KUALA LUMPUR (March 7): Bursa Malaysia closed higher on Thursday as risk appetite was lifted after Bank Negara Malaysia (BNM) kept the overnight policy rate (OPR) unchanged at 3%, a move seen as supportive of the domestic economy.

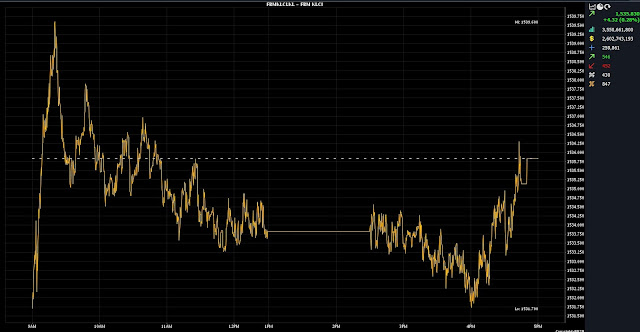

At 5pm, the FTSE Bursa Malaysia KLCI (FBM KLCI) added 4.32 points to 1,535.83 from Wednesday's close of 1,531.51.

The benchmark index, which opened 0.19 of a point higher at 1,531.7, moved within a narrow range between 1,531.7 and 1,539.6 throughout the day.

On the broader market, gainers outnumbered decliners 546 to 452, while 430 counters were unchanged, 847 untraded and 29 suspended.

However, turnover fell to 3.55 billion units worth RM2.60 billion from 3.65 billion units worth RM2.66 billion on Wednesday.

Mohd Sedek Jantan, head of wealth research and advisory and a designated portfolio manager at UOB Kay Hian Wealth Advisors, said the market was buoyed by the Malaysian central bank’s decision to maintain the OPR at 3%, in line with analysts' forecasts.

“Looking ahead, tomorrow's [March 8] release of US non-farm payroll numbers, unemployment rate and wage data are anticipated to align with market expectations, further justifying the case for the US Federal Reserve [Fed] to consider reducing interest rates in the second half of the year,” he said.

Fed chairman Jerome Powell, in his two-day Congressional testimony beginning on Wednesday, reportedly said that interest rates will be cut this year but borrowing costs will remain high going forward.

Sedek also noted that Malaysia's primary trading partner, China, reported robust export and import growth for February, with export growth accelerating to 7.1% year-on-year and imports expanding by 3.5%. “We anticipate that Malaysia's exports to China will improve following the decline observed in January, in line with this positive development,” he added.

Among heavyweight counters, Maybank Bhd added six sen to RM9.70, CIMB Group Holdings Bhd rose a sen to RM6.52 while Public Bank Bhd and Tenaga Nasional Bhd were unchanged at RM4.30 and RM11.16, respectively. Petronas Chemicals Group Bhd slid to two sen to RM6.94.

As for

the active stocks, Powerwell Holdings Bhd rallied 5.5 sen to 36.5 sen,

Econpile Holdings Bhd added 4.5 sen to RM4.10 and Velesto Energy Bhd

inched up one sen to 28 sen. Widad Group Bhd and TWL Holdings Bhd were

both flat at 9.5 sen and 3.5 sen, respectively.

On the index board, the FBM Emas Index gained 32.26 points to 11,392.99,

the FBMT 100 Index added 29.02 points to 11,055.46 and the FBM Emas

Shariah Index increased 35.71 points to 11,401.64. The FBM 70 Index

bagged 31.67 points to 15,343.27 and the FBM ACE Index gained 23.84

points to 4,705.28.

Sector-wise, the Financial Services Index picked up 32.02 points to 17,263.84, the Plantation Index garnered 47.77 points to 7,267.81 and the Energy Index improved by 1.34 points to 897.21. The Industrial Products and Services Index edged up 0.64 of a point to 175.05.

The Main Market volume expanded to 1.86 billion units valued at RM2.31 billion from 1.7 billion units valued at RM2.34 billion on Wednesday.

Warrant turnover dropped to 1.04 billion units worth RM137.33 million from 1.3 billion units worth RM174.73 million previously.

The ACE Market volume dropped to 624.71 million shares worth RM146.57 million from 642.46 million shares worth RM151.44 million the day before.

Consumer products and services counters accounted for 247.55 million shares traded on the Main Market, industrial products and services (319.63 million); construction (182.93 million); technology (168.32 million); SPAC (nil); financial services (124.16 million); property (378.82 million); plantation (107.61 million); REITs (9.20 million), closed/fund (11,200); energy (143.55 million); healthcare (55.17 million); telecommunications and media (20.89 million); transportation and logistics (20.09 million); and utilities (78.06 million).

Source: The Edge

Comments

Post a Comment