KUALA LUMPUR (March 23): Bursa Malaysia pared most of its earlier losses to close marginally lower by 0.08% on Thursday (March 23), weighed by financial services stocks amid weak market sentiment.

Banking counters Public Bank Bhd declined five sen to RM3.95 a share, and Malayan Banking Bhd (Maybank) shed six sen to RM8.49. Both counters contributed 2.81 points to the key index's fall at the close on Thursday.

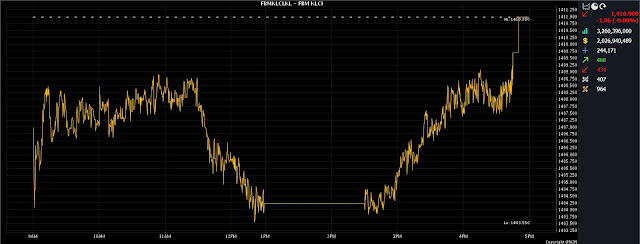

At 5pm, the benchmark FBM KLCI had fallen 1.06 points to 1,410.98, which was the day’s high, from Wednesday's close at 1,412.04.

On the broader market, decliners leading gainers 434 to 468, while 407 counters were unchanged, 964 untraded and seven others suspended.

Turnover rose to 3.26 billion units worth RM2.03 billion, from Wednesday's 3.12 billion units worth RM1.89 billion.

Regionally, Hong Kong's Hang Seng Index advanced 2.34% to 20,049.64, Indonesia's Jakarta Composite Index improved by 1.20% to 6,691.61, Singapore's Straits Times Index slid 0.06% to 3,219.00, Japan's Nikkei 225 declined 0.17% to 27,419.61, while China’s SSE Composite Index rose 0.64% to 3,286.65.

A dealer said the market reacted negatively to the US Federal Reserve's decision to hike its interest rate by 25 basis points, and investors were also cautious ahead of the release of Malaysia's consumer price index on Friday.

Meanwhile, Malacca Securities Sdn Bhd, in its research note earlier on Thursday, said investors may brace for more volatility, and would likely choose to expose further in defensive stocks in the consumer, telecommunications and utilities sectors.

Among Bursa heavyweights, CIMB Group Holdings Bhd at RM5.21 and Petronas Chemicals Group Bhd at RM6.80 had added one sen each, Tenaga Nasional Bhd advanced four sen to RM9.56, Public Bank Bhd declined five sen to RM3.95, and IHH Healthcare Bhd went down six sen to RM5.82.

Among the actives, Top Glove Corp Bhd jumped seven sen to RM1.02, Careplus Group Bhd rose three sen to 33.5 sen, Hong Seng Consolidated Bhd was flat at 13.5 sen, Zen Tech International Bhd inched down half a sen to 2.5 sen, and Computer Forms (Malaysia) Bhd slipped 8.5 sen to 35 sen.

On the index board, the FBM Emas Index was 14.31 points higher at 10,337.05, the FBMT 100 Index increased 12.57 points to 10,029.17, and the FBM 70 Index surged 100.05 points to 13,389.18.

The FBM Emas Shariah Index went up 44.17 points to 10,670.54, and the FBM ACE Index climbed 12.97 points to 5,314.65.

Sector-wise, the Financial Services Index trimmed 80.85 points to 15,566.15, the Energy Index rose 5.16 points to 811.25, the Plantation Index put on 20.33 points to 6,769.51, and the Industrial Products and Services Index added 0.46 of a point to 167.17.

The Main Market volume expanded to 2.28 billion shares worth RM1.76 billion, compared with 2.04 billion shares worth RM1.59 billion on Wednesday.

Warrant turnover swelled to 433.61 million units worth RM73.54 million, against 422.09 million units worth RM64.29 million on Wednesday.

The ACE Market volume declined to 546.78 million shares worth RM189.56 million, from 648.05 million shares worth RM232.34 million.

Consumer product and service counters accounted for 302.63 million shares traded on the Main Market, followed by industrial products and services (521.04 million), construction (56.17 million), technology (424.73 million), special purpose acquisition companies (nil), financial services (71.60 million), property (179.73 million), plantation (22.46 million), real estate investment trusts (10.33 million), closed/funds (nil), energy (120.57 million), healthcare (418.96 million), telecommunications and media (86.34 million), transportation and logistics (25.96 million), and utilities (37.89 million).

Source: The Edge

Comments

Post a Comment