KUALA LUMPUR (Feb 29): Bursa Malaysia’s benchmark FTSE Bursa Malaysia KLCI (FBM KLCI) ended higher on Thursday in tandem with the upbeat performance in most regional markets and ahead of the US personal consumption expenditure (PCE) data due out later in the night.

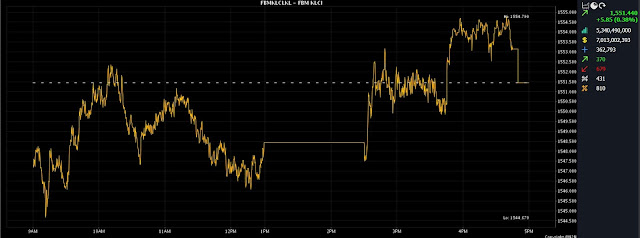

At 5pm, the KLCI added 5.85 points to close at 1,551.44 from Wednesday’s close of 1,545.59.

The benchmark index opened 2.03 points better at 1,547.62 and moved between 1,544.67 and 1,554.79 throughout the session.

However, in the broader market, losers outpaced gainers 679 to 370, while 431 counters were unchanged, 810 untraded and 43 others suspended.

Turnover expanded to 5.34 billion units worth RM7.01 billion versus Wednesday's 4.78 billion units worth RM3.3 billion.

Head of wealth research & advisory, designated portfolio manager at UOB Kay Hian Wealth Advisors, Mohd Sedek Jantan said Malaysian equities experienced a surge, mirroring the positive trend in most regional stock markets.

"Although there was some initial caution among investors awaiting the US inflation data to gauge the Federal Reserve’s interest rate adjustments, the overall market sentiment remained optimistic," he said.

He said notably, the plantation sector emerged as a top performer, benefitting from both anticipated lower output due to the mild El Nino weather phenomenon forecast and increased demand from China, the world’s largest importer of palm oil.

"Malaysia’s significant role in the global palm oil industry, accounting for 23% of total production and nearly 30% of total exports, underscores its position as a key player in this commodity market," he added.

Meanwhile, ActivTrades trader Anderson Alves said investors are now turning their attention to the upcoming release of the US PCE report.

“This report is anticipated to shed light on inflationary pressures and could signal upcoming shifts in monetary policy.

“The consensus forecast for the report suggests a month-on-month increase of 0.4%, closely aligned with the average analysts’ prediction at 0.39%,” he said.

Additionally, he said the core PCE, which excludes volatile items, is expected to show an even more pronounced increase, with some projections reaching 0.55%.

“Should these figures exceed expectations, it could strengthen the US dollar and exert downward pressure on bond markets, potentially affecting global stock markets, particularly in the US,” he added.

Bursa Malaysia heavyweights, Maybank Bhd gained two sen to RM9.53, CIMB Group Holdings Bhd perked up three sen to RM6.46, Tenaga Nasional Bhd rose 30 sen to RM11.26, Petronas Chemicals Group Bhd edged up 15 sen to RM7, and Public Bank Bhd fell three sen to RM4.40.

As for

the actives, YTL Corp Bhd increased three sen to RM2.67, MyEG Services

Bhd advanced 1.5 sen to 80.5 sen, Dialog Group Bhd eased nine sen to

RM2.10, YTL Power International Bhd lost six sen to RM3.95, while Hong

Seng Consolidated Bhd was flat at 1.5 sen.

On the index board, the FBM Emas Index climbed 28.19 points to

11,491.82, the FBMT 100 Index put on 32.86 points to 11,158.2, the FBM

Emas Shariah Index increased 45.03 points to 11,527.99, the FBM 70 Index

rose 7.52 points to 15,446.15, and the FBM ACE Index notched up 2.89

points at 4,768.13.

Sector-wise, the Financial Services Index went up 16.87 points to 17,316.5, the Plantation Index was 38.95 points better at 7,194.67, the Utilities Index shed 27.51 points to 1,539, the Industrial Products and Services Index added 0.34 of a point to 176.28, and the Energy Index inched up 0.06 of a point to 924.7.

The Main Market volume expanded to 3.69 billion units valued at RM6.74 billion from 3.47 billion units valued at RM3.07 billion.

Warrants turnover soared to 1.11 billion units worth RM145.8 million from 752.89 million units worth RM103.81 million on Wednesday.

The ACE Market volume widened to 546.8 million shares worth RM127.64 million from 533.73 million shares worth RM126.84 million previously.

Consumer products and services counters accounted for 382.99 million shares traded on the Main Market, industrial products and services (468.62 million); construction (208.03 million); technology (415.19 million); SPAC (nil); financial services (177.81 million); property (336.43 million); plantation (42.11 million); REITs (45.48 million), closed/fund (11,500); energy (692.44 million); healthcare (116.88 million); telecommunications and media (69.02 million); transportation and logistics (43.3 million); and utilities (687.09 million).

Source: The Edge

Comments

Post a Comment