KUALA LUMPUR (Feb 27): Bursa Malaysia’s benchmark index continued its upward trajectory on Tuesday to end at its highest level since May 2022 on strong buying activities in heavyweights led by YTL Corp Bhd, Axiata Group Bhd and YTL Power International Bhd.

YTL Corp surged 21 sen to RM2.71, Axiata increased 11 sen to RM2.85 and YTL Power gained nine sen to RM4.15. These three counters lifted the composite index by a combined of 6.73 points.

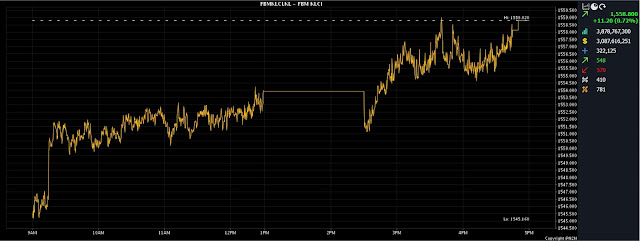

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) surged 11.2 points to 1,558.8 from Monday’s close of 1,547.6.

The benchmark index opened 2.08 points lower at 1,545.52 and moved between 1,545.16 and 1,559.02 throughout the session.

However, in the broader market, losers beat gainers 570 to 548, while 410 counters were unchanged, 781 untraded and 47 others suspended.

Turnover improved to 3.88 billion units worth RM3.09 billion versus Monday's 3.74 billion units worth RM3.12 billion.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said most regional markets rebounded from their downbeat performance yesterday with strong gains in China and Hong Kong, fuelled by investor optimism as China's state funds reportedly pumped in over US$57 billion (RM273.32 billion) to support the market while at the same time, global funds continue to flow into the region.

"On the other hand, investors are cautiously awaiting various economic data releases, including China's manufacturing purchasing managers' index and the US Personal Consumption Expenditures Price Index, which serves as the Federal Reserve's (Fed) preferred inflation gauge.

"Domestically, we remain optimistic on the market undertone which is supported by solid fundamentals with strong buying in blue chips following their strong quarterly earnings.

"Nonetheless, we recognise the chance for profit taking, a factor we do not overlook," he said.

Hence, Thong anticipates the KLCI to trend within the 1,540-1,570 range for the week, while from a technical perspective, the immediate resistance is spotted at 1,570 and support at 1,534.

Meanwhile, head of wealth research & advisory, designated portfolio manager at UOB Kay Hian Wealth Advisors, Mohd Sedek Jantan said Bursa Malaysia concluded on a positive trajectory, marked by diverse sectoral performances.

"The utilities sector showcased notable resilience, propelled by robust quarterly earnings disclosures.

"In addition, the recent upward momentum received further impetus from the rollout of renewable energy initiatives, including the large-scale solar and low carbon energy generation programmes, aimed at fostering sustainable practices," he said.

Mohd Sedek said so far, the majority of quarterly earnings were consistently aligned with market forecasts, bolstering sustained investor confidence and perpetuating a trend of ongoing market activity.

"However, select investors are capitalising on profit-taking opportunities to safeguard gains amid prevailing uncertainties surrounding the Fed's policy trajectory.

“We maintain an optimistic outlook on the Malaysian market, anticipating continued bullish trends supported by the economic resurgence in China," he said.

Among other heavyweights, Sime Darby Plantation Bhd added seven sen to RM4.30, Maxis Bhd perked six sen to RM3.83, but Petronas Chemicals Group Bhd edged down five sen to RM6.94, and MISC Bhd inched down one sen to RM7.50.

As for the actives, PUC Bhd rose a sen to 5.5 sen, Cape EMS Bhd tumbled 19.5 sen to 93.5 sen, Master Tec Group Bhd shed half a sen to 64.5 sen, while Hong Seng Consolidated Bhd was flat at two sen.

On the index board, the FBM Emas Index climbed 57.35 points to 11,554.63, the FBMT 100 Index widened 60.9 points to 11,209.59, the FBM Emas Shariah Index put on 51.17 points to 11,581.09, the FBM 70 Index edged up 3.07 points to 15,510.8, and the FBM ACE Index slid 40.85 points to 4,804.95.

Sector-wise, the Financial Services Index climbed 22.74 points to 17,342.15, the Plantation Index increased 23.37 points to 7,183.06, the Utilities Index gained 27.81 points to 1,608.02, the Industrial Products and Services Index declined by 0.14 of a point to 177.79, and the Energy Index lost 4.75 points to 931.48.

The Main Market volume narrowed to 2.45 billion units valued at RM2.78 billion from Monday’s 2.61 billion units valued at RM2.87 billion.

Warrants turnover expanded to 743.51 million units worth RM119.68 million from 717.03 million units worth RM100.59 million the day before.

The ACE Market volume swelled to 669.73 million shares worth RM187.75 million from 412.27 million shares worth RM144.75 million previously.

Consumer products and services counters accounted for 420.57 million shares traded on the Main Market, industrial products and services (474.88 million); construction (133.97 million); technology (533.54 million); SPAC (nil); financial services (106.03 million); property (301.48 million); plantation (34.84 million); REITs (14.38 million), closed/fund (91,800); energy (123.02 million); healthcare (64.87 million); telecommunications and media (42.84 million); transportation and logistics (35.56 million); and utilities (165.3 million).

Source: The Edge

Comments

Post a Comment