KUALA LUMPUR (March 21): Bursa Malaysia rebounded from two consecutive days of declines to close higher on Thursday, spurred by bargain-hunting activities amid the recent market sell-off.

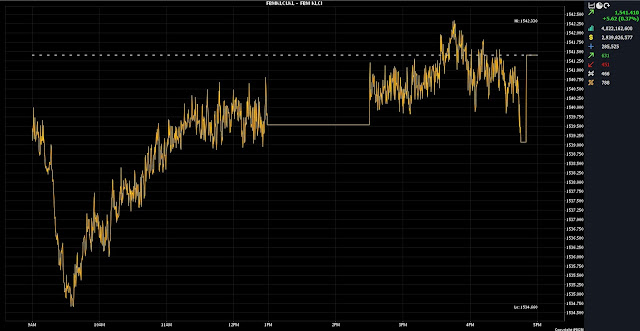

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) rose 5.62 points to 1,541.41 from Wednesday’s close of 1,535.79.

The benchmark index, which opened 3.33 points firmer at 1,539.12, moved between 1,534.66 and 1,542.33 throughout the day.

Market breadth was positive with gainers leading decliners 631 to 451, while 466 counters were unchanged, 788 untraded, and 11 others suspended.

Turnover increased to 4.02 billion units worth RM2.94 billion from 3.82 billion units worth RM2.66 billion on Wednesday.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said key regional indices closed mostly higher, buoyed by strong corporate earnings by China's technology companies, while the US Federal Reserve opted to keep interest rates steady and signalled potential consideration of at least three rate cuts in 2024.

Additionally, he said the Chinese government announced fresh measures to support the economy.

On the home front, Thong cautiously expects an optimistic outlook for the local market amidst its escalating volatility.

“Nonetheless, we maintain a positive long-term view supported by attractive valuations, robust corporate earnings, and improving economic conditions. As such, we anticipate the benchmark index to trend within the 1,540-1,550 range towards the weekend,” he said.

Among the heavyweights, CIMB Group Holdings Bhd added seven sen to RM6.55, Tenaga Nasional Bhd and Petronas Chemicals Group Bhd were four sen higher at RM11.54 and RM6.87, respectively, while Maybank Bhd and Public Bank Bhd lost two sen each to RM9.55 and RM4.22, respectively.

As for the actives, both Evergreen Fibreboard Bhd and SP Setia Bhd increased six sen to 51 sen and RM1.26, respectively, Minetech Resources Bhd was up 2.5 sen to 16 sen, Wentel Engineering Holdings Bhd climbed three sen to 36 sen, while Top Glove Corp Bhd lost 4.5 sen to 81.5 sen.

On the index board, the FBM Emas Index rose 51.53 points to 11,536.49 and the FBMT 100 Index was 47.02 points firmer at 11,185.9.

The FBM Emas Shariah Index surged 70.28 points to 11,632.3, the FBM 70 Index jumped 92.52 points to 15,898.68, and the FBM ACE Index perked up 62.32 points to 4,835.33.

Sector-wise, the Plantation Index climbed 57.94 points to 7,352.67, the Industrial Products and Services Index firmed 1.78 points to 179.02, and the Financial Services Index expanded by 19.5 points to 17,143.68.

However, the Energy Index slipped 2.06 points to 934.61.

The Main Market volume increased to 2.34 billion units valued at RM2.51 billion from 2.07 billion units valued at RM2.30 billion on Wednesday.

Warrants turnover narrowed to 785.77 million units worth RM111.6 million from 864.16 million units worth RM117.07 million the previous day.

The ACE Market volume improved to 893.95 million shares worth RM316.39 million from 846.93 million shares worth RM240.19 million previously.

Consumer products and services counters accounted for 270.08 million shares traded on the Main Market, industrial products and services (556.08 million); construction (192.82 million); technology (228.5 million); SPAC (nil); financial services (92.93 million); property (533.28 million); plantation (40.86 million); REITs (27.17 million), closed/fund (280,700); energy (147.59 million); healthcare (96.02 million); telecommunications and media (41.46 million); transportation and logistics (49.41 million); and utilities (64.05 million).

Source: The Edge

Comments

Post a Comment