KUALA LUMPUR (Feb 9): Bursa Malaysia ended on a flat note in a quiet market ahead of the Chinese New Year’s long weekend.

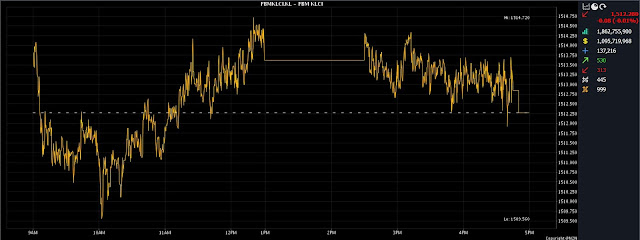

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) was flat, just 0.08 of-a-point lower at 1,512.28 from from Thursday’s close of 1,512.36.

The market will be closed next Monday (Feb 12) for the Chinese New Year public holiday.

Gainers trounced losers 530 to 313 on the broader market, while 445 counters were unchanged, 999 untraded and 11 others suspended.

Turnover slid to 1.86 billion units valued at RM1.1 billion from Thursday’s 3.25 billion units valued at RM2.0 billion.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said Bursa Malaysia finished on thin volume, with buying interest in the broader market mainly on energy and property sectors.

Among the heavyweights, CelcomDigi Bhd added one sen to RM4.23, Press Metal Aluminium Holdings Bhd increased one sen to RM4.63, and MISC Bhd gained two sen to RM7.35. Tenaga Nasional Bhd stood at RM10.78, followed by Malayan Banking Bhd at RM9.26 and Petronas Chemicals Group Bhd at RM6.71, as all three counters were flat. Meanwhile, Public Bank Bhd eased two sen to RM4.35 and CIMB Group Holdings Bhd declined four sen to RM6.19.

As for the actives, Dataprep Holdings Bhd rose two sen to 15 sen, Minetech Resources Bhd improved by 1.5 sen to 14.5 sen, Velesto Energy Bhd was flat at 26.5 sen, Reneuco Bhd shed 1.5 sen to 5.5 sen, while Widad Group Bhd eased half sen to 12 sen and TWL Holdings Bhd dipped half sen to 3.5 sen.

In a filing with Bursa Malaysia on Friday, Reneuco announced that the company is an affected listed issuer under Practice Note 17 of the Main Market Listing Requirements of Bursa Malaysia.

On the index board, the FBM Emas Index was 11.09 points higher at 11,245.02, the FBMT 100 Index advanced 7.03 points to 10,904.51, the FBM 70 Index strengthened by 41.10 points to 15,210.33, the FBM Emas Shariah Index appreciated 20.35 points to 11,286.18, and the FBM ACE Index swelled 50.40 points to 4,822.21.

Sector-wise, the Property Index went up 7.25 points to 912.35, the Plantation Index gave up 5.75 points to 7,192.16 and the Energy Index added 7.26 points to 887.96.

The Financial Services Index depreciated 35.92 points to 16,880.97, but the Industrial Products and Services Index added 0.46 of-a-point to 172.69.

The Main Market volume eased slightly to 1.08 billion units worth RM933.56 million from Thursday’s 1.85 billion units worth RM1.77 billion.

Warrants turnover fell to 448.53 million units worth RM71.83 million from 676.53 million units worth RM102.92 million on Thursday.

The ACE Market volume declined to 325.18 million shares worth RM88.91 million against 695.62 million shares worth RM118.56 million previously.

Consumer products and services counters accounted for 224.44 million shares traded on the Main Market, industrial products and services (200.03 million), construction (71.30 million), technology (135.69 million), SPAC (nil), financial services (26.82 million), property (207.56 million), plantation (10.43 million), REITs (8.02 million), closed/fund (27,000), energy (90.56 million), healthcare (33.31 million), telecommunications and media (16.64 million), transportation and logistics (13.00 million), and utilities (38.05 million).

Source: The Edge

Comments

Post a Comment