBM KLCI remains attractive. The index has successfully maintained above the 1,500-mark since having surpassed this resistance level last week,” he told Bernama.

Among the heavyweights, Malayan Banking Bhd (Maybank) advanced 8.0 sen to RM9.34, Public Bank Bhd gained 4.0 sen to RM4.43, Tenaga Nasional Bhd (TNB) went up 14 sen to RM10.86, Petronas Chemicals Group Bhd added 1.0 sen to RM6.78, while CIMB Group Holdings Bhd was flat at RM6.23.

As for the actives, both Minetech Resources Bhd and Widad Group Bhd were flat 14.5 sen and 13.5 sen respectively, Velesto Energy Bhd eased half-a-sen to 25.5 sen, Malaysian Resources Corporation Bhd (MRCB) slipped 3.5 sen to 61.5 sen, while YTL Power International Bhd lost 17 sen to RM3.94.

On the index board, the FBM Emas Index was 5.40 points better at 11,248.73, the FBMT 100 Index increased 12.20 points to 10,916.02, the FBM 70 Index shed 39.72 points to 15,146.20, the FBM Emas Shariah Index dipped 9.26 points to 11,268.83, and the FBM ACE Index slid 56.82 points to 4,698.21.

Sector-wise, the Property Index fell 10.03 points to 910.85, the Plantation Index slipped 1.65 points to 7,169.21, and the Energy Index erased 14.14 points to 880.96.

The Financial Services Index garnered 61.94 points to 17,004.93, and the Industrial Products and Services Index eased 1.24 points to 171.87.

The Main Market volume decreased to 2.29 billion units worth RM2.75 billion, from 2.52 billion units worth RM2.63 billion on Wednesday.

Warrants turnover swelled to 679.04 million units valued at RM102.62 million, versus 554.55 million units valued at RM88.19 million previously.

The ACE Market volume declined to 562.41 million shares worth RM138.30 million, compared with Wednesday's 582.84 million shares worth RM136.76 million.

Consumer products and services counters accounted for 324.05 million shares traded on the Main Market, industrial products and services (462.85 million); construction (159.15 million); technology (162.61 million); SPAC (nil); financial services (119.37 million); property (403.29 million); plantation (26.36 million); REITs (33.53 million), closed/fund (nil); energy (292.29 million); healthcare (92.36 million); telecommunications and media (37.37 million); transportation and logistics (41.16 million); and utilities (138.80 million).

Source: The Edge

Comments

Post a Comment