KUALA LUMPUR (March 17): Bursa Malaysia rebounded and ended sharply higher on Friday (March 17), in tandem with the recovery across regional markets as worries over a global banking crisis receded, said an analyst.

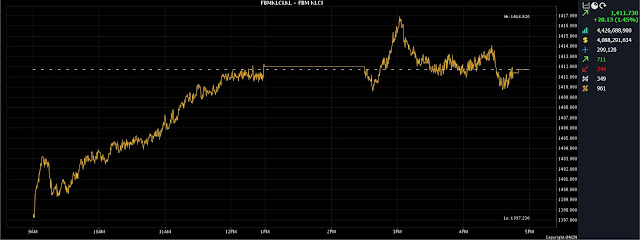

At 5pm, the benchmark FTSE Bursa Malaysia KLCI (FBM KLCI) jumped 20.13 points, or 1.45%, to 1,411.73 from Thursday's close of 1,391.6.

The market bellwether opened 5.68 points better at 1,397.28 and moved between 1,397.23 and 1,416.92 throughout the day.

Turnover amounted to 4.43 billion units worth RM4.09 billion.

Malacca Securities Sdn Bhd senior analyst Kenneth Leong said the FBM KLCI staged a strong rally on Friday, taking the cue from a rebound on Wall Street after major US banks pledged to inject US$30 billion (RM135 billion) in liquidity to rescue First Republic Bank.

"Meanwhile, RAM Ratings reassured that Malaysian banks' ratings remain intact given that the domestic banking system's exposure to bond securities is relatively low at less than 25% compared to Silicon Valley Bank at more than 50% exposure to bond securities," he told Bernama.

Echoing Leong, Rakuten Trade Sdn Bhd vice-president of equity research Thong Pak Leng said reports of major US banks collaborating to rescue First Republic Bank has boosted confidence in the US banking system.

Among the heavyweight stocks, Malayan Banking Bhd added 12 sen to RM8.38, Public Bank Bhd advanced four sen to RM3.97 and Petronas Chemicals Group Bhd surged 24 sen to RM7.23.

CIMB Group Holdings Bhd climbed seven sen to RM5.22 and Tenaga Nasional Bhd improved 20 sen to RM9.55.

Among the actives, Top Glove Corp Bhd rallied eight sen to 91.5 sen, Capital A Bhd jumped 5.5 sen to 83 sen, and Zen Tech International Bhd grew by one sen to three sen.

Minda Global Bhd garnered three sen to 14.5 sen and SMRT Holdings Bhd shaved off 5.5 sen to 51 sen.

Source: The Edge

Comments

Post a Comment