KUALA LUMPUR (March 22): Bursa Malaysia managed to recover from earlier losses to end the week marginally higher on Friday on late buying, despite the mostly downbeat performance in regional markets, said an analyst.

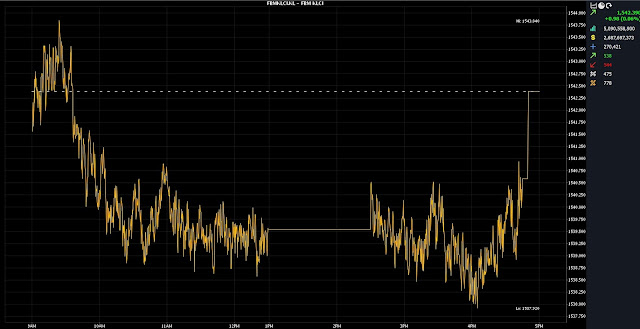

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) inched up by 0.98 of a point to 1,542.39 from Thursday’s close of 1,541.41.

The benchmark index, which opened 0.15 of a point better at 1,541.56, moved in a tight range between 1,537.92 and 1,543.84 throughout the day.

On the broader market, losers beat gainers 538 to 544, while 475 counters were unchanged, 778 untraded, and 18 others suspended.

Turnover increased to 5.08 billion units worth RM2.69 billion from 4.02 billion units worth RM2.94 billion on Thursday.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said the KLCI moved within a tight range on Friday as investors pivoted towards smaller-cap stocks, particularly those within the property, construction, and technology sectors.

"The benchmark index, however, managed to finish in the green due to late buying," he said.

Thong noted that key regional markets closed mostly lower due to differing reactions to the outlook of the US interest rate decision, with investors anticipating an earlier cut.

In Hong Kong, the Hang Seng Index tumbled 2.16% to 16,499.47, South Korea’s Kospi slipped 0.23% to 2,748.56, Singapore’s Straits Times Index eased 0.07% to 3,217.97, and China's SSE Composite Index slid 0.95% to 3,048.03.

However, Japan's Nikkei 225 rose 0.18% to 40,888.43.

Among the heavyweights, Maybank Bhd added four sen to RM9.59, Public Bank Bhd and Tenaga Nasional Bhd gained two sen each to RM4.24 and RM11.56, respectively, while Petronas Chemicals Group Bhd shed eight sen to RM6.79 and CIMB Group Holdings Bhd was flat at RM6.55.

As for the actives, Borneo Oil Bhd, Alpha IVF Group Bhd and Fitters Diversified Bhd were flat at half a sen, 32 sen and 5.5 sen, respectively.

TWL Holdings Bhd gave up a sen to 2.5 sen and SP Setia advanced seven sen to RM1.33.

On the index board, the FBM Emas Index increased 18.61 points to

11,555.1, the FBMT 100 Index was 18.28 points firmer at 11,204.18, the

FBM 70 Index surged 72.02 points to 15,970.7, the FBM ACE Index perked

up 21.01 points to 4,856.34, and the FBM Emas Shariah Index put on 19.68

points to 11,651.98.

Sector-wise, the Plantation Index gave up 16 points to 7,336.67, the Industrial Products and Services Index trimmed 0.29 of a point to 178.73, and the Energy Index slipped 0.27 of a point to 934.34, but the Financial Services Index added 45.2 points to 17,188.88.

The Main Market volume surged to 3.35 billion units valued at RM2.27 billion from 2.34 billion units valued at RM2.51 billion on Thursday.

Warrants turnover expanded to 877.09 million units worth RM117.79 million from 785.77 million units worth RM111.60 million the previous day.

The ACE Market volume dwindled to 858.13 million shares worth RM296.59 million from 893.95 million shares worth RM316.39 million previously.

Consumer products and services counters accounted for 294.02 million shares traded on the Main Market, industrial products and services (1.30 billion); construction (276.85 million); technology (164.67 million); SPAC (nil); financial services (75.56 million); property (854.77 million); plantation (35.86 million); REITs (16.78 million), closed/fund (81,000); energy (127.86 million); healthcare (48.11 million); telecommunications and media (47.02 million); transportation and logistics (58.5 million); and utilities (50.35 million).

Source: The Edge

Comments

Post a Comment