KUALA LUMPUR (July 25): Bursa Malaysia extended its gaining streak for a fourth consecutive day on Tuesday (July 25), in line with most key regional indices and persistent buying mainly for banking and commodity-related stocks, said an analyst.

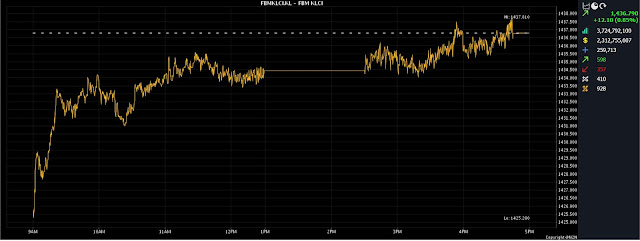

At 5pm, the benchmark FBM KLCI had risen 0.85% or 12.10 points to 1,436.79, from 1,424.69 at Monday’s close.

The market bellwether opened 1.07 points higher at 1,425.76 on Tuesday morning, and moved between 1,425.76 and 1,437.81 throughout the day.

Turnover stood at 3.72 billion units worth RM2.31 billion.

The KLCI gained 33.76 points in the last four trading days.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the KLCI had broken four resistance levels (1,390, 1400, 1,415, and 1,430) since July 7, thanks to buying support from foreign funds.

“We believe the local market undertone should remain steady, due to improving investor sentiment, and the index to stay positive going forward, although we do not discount the possibility of profit-taking shortly.

“In the meantime, there was an uptick in crude oil prices, due to indications of reduced supplies, and assurances from China’s authorities to boost their economy,” he told Bernama.

In addition, Thong cited Monday’s report that Petronas Carigali had announced six significant oil and gas discoveries off the coast of Sarawak.

Given these discoveries and the surge in crude oil prices, he believes these would provide an opportunity for short-term play for the oil and gas sector.

“We raise our weekly KLCI target from 1,415-1,430 to 1,430-1,450, with immediate resistance at 1,445 and support at 1,400,” Thong said.

Among the heavyweights, Malayan Banking Bhd (Maybank) rose six sen to RM8.98 a share, Public Bank Bhd added seven sen to RM4.05, CIMB Group Holdings Bhd widened eight sen to RM5.43, Tenaga Nasional Bhd edged up one sen to RM9.47, and Petronas Chemicals Group Bhd surged 26 sen to RM6.76.

Of the active counters, Classita Holdings Bhd went down 2.5 sen to 12.5 sen, Hong Seng Consolidated Bhd increased one sen to 9.5 sen, ACE Market debutant MYMBN Bhd bagged six sen to 27 sen, UEM Sunrise Bhd grew by four sen to 47.5 sen, while AT Systematization Bhd was flat at one sen.

On the index board, the FBM Emas Index gained 83.48 points to 10,590.56, the FBMT 100 Index was 80.68 points higher at 10,276.57, the FBM Emas Shariah Index increased 64.44 points to 10,875.32, the FBM 70 Index climbed 85.16 points to 13,984.26, and the FBM ACE Index garnered 1.81 points to 5,321.67.

Sector-wise, the Financial Services Index ballooned 182.34 points to 16,004.63, the Plantation Index increased 62.71 points to 7,198.02, the Energy Index inched up 6.59 points to 830.20, and the Industrial Products and Services Index rose 3.42 points to 166.30.

The Main Market volume advanced to 2.53 billion units valued at RM2.02 billion, from 2.32 billion units valued at RM1.53 billion on Monday.

Warrant turnover expanded to 498.07 million units worth RM75.70 million, versus 462.79 million units worth RM63.61 million previously.

The ACE Market volume soared to 694.15 million shares valued at RM220.44 million, compared with 512.28 million shares valued at RM189.02 million on Monday.

Consumer product and service counters accounted for 702.19 million shares traded on the Main Market, followed by industrial products and services (477.57 million), construction (109.71 million), technology (290.99 million), special purpose acquisition companies (nil), financial services (119.30 million), property (374.39 million), plantation (70.44 million), real estate investment trusts (13.73 million), closed/funds (39,700), energy (185.14 million), healthcare (61.16 million), telecommunications and media (24.51 million), transportation and logistics (24.13 million), and utilities (74.11 million).

Source: The Edge

Comments

Post a Comment