KUALA LUMPUR (March 14): Late buying in selected industrial products and services as well as plantation counters pushed Bursa Malaysia to end at its intraday high on Thursday, amidst the mixed sentiment on regional bourses, dealers said.

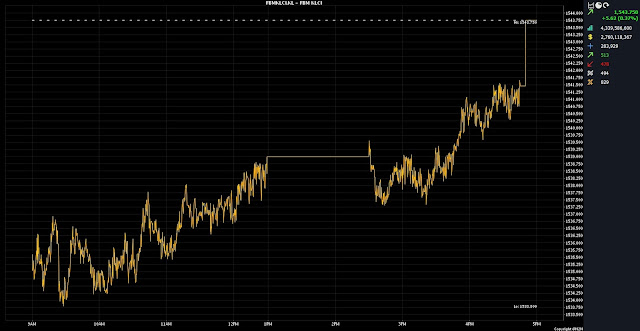

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 5.62 points to 1,543.75 from Wednesday's close of 1,538.13.

The benchmark index, which opened 2.53 points weaker at 1,535.6, slipped to its lowest point at 1,533.8 in the early morning session.

On the broader market, gainers beat decliners 513 to 478, while 493 counters were unchanged, 830 untraded and 26 others suspended.

Turnover rose to 4.34 billion units worth RM2.76 billion from 4.18 billion units worth RM2.73 billion on Wednesday.

Petronas Chemicals Group Bhd and Sime Darby Plantation Bhd were among the top contributors to the gains in the benchmark index, rising six sen each to RM6.87 and RM4.39, respectively, contributing a total 1.49 points.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said the KLCI closed marginally higher as investors seized the opportunity to bargain hunt for plantation stocks at lower levels following Wednesday's selloff.

“The key regional indices ended mixed due to mixed cues from Wall Street overnight. Investor sentiment was also dampened by increasing speculation that the Bank of Japan might consider ending its negative interest rate policy in its upcoming meeting,” he said.

On a positive note, Thong said expectations still favour the US Federal Reserve initiating rate cuts in June. This is primarily because the longer-term trend for inflation seems to be downward.

“On the local bourse, we anticipate investor sentiment to remain positive as the increasing daily trading volume signifies a higher appetite for the market. Therefore, we anticipate the FBM KLCI to trend within the 1,540-1,550 range towards the weekend,” he said.

Among other heavyweights, Maybank Bhd rose three sen to RM9.65, Public Bank Bhd perked up a sen to RM4.23, Tenaga Nasional Bhd advanced two sen to RM11.56, CIMB Group Holdings Bhd was flat at RM6.70, and IHH Healthcare Bhd slipped three sen to RM6.10.

As for the actives, Hong Seng Consolidated Bhd and TWL Holdings Bhd were flat at 1.5 sen and 3.5 sen, respectively, Eversendai Corp Bhd declined six sen to 33 sen, and Pan Malaysia Holdings Bhd put on half a sen to 20.5 sen.

Meanwhile in a filing on the exchange, Bursa Malaysia said that the short selling under intraday short selling (IDSS) for stock Comintel Corp has been suspended for the rest of the day as the Last Done Price of the Approved Securities dropped more than 15 per cent/15 Sen from the Reference Price.

“The short selling under IDSS will only be activated the following trading day, Friday March 15, 2024, at 8.30 am,” it said.

On the index board, the FBM Emas Index was 35.67 points firmer at 11,478.58, the FBMT 100 Index climbed 36.41 points to 11,141.63, the FBM Emas Shariah Index increased 41.26 points to 11,536.5, the FBM 70 Index garnered 33.62 points to 15,583.13, and the FBM ACE Index improved 21.16 points to 4,727.58.

Sector-wise, the Financial Services Index added 5.79 points to 17,241.36, the Plantation Index surged 40.56 points to 7,315.76, the Energy Index advanced 11.27 points to 917.77, and the Industrial Products and Services Index ticked up 0.41 of a point to 176.1.

The Main Market volume expanded to 3.0 billion units valued at RM2.48 billion from 2.91 billion units valued at RM2.46 billion on Wednesday.

Warrants turnover slid to 697.25 million units worth RM91.47 million from 707.51 million units worth RM85.01 million the previous day.

Meanwhile, the ACE Market volume swelled to 622.46 million shares worth RM187.89 million from 549.03 million shares worth RM183.93 million previously.

Consumer products and services counters accounted for 300.37 million shares traded on the Main Market, industrial products and services (351.25 million); construction (662.54 million); technology (753.54 million); SPAC (nil); financial services (130.33 million); property (394.59 million); plantation (41.8 million); REITs (6.89 million), closed/fund (3,200); energy (118.26 million); healthcare (43.27 million); telecommunications and media (31.83 million); transportation and logistics (116.83 million); and utilities (51.18 million).

Source: The Edge

Comments

Post a Comment