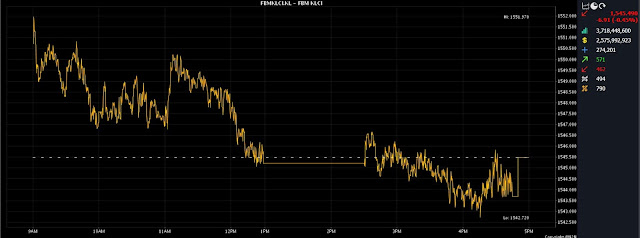

KUALA LUMPUR (Feb 22): The FBM KLCI lost ground for the second consecutive day on Thursday, trimming gains it made over the past few trading sessions.

The benchmark index fell 6.91 points or 0.45% to close the day at 1,545.49, after trading between 1,542.72 and 1,551.97.

Among KLCI constituents pulling the index down, the biggest declines were YTL Group counters — YTL Corp Bhd fell 3.15% to RM2.15, followed by YTL Power International Bhd (down 3.08% to RM3.78) — and PPB Group Bhd (down 1.94% to RM15.20).

Compared to regional counterparts, the KLCI lagged. The Stock Exchange of Thailand Index gained 0.74%, followed by the Philippines Stock Exchange Index (up 0.08%), and the Straits Times Index (up 0.05%), while the Jakarta Composite slipped 0.13%.

Overall, market breadth on Bursa Malaysia was positive as 571 stocks advanced, 462 retreated and 494 traded sideways, with 3.72 billion shares worth RM2.58 billion exchanging hands.

The most actively traded stocks on the bourse were Hong Seng Consolidated Bhd, which closed unchanged at two sen, followed by Reneuco Bhd (down 5.26% to nine sen) and Notion VTec Bhd (up 44.44% to 45.5 sen).

Both the FBM Small Cap and FBM Ace indices, which gained 0.48% and 1.43% respectively, outperformed the FBM Top 100 index (down 0.12%).

Sectoral indices were mixed on Thursday, with technology leading the gainers, while utilities led the laggards.

Tech index surges to seven-month high

The technology index gained 3.13% to a seven-month high of 65.65, in line with other continental peers as US chip designer Nvidia’s earnings forecast boosted sentiment and eased concerns over stretched valuations.

Leading the local technology index was outsourced semiconductor assembly and test (OSAT) firm Malaysian Pacific Industries Bhd (MPI), which gained 9.93% or RM2.60 to RM28.74 after reporting on Wednesday a 75% year-on-year jump for its second quarter net profit to RM32.15 million.

Analysts remained optimistic about MPI, premised on its strategic operation in the supply of content for vehicles, which is expected to be catalysed by growing demand for electric vehicles and autonomous driving.

Source: The Edge

Comments

Post a Comment