KUALA LUMPUR (July 14): Bursa Malaysia maintained its uptrend to close higher on Friday (July 14), supported by persistent buying of most heavyweights, led by telecommunications and media as well as financial services counters, in line with positive sentiment on regional bourses.

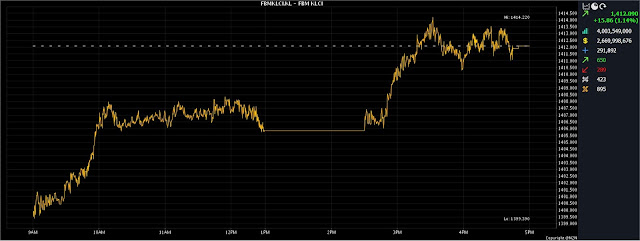

At 5pm, the FBM KLCI had jumped 15.86 points, or 1.14%, to 1,412.09, from 1,396.23 at Thursday’s close.

The barometer index opened 3.30 points better at 1,399.53 on Friday morning, and moved between 1,399.39 and 1,414.22 throughout the day.

Turnover rose to four billion units worth RM2.67 billion, versus 2.93 billion units worth RM1.78 billion on Thursday.

CelcomDigi Bhd and Public Bank Bhd were the top contributors to the gain in the key index, with a combined total of 4.57 points.

CelcomDigi rose 12 sen to RM4.31, while Public Bank gained seven sen to RM3.99.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the KLCI showcased yet another impressive performance, buoyed by strong buying support from local institutions and the resurgence of foreign funds.

“Across the region, key indices demonstrated positive momentum, propelled by encouraging signals from international stock markets.

“Investor sentiment remained positive, following the release of the US producer price index, which came in lower than expected, fuelling optimism that the US Federal Reserve may cool down on its rate hikes later this month,” he told Bernama on Friday.

Furthermore, he said, Beijing is actively preparing stimulus measures, which are expected to yield favourable results for China's technology sector.

Among other heavyweights, Malayan Banking Bhd (Maybank) at RM8.80 and IHH Healthcare Bhd at RM5.84 had gained seven sen each, CIMB Group Holdings Bhd increased 10 sen to RM5.30, Petronas Chemicals Group Bhd improved eight sen to RM6.39, and Tenaga Nasional Bhd went up nine sen to RM9.19.

Of the actives, Classita Holdings Bhd advanced 7.5 sen to 21.5 sen, Dagang NeXchange Bhd added three sen to 50 sen, while Widad Group Bhd was flat at 42 sen, and Jade Marvel Group Bhd slipped one sen to 21 sen.

On the index board, the FBM Emas Index was 129.89 points firmer at 10,432.12, the FBMT 100 Index surged 125.24 points to 10,114.50, the FBM Emas Shariah Index was 125.40 points better at 10,709.33, the FBM 70 Index chalked up 220.32 points to 13,825.29, and the FBM ACE Index garnered 67.25 points to 5,279.77.

Sector-wise, the Financial Services Index bolstered 190.06 points to 15,735.22, the Industrial Products and Services Index improved 1.75 points to 162.82, the Energy Index went up 12.02 points to 823.20, while the Plantation Index rose 2.45 points to 6,898.12.

The Main Market volume widened to 3.11 billion units valued at RM2.40 billion, from 1.99 billion units valued at RM1.53 billion on Thursday.

Warrant turnover narrowed to 306.45 million units worth RM43.92 million, against 399.67 million units worth RM62.76 million.

The ACE Market volume strengthened to 586.62 million shares valued at RM225.18 million, from 536.55 million shares valued at RM182.49 million previously.

Consumer products and services counters accounted for 1.15 billion shares traded on the Main Market, followed by industrial products and services (638.61 million), construction (73.21 million), technology (378.40 million), special purpose acquisition companies (nil), financial services (113.77 million), property (293.99 million), plantation (35.37 million), real estate investment trusts (7.61 million), closed/funds (23,400), energy (247.52 million), healthcare (50.83 million), telecommunications and media (28.25 million), transportation and logistics (47.03 million), and utilities (43.95 million).

Source: The Edge

Comments

Post a Comment