KUALA LUMPUR (July 12): Bursa Malaysia extended its gaining streak for a third consecutive day on Wednesday (July 12), supported by persistent buying of heavyweights led by industrial products and services counters, in sync with the positive performance of regional bourses.

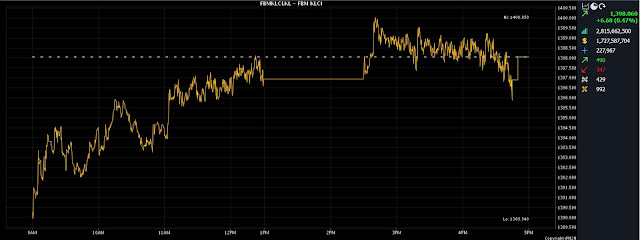

At 5pm, the FBM KLCI had gained 6.60 points, or 0.47%, to 1,398.06, from 1,391.46 at Tuesday’s close.

The barometer index opened 1.19 points easier at 1,390.27 on Wednesday morning, and moved to a low of 1,389.94 in the early session, and breached the psychological level of 1,400 points when it hit an intraday high of 1,400.05 in the mid-afternoon.

The broader market was also positive, as gainers beat losers 490 to 347, while 429 counters were unchanged, 992 untraded and 16 others suspended.

Turnover inched down to 2.82 billion units worth RM1.73 billion, versus 2.83 billion units worth RM1.86 billion on Tuesday.

Petronas Chemicals Group Bhd (PetChem) and Press Metal Aluminium Holdings Bhd were the top contributors to the gain in the key index.

PetChem rose 20 sen to RM6.34, while Press Metal gained nine sen to RM4.89, contributing a combined total of 3.87 points.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the key regional indices ended mostly higher, buoyed by optimism about China's support for the property sector.

He told Bernama on Wednesday that the world's second-largest economy is expected to accelerate its policy roll-out to support the real estate market, and that measures to support business confidence may be introduced.

Meanwhile, he said investors are hoping that the US Federal Reserve would halt its interest rates hikes ahead of the nation’s inflation report later on Wednesday, which would cause less damage to business activities.

“Back home, we reckon the outlook for local equities would remain steady, with strong buying support from local institutions due to cheap valuations, on the back of strong local economic fundamentals that will drive the market going forward.

“Hence, we anticipate the KLCI to retest the 1,400 mark soon. If the KLCI is able to sustain above the 1,400 mark for a longer period, the outlook for the benchmark index will be positive in the midterm.

“After breaking the 1,400-strong psychology level, we spot the next resistance at 1,415 and support at 1,375,” he said.

Among the heavyweights, Malayan Banking Bhd (Maybank) gained one sen to RM8.75 and CIMB Group Holdings Bhd too inched up one sen to RM5.22, IHH Healthcare Bhd advanced seven sen to RM5.95, Public Bank Bhd was flat at RM3.87, while Tenaga Nasional Bhd went down two sen to RM9.03.

Of the actives, Sarawak Consolidated Industries Bhd added one sen to 49.5 sen and KNM Group Bhd improved by one sen as well to 8.5 sen, Salutica Bhd jumped 11.5 sen to 72 sen, and RGB International Bhd advanced 2.5 sen to 36.5 sen.

On the index board, the FBM Emas Index was 43.80 points firmer at 10,300.35, the FBMT 100 Index bagged 41.29 points to 9,990.19, the FBM Emas Shariah Index was 58.15 points better at 10,602.51, the FBM 70 Index improved 31.03 points to 13,554.86, and the FBM ACE Index rose 1.74 points to 5,221.27.

Sector-wise, the Financial Services Index increased 30.40 points to 15,497.28, the Industrial Products and Services Index inched up 2.21 points to 161.26, the Energy Index put on 11.66 points to 813.88, while the Plantation Index shed 5.40 points to 6,896.03.

The Main Market volume expanded to 2.09 billion units valued to RM1.50 billion, from 2.01 billion units valued at RM1.60 billion on Tuesday.

Warrant turnover declined to 299.16 million units worth RM47.77 million, against 311.74 million units worth RM48 million.

The ACE Market volume fell to 422.16 million shares valued at RM179.29 million, from 504.39 million shares valued at RM213.07 million previously.

Consumer products and services counters accounted for 503.86 million shares traded on the Main Market, followed by industrial products and services (632.60 million), construction (86.05 million), technology (140.79 million), special purpose acquisition companies (nil), financial services (72.74 million), property (213.60 million), plantation (31.59 million), real estate investment trusts (10.67 million), closed/funds (24,900), energy (228.10 million), healthcare (43.93 million), telecommunications and media (46.40 million), transportation and logistics (24.56 million), and utilities (57.01 million).

Source: The Edge

Comments

Post a Comment