KUALA LUMPUR (July 17): The FTSE Bursa Malaysia KLCI (FBM KLCI) ended lower on Monday (July 17), weighed by profit-taking in heavyweights amid a mixed regional market performance, a dealer said.

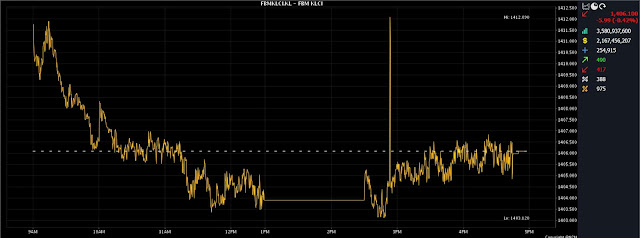

At 5pm, the FBM KLCI fell 5.99 points, or 0.42%, to 1,406.10 from 1,412.09 at last Friday’s close.

The key index opened 0.32 of-a-point lower at 1,411.77 and moved between 1,403.12 and 1,412.09 throughout the day.

However, the broader market turned positive as gainers beat decliners 490 to 417, while 390 counters were unchanged, 973 untraded, and 18 others suspended.

Turnover narrowed to 3.6 billion units worth RM2.18 billion from 4.0 billion units worth RM2.67 billion last Friday.

Malacca Securities Sdn Bhd senior analyst Kenneth Leong said the local index pared its previous session’s gains as sentiment turned negative following China’s weaker-than-expected gross domestic product data for the second quarter of 2023.

"Looking ahead, we expect a consolidation could take shape with investors shifting their attention to the deluge of corporate earnings releases in the United States.

"We reckon that investors may also retreat to the sidelines ahead of the mid-week break before returning to the fore," he told Bernama.

Among the heavyweights, Malayan Banking Bhd rose five sen to RM8.85, Public Bank Bhd was unchanged at RM3.99, CIMB Group Holdings Bhd fell one sen to RM5.29, Tenaga Nasional Bhd eased six sen to RM9.13, and IHH Healthcare Bhd lost four sen to RM5.80.

Of the actives, newly listed DC Healthcare Holdings Bhd increased 20 sen to 45 sen, Classita Holdings Bhd rose one sen to 22.5 sen, Advance Synergy Bhd went up one sen to 16.5 sen, MyEG Services Bhd gained two sen to 75 sen, and Dagang NeXchange Bhd was flat at 50 sen.

On the index board, the FBM Emas Index declined 17.06 points to 10,415.06, the FBMT 100 Index was 19.30 points lower at 10,095.20, and the FBM Emas Shariah Index slipped 22.87 points to 10,686.46.

The FBM 70 Index improved 73.42 points to 13,898.71, and the FBM ACE Index advanced 54.87 points to 5,334.64.

Sector-wise, the Financial Services Index rose 18.38 points to 15,753.60, the Plantation Index dropped 19.30 points to 6,878.82, the Industrial Products and Services Index eased 1.26 points to 161.56, and the Energy Index shed 10.71 points to 812.49.

The Main Market volume shrank to 2.50 billion units valued at RM1.82 billion from 3.11 billion units valued at RM2.40 billion last Friday.

Warrants turnover tumbled to 122.25 million units worth RM13.82 million versus 306.45 million units worth RM43.92 million previously.

The ACE Market volume surged to 952.32 million shares valued at RM342.03 million compared to 586.62 million shares valued at RM225.18 million last Friday.

Consumer products and services counters accounted for 877.75 million shares traded on the Main Market, industrial products and services (454.65 million), construction (89.46 million), technology (323.63 million), SPAC (nil), financial services (59.92 million), property (303.85 million), plantation (30.83 million), REITs (9.71 million), closed/fund (82,000), energy (141.79 million), healthcare (105.03 million), telecommunications and media (35.23 million), transportation and logistics (26.74 million), and utilities (45.58 million).

Comments

Post a Comment