KUALA LUMPUR (July 3): Bursa Malaysia ended broadly higher on Monday (July 3) due to bargain-hunting in banking stocks following the selldown last Friday, in tandem with the upbeat performance in regional peers.

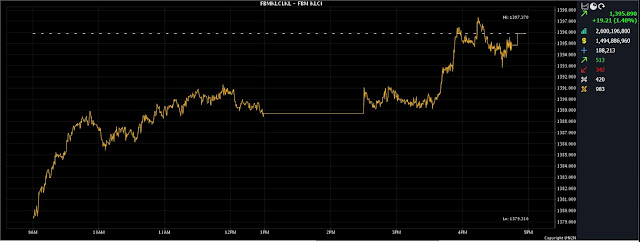

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) surged 19.21 points, or 1.4%, to 1,395.89 from 1,376.68 at last Friday’s close.

The key index opened 2.71 points better at 1,379.39 on Monday morning and moved between 1,379.31 and 1,397.37 throughout the session.

Turnover narrowed to 2.61 billion units worth RM1.50 billion versus 2.65 billion units worth RM2.03 billion last Friday.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said regionally, key indices ended higher as the decrease in US inflation sparked optimism for the US Federal Reserve to pursue a hawkish stance on monetary policy.

“Additionally, data indicating a positive shift in sentiment towards the Japanese economy propelled the Nikkei index to its highest level in 33 years.

“Over to Hong Kong, stocks rose sharply higher on hopes of China’s stimulus measure to support economic growth and employment,” he told Bernama.

Regionally, Hong Kong’s Hang Seng Index rose 2.06% to 19,306.59, China’s SSE Composite Index gained 1.31% to 3,243.98 and Shenzhen Index increased 0.59% to 11,091.56.

On the domestic front, Thong said the benchmark index continued its upward trajectory thanks to improving global market sentiment.

“Having broken the 1,390 resistance, we anticipate the FBM KLCI to re-test the 1,400 mark this week.

“Nonetheless, we advise investors to remain cautious ahead of the Bank Negara Malaysia Monetary Policy Committee meeting scheduled for this Wednesday and Thursday although we believe the overnight policy rate will be maintained,” he said.

He added that technically, the next resistance level is expected at 1,415 while support remained at 1,373.

Among the heavyweight stocks, Malayan Banking Bhd rose 12 sen to RM8.75, Public Bank Bhd gained nine sen to RM3.94, CIMB Group Holdings Bhd was 10 sen firmer at RM5.16, Tenaga Nasional Bhd ticked up five sen to RM9.10 but IHH Healthcare Bhd slid one sen to RM5.88.

Of the actives, RGB International Bhd increased 2.5 sen to 36 sen, TWL Holdings Bhd inched up half-a-sen to 3.5 sen while Sarawak Consolidated Industries Bhd stood at 47 sen, followed by Widad Group Bhd at 42 sen and BTM Resources Bhd at nine sen, as all three counters were flat.

On the index board, the FBM Emas Index soared 131.21 points to 10,272.55, the FBMT 100 Index shoot up 130.30 points to 9,974.30, the FBM Emas Shariah Index jumped 120.01 points to 10,534.88, the FBM ACE Index strengthened 47.56 points to 5,115.58 and the FBM 70 Index perked up 147.05 points to 13,531.63.

Sector-wise, the Financial Services Index rose 185.21 points to 15,518.08, the Industrial Products and Services Index gained 1.98 points to 158.90, the Energy Index recovered 14.05 points to 788.14 and the Plantation Index bagged 128.83 points to 6,827.48.

The Main Market volume dwindled to 1.80 billion units valued at RM1.26 billion from 1.93 billion units valued at RM1.82 billion last Friday.

Warrants turnover expanded to 333.22 million units worth RM60.90 million against 226.52 million units worth RM39.82 million previously.

The ACE Market volume decreased slightly to 483.43 million shares valued at RM179.48 million from 494.11 million shares valued at RM173.01 million last Friday.

Consumer products and services counters accounted for 349.89 million shares traded on the Main Market, industrial products and services (606.59 million), construction (46.56 million), technology (135.22 million), SPAC (nil), financial services (58.86 million), property (238.76 million), plantation (47.67 million), REITs (6.30 million), closed/fund (88,200), energy (129.90 million), healthcare (77.49 million), telecommunications and media (26.81 million), transportation and logistics (22.54 million), and utilities (49.55 million).

Source: The Edge

Comments

Post a Comment