KUALA LUMPUR (March 5): Bursa Malaysia recouped most of its earlier losses to close slightly lower on Tuesday as late buying in gaming, telecommunications and banking stocks supported the benchmark index, amid the downbeat performance in most regional markets, dealers said.

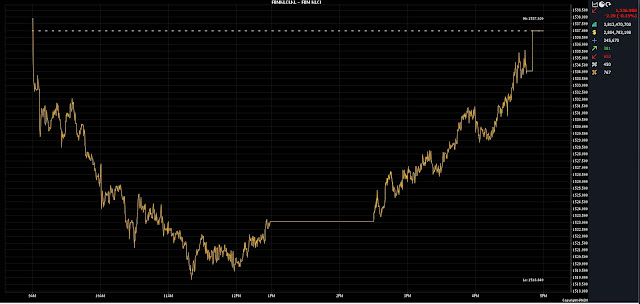

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) shed 2.29 points to 1,536.98 from Monday's close of 1,539.27.

The benchmark index, which opened 1.35 points lower at 1,537.92, moved between 1,518.84 and 1,537.92 throughout the day.

On the broader market, losers outpaced gainers 654 to 380, while 450 counters were unchanged, 767 untraded and 13 others suspended.

Turnover rose to 3.81 billion units worth RM2.8 billion from 3.32 billion units worth RM2.56 billion the previous day.

Rakuten Trade Sdn Bhd equity research vice president Thong Pak Leng said that the key regional indices mostly ended lower, seeing strong selling in technology stocks following a negative cue from Wall Street overnight.

Back home, he said sentiment turned cautious after the benchmark index broke the 1,534 support level. The next support level is seen at 1,520, he added.

“Despite the prevailing cautious sentiment, we believe the sell-off presents an opportunity for investors to seek bargains in stocks at lower levels,” he said.

Meanwhile, UOB Kay Hian Wealth Advisors head of wealth research & advisory (designated portfolio manager) Mohd Sedek Jantan said investor disappointment was particularly palpable following announcements made at the National People's Congress on Tuesday.

The Chinese government reportedly set a conservative 5% economic growth target for 2024, significantly lower than the previous double-digit figures.

“This shift towards stability rather than aggressive stimulus measures has raised concerns among investors regarding the future growth prospects,” he said.

On the local bourse, heavyweights Maybank Bhd added three sen to RM9.63, CIMB Group Holdings Bhd rose eight sen to RM6.53, Public Bank Bhd increased two sen to RM4.32, while Tenaga Nasional Bhd fell four sen to RM11.16, and Petronas Chemicals Group Bhd dipped two sen to RM6.86.

As for

the actives, Harvest Miracle Capital Bhd shrank half a sen to 13.5 sen,

Sapura Energy Bhd shaved off half a sen to 4.5 sen, Widad Group Bhd

declined 1.5 sen to 9.5 sen, and both TWL Holdings Bhd and Fitters

Diversified Bhd were unchanged at 3.5 sen and five sen, respectively.

On the index board, the FBM Emas Index was 20.09 points lower at

11,397.01, the FBMT 100 Index trimmed 19.02 points to 11,065.29, the FBM

ACE Index fell 51.2 points to 4,699.16, the FBM Emas Shariah Index lost

58.40 points to 11,385.09, and the FBM 70 Index dropped 36.72 points to

15,363.41.

Sector-wise, the Financial Services Index climbed 36.6 points to 17,290.13, the Plantation Index tumbled 117.81 points to 7,178.29, the Energy Index shed 6.49 points to 907.27, and the Industrial Products and Services Index eased 1.22 points to 174.47.

The Main Market volume increased to 1.99 billion units valued at RM2.51 billion from 1.93 billion units valued at RM2.32 billion on Monday.

Warrants turnover surged to 1.22 billion units worth RM151.75 million from 786.11 million units worth RM102.03 million previously.

The ACE Market volume expanded to 595.83 million shares worth RM140.07 million from 589.15 million shares worth RM134.95 million on Monday.

Consumer products and services counters accounted for 252.26 million shares traded on the Main Market, industrial products and services (412.72 million); construction (140.51 million); technology (197.07 million); SPAC (nil); financial services (150.35 million); property (388.42 million); plantation (41.36 million); REITs (13.19 million), closed/fund (25,800); energy (186.23 million); healthcare (42.44 million); telecommunications and media (32.13 million); transportation and logistics (29.14 million); and utilities (103.62 million).

Source: The Edge

Comments

Post a Comment