KUALA LUMPUR (July 28): Bursa Malaysia snapped a six-day rally to end lower on Friday (July 28), due to profit-taking activities.

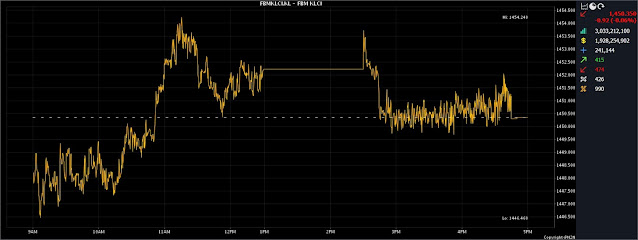

At 5pm, the FBM KLCI had slipped by 0.92 of a point to 1,450.35, from 1,451.27 at Thursday’s close.

The market bellwether opened 3.06 points lower at 1,448.21 on Friday morning, and moved between 1,446.46 and 1,454.24 throughout the day.

The broader market was negative, as decliners trounced advancers 474 to 415, while 426 counters were unchanged, 990 untraded, and 71 others suspended.

Turnover stood at 3.03 billion units worth RM1.93 billion.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng expects the outlook to remain positive in the near to mid term, due to attractive valuations and continuous support from foreign funds.

“Following the KLCI's rebound on July 7, Malaysian equities experienced net foreign buying totalling RM1.3 billion.

“Foreign funds are likely to keep buying in the region, given the attractive valuations of regional markets and expectations of better economic growth.

“As a result, the local market is expected to benefit from the spillover effect,” he told Bernama.

Among the heavyweights, Public Bank Bhd added three sen to RM4.14, Petronas Chemicals Group Bhd gained four sen to RM6.85, Malayan Banking Bhd (Maybank) at RM8.99 and CIMB Group Holdings Bhd at RM5.50 were both flat, while Tenaga Nasional Bhd slid three sen to RM9.57.

Of the actives, KNM Group Bhd at nine sen and UEM Sunrise Bhd at 49 sen had gained half a sen each, AT Systematization Bhd was flat at one sen, while Capital A Bhd declined half a sen to 91 sen, and Hong Seng Consolidated Bhd shed one sen to 7.5 sen.

On the index board, the FBM 70 Index eased 16.39 points to 13,935.32, the FBM Emas Index fell 8.45 points to 10,652.93, the FBMT 100 Index was 7.97 points lower at 10,341.18, the FBM Emas Shariah Index was down 24.26 points to 10,905.20, and the FBM ACE Index trimmed 10.21 points to 5,321.33.

Sector-wise, the Financial Services Index advanced 14.93 points to 16,179.81, and the Industrial Products and Services Index inched up 0.41 of a point to 167.51, while the Plantation Index fell 55.44 points to 7,150.11, and the Energy Index shed 3.99 points to 832.70.

The Main Market volume reduced to 2.07 billion units valued at RM1.69 billion, from 2.70 billion units valued at RM2.17 billion on Thursday.

Warrant turnover swelled to 373.88 million units worth RM60.81 million, versus 323.84 million units worth RM47.52 million previously.

The ACE Market volume slipped to 579.16 million shares valued at RM166.44 million, compared with 697.60 million shares valued at RM226.42 million a day earlier.

Consumer products and services counters accounted for 419.46 million shares traded on the Main Market, along with industrial products and services (349.09 million), construction (195.73 million), technology (289.05 million), special purpose acquisition companies (nil), financial services (67.61 million), property (271.90 million), plantation (38.85 million), real estate investment trusts (9.45 million), closed/funds (21,000), energy (243.62 million), healthcare (101.41 million), telecommunications and media (23.66 million), transportation and logistics (23.40 million), and utilities (36.86 million).

Source: The Edge

Comments

Post a Comment