KUALA LUMPUR (March 8): Bursa Malaysia closed marginally higher on Friday in line with the positive tone from the regional markets, ahead of the US Nonfarm Payrolls data announcement later on Friday night.

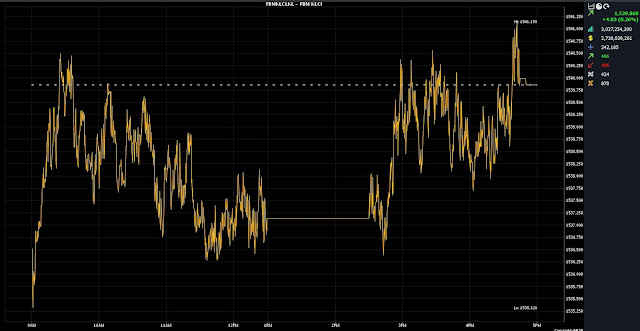

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) added 4.03 points to 1,539.86 from Thursday's close of 1,535.83.

The benchmark index, which opened 0.69 of a point higher at 1,536.52, moved within a narrow range between 1,535.32 and 1,541.15 throughout the day.

On the broader market, decliners beat gainers 495 to 486, while 425 counters were unchanged, 870 untraded, and 29 others suspended.

However, turnover fell to 3.03 billion units worth RM2.73 billion from 3.65 billion units worth RM2.66 billion on Thursday.

Mohd Sedek Jantan, head of wealth research and advisory and designated portfolio manager at UOB Kay Hian Wealth Advisors, said the KLCI is poised for potential upward movement ahead of the release of crucial US jobs data on Friday night.

“Investors are meticulously assessing various factors, including the prospect of rate cuts and the resumption of foreign net selling.

“Notably, sectors such as plantation, financial services, and energy are leading the gains, with the plantation sector particularly demonstrating an upward trend over the past three days, driven by market concerns over supply issues,” he said.

On a regional basis, Asian stock markets are predominantly on an upward trajectory, buoyed by encouraging signals from global markets and growing anticipation of interest rate cuts by major central banks.

Among heavyweight counters, Maybank Bhd added five sen to RM9.75, CIMB Group Holdings Bhd rose 13 sen to RM6.65, Tenaga Nasional Bhd perked up 12 sen to RM11.28, while Public Bank Bhd slid a sen to RM4.29, and Petronas Chemicals Group Bhd eased 13 sen to RM6.81.

As for the active stocks, AMMB Holdings Bhd gained 18 sen to RM4.13, while YTL Power International Bhd down 16 sen to RM3.67, YTL Corp Bhd slipped nine sen to RM2.50, MyEG Services Bhd dropped 1.5 sen to 77.5 sen, and Matang Bhd inched down 1.5 sen to 8.5 sen.

On the index board, the FBM Emas Index was 30.14 points firmer at 11,423.14, the FBMT 100 Index improved 32.59 points to 11,088.05, the FBM Emas Shariah Index increased 22.34 points to 11,423.98 and the FBM 70 Index garnered 60.11 points to 15,403.38, while the FBM ACE Index slid 16.23 points to 4,689.05.

Sector-wise, the Financial Services Index jumped 104.9 points to 17,368.74, the Plantation Index increased 48.52 points to 7,316.33, the Energy Index climbed 6.36 points to 903.57, while the Industrial Products and Services Index eased 0.89 of a point to 174.16.

The Main Market volume decreased to 1.8 billion units valued at RM2.48 billion from 1.86 billion units valued at RM2.31 billion on Thursday.

Warrants turnover dwindled to 798.79 million units worth RM115.89 million from 1.04 billion units worth RM137.33 million previously.

The ACE Market volume declined to 429.91 million shares worth RM128.38 million from 624.71 million shares worth RM146.57 million the day before.

Consumer products and services counters accounted for 268.77 million shares traded on the Main Market, industrial products and services (389.14 million); construction (117.3 million); technology (172.82 million); SPAC (nil); financial services (155.51 million); property (286.73 million); plantation (58.71 million); REITs (14.42 million), closed/fund (34,800); energy (107.15 million); healthcare (42.91 million); telecommunications and media (22.8 million); transportation and logistics (21.69 million); and utilities (138.93 million).

Source: The Edge

Comments

Post a Comment