KUALA LUMPUR (March 6): Bursa Malaysia bucked the regional trend to end slightly lower on Monday (March 6), dragged down by last-minute selling of selected heavyweight stocks.

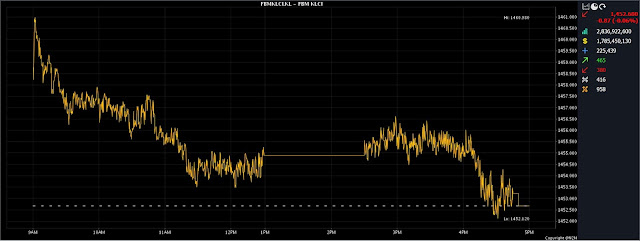

At 5pm, the benchmark FBM KLCI had eased 0.87 of a point to 1,452.68, from last Friday’s closing at 1,453.55.

The key index opened 5.22 points better at 1,458.77, and moved between 1,452.12 to 1,460.98 during the day.

However, market breadth was positive, with advancers outpacing decliners 465 to 380, while 415 counters were unchanged, 959 untraded, and 11 others suspended.

Turnover rose to 2.84 billion units worth RM1.79 billion, from last Friday's close at 2.69 billion units worth RM1.89 billion.

Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said the KLCI closed flattish after a bumpy trading day as investors were cautious ahead of Bank Negara Malaysia's Monetary Policy Committee meeting on Wednesday and Thursday. Thus, he reckoned that the indices would remain in the consolidation phase over the short term.

“Key regional indices were mostly in positive territory, following a positive cue from global equities last Friday, amid easing concerns about interest rates following recent comments from US Federal Reserve officials and the latest economic data.

“As such, we see the KLCI trending sideways with an upside bias within the 1,450-1,470 range for this week. Technically, we spot the immediate resistance at 1,460, with support at 1,440,” he told Bernama.

Region-wise, Hong Kong's Hang Seng Index added 0.17% to 20,603.19, Singapore's Straits Times Index pushed up 0.29% to 3,241.30, while Japan’s Nikkei 225 rose 1.11% to 28,237.78, and South Korea’s Kospi gained 1.26% to 2,462.62.

Among heavyweight counters at home, Malayan Banking Bhd (Maybank) declined two sen to RM8.69 a share, Public Bank Bhd was down four sen to RM4.10, Tenaga Nasional Bhd lost six sen to RM9.34, Petronas Chemicals Group Bhd went up four sen to RM7.30, while CIMB Group Holdings Bhd was flat at RM5.59.

Among the active stocks, Minda Global Bhd advanced 4.5 sen to 13 sen, Velesto Energy Bhd added 2.5 sen to 24 sen, MyEG Services Bhd gained 1.5 sen to 75 sen, while Saudee Group Bhd at four sen and Vinvest Capital Holdings Bhd at 23 sen were both flat.

On the index board, the FBM Emas Index gained 10.54 points to 10,598.97, the FBM 70 Index garnered 60.42 points to 13,507.03, and the FBM ACE Index grew 50.55 points to 5,477.28.

The FBMT 100 Index advanced 6.08 points to 10,275.84, and the FBM Emas Shariah Index gained 39.42 points to 10,853.46.

Sector-wise, the Plantation Index jumped 48.18 points to 6,879.18, the Energy Index earned 18.22 points to 889.95, and the Industrial Products and Services Index inched up 0.50 of a point to 178.15.

However, the Financial Services Index declined 57.77 points to 16,105.96.

The Main Market volume advanced to 1.98 billion shares worth RM1.47 billion, from last Friday's 1.95 billion shares worth RM1.64 billion.

Warrant turnover improved to 263.17 million units worth RM44.89 million, from 254.87 million units worth RM48.60 million previously.

The ACE Market volume garnered to 595.74 million shares worth RM268.61 million, from 479.55 million shares worth RM201.85 million last Friday.

Consumer product and service counters accounted for 482.90 million shares traded on the Main Market, followed by industrial products and services (369.63 million), construction (55.28 million), technology (264.04 million), special purpose acquisition companies (nil), financial services (55.94 million), property (138.11 million), plantation (63.05 million), real estate investment trusts (8.79 million), closed/funds (1,000), energy (311.92 million), healthcare (115.39 million), telecommunications and media (56.91 million), transportation and logistics (28.19 million), and utilities (26.46 million).

Source: The Edge

Comments

Post a Comment