KUALA LUMPUR (July 24): Bursa Malaysia's key index rallied to close higher for a third straight session on Monday (July 24) on continuous foreign buying support mainly for banking stocks.

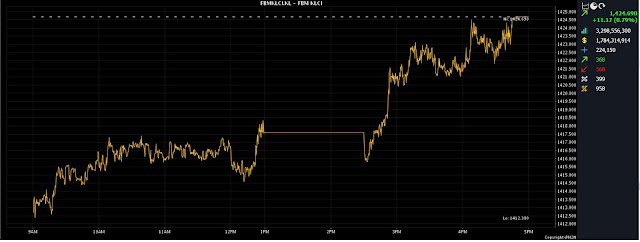

At 5pm, the benchmark FBM KLCI had risen 0.79% or 11.17 points to settle at its intraday high of 1,424.69, from 1,413.52 at last Friday’s close.

The market bellwether opened 0.84 of a point lower at 1,412.68 on Monday morning, and hit a low of 1,412.38 in the early session, before gaining momentum to move in an upward trajectory towards closing.

However, the broader market was negative, as decliners outpaced advancers 568 to 368, while 399 counters were unchanged, 958 untraded, and 16 others suspended.

Turnover stood at 3.29 billion units worth RM1.78 billion.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng believes the overall outlook for Malaysian equities would remain stable in the medium term, given their attractive valuations, stronger corporate earnings, and improved economic conditions.

“However, the global volatility will also play a major role in determining the local market's direction,” he told Bernama.

“From a technical point of view, the benchmark index has broken its 1,415 resistance, due to continuous foreign buying support, and is expected to test the 1,430 level soon, on the back of improved investor sentiment, while support is unchanged at 1,400,” he added.

Meanwhile, Thong said the region’s stock performance ended mixed, as investors were cautiously awaiting the outcome of the US Federal Reserve meeting, which starts on Tuesday and ends on Wednesday, whereby the central bank is widely expected to raise rates by 25 basis points.

“Despite this, many hold the belief that this could mark the end of the tightening cycle, considering that inflation has been cooling since the previous summer,” he said.

Among the heavyweights, Malayan Banking Bhd (Maybank) rose 14 sen to RM8.92 a share, CIMB Group Holdings Bhd added five sen to RM5.35, Tenaga Nasional Bhd perked up 35 sen to RM9.46, while Public Bank Bhd at RM3.98 and Petronas Chemicals Group Bhd at RM6.50 were both flat.

Of the active counters, Classita Holdings Bhd went down 1.5 sen to 15 sen, Malaysian Resources Corp Bhd eased two sen to 37.5 sen, UEM Sunrise Bhd declined five sen to 43.5 sen, while Hong Seng Consolidated Bhd at 8.5 sen and XOX Bhd at 1.5 sen were both flat.

On the index board, the FBM Emas Index gained 58.29 points to 10,507.08, the FBMT 100 Index was 64.52 points better at 10,195.89, the FBM Emas Shariah Index increased 63.93 points to 10,810.88, the FBM 70 Index climbed 22.81 points to 13,899.10, while the FBM ACE Index slid 9.73 points to 5,319.86.

Sector-wise, the Financial Services Index put on 93.79 points to 15,822.29, the Plantation Index increased 47.72 points to 7,135.31, the Energy Index edged up 5.89 points to 823.61, and the Industrial Products and Services Index inched up 0.02 of a point to 162.88.

The Main Market volume shrank to 2.32 billion units valued at RM1.53 billion, from 2.46 billion units valued at RM1.78 billion last Friday.

Warrant turnover expanded to 462.79 million units worth RM63.61 million, versus 350.74 million units worth RM48.34 million previously.

The ACE Market volume swelled to 512.28 million shares valued at RM189.02 million, compared with 476.36 million shares valued at RM180.59 million last Friday.

Consumer product and service counters accounted for 728.96 million shares traded on the Main Market, followed by industrial products and services (469.39 million), construction (126.12 million), technology (231.79 million), special purpose acquisition companies (nil), financial services (50.94 million), property (418.43 million), plantation (35.62 million), real estate investment trusts (7.93 million), closed/funds (7,600), energy (121.17 million), healthcare (44.40 million), telecommunications and media (27.13 million), transportation and logistics (17.54 million), and utilities (42.95 million).

Source: The Edge

Comments

Post a Comment