KUALA LUMPUR (March 27): Bursa Malaysia struggled to stay above the 1,400-point level on Monday (March 27) amid global banking sector woes.

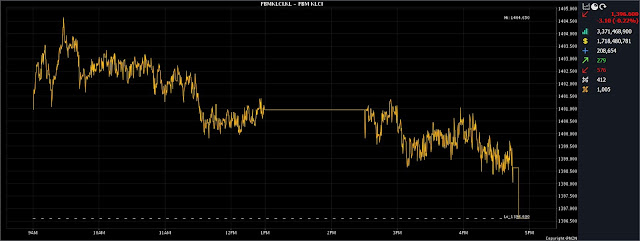

At 5pm, the FBM KLCI had lost 3.10 points, or 0.22%, to end at its intraday low of 1,396.60, compared with last Friday's close at 1,399.70.

The market bellwether opened 1.25 points higher at 1,400.95, and hit its intraday high of 1,404.65 in the early morning session.

Turnover, however, rose to 3.37 billion units valued at RM1.72 billion, from 2.99 billion units worth RM1.91 billion at last Friday's close.

Rakuten Trade Sdn Bhd equity research vice-president Thong Pak Leng said the market saw a volatile trading day, as investors remained wary that the global banking crisis would worsen.

“The key regional markets ended mixed on renewed concerns over more defaults by US and European banks, while the cost of insuring against a default is reaching threatening levels.

“Back home, we are still cautious, and believe the near-term direction of the local market is still very much dependent on global and regional volatilities,” he told Bernama.

Nonetheless, cheap valuations of the benchmark index may provide opportunities to pick up stocks at lower levels.

“We anticipate the KLCI to trend within the 1,395-1,410 range for the week,” he noted.

Among Bursa heavyweights, IHH Healthcare Bhd eased five sen to RM5.74, Sime Darby Plantation Bhd was six sen lower at RM4.17, Tenaga Nasional Bhd fell 14 sen to RM9.40, and CIMB Group Holdings Bhd shed three sen to RM5.16.

Public Bank Bhd dipped one sen to RM3.89, and Petronas Dagangan Bhd slipped 32 sen to RM20.66.

Conversely, Petronas Chemicals Group Bhd rose 15 sen to RM6.82, while Petronas Gas Bhd gained 38 sen to RM16.50.

Meanwhile, among the actives, Sapura Energy Bhd was down half a sen to four sen, Computer Forms (Malaysia) Bhd dropped 4.5 sen to 23 sen, while AT Systematization Bhd at one sen and Zen Tech International Bhd at two sen were flat.

On the index board, the FBM Emas Index decreased 24.16 points to 10,234.02, the FBMT 100 Index fell 21.42 points to 9,930.41, the FBM Emas Shariah Index went down 31.73 points to 10,567.48, the FBM 70 Index trimmed 26.08 points to 13,271.64, and the FBM ACE Index declined 86.87 points to 5,216.95.

Sector-wise, the Financial Services Index sank 27.02 points to 15,422.50, the Energy Index gave up 9.93 points to 792.95, the Plantation Index shaved off 57.21 points to 6,656.72, while the Industrial Products and Services Index inched up 0.42 of a point to 166.96.

The Main Market volume expanded to 2.13 billion shares worth RM1.45 billion, against 1.89 billion shares worth RM1.64 billion last Friday.

Warrant turnover increased to 456.14 million units worth RM66.12 million, from 415.85 million units worth RM51.81 million.

The ACE Market volume swelled to 779.51 million shares worth RM202.91 million, from 676.06 million shares worth RM216.94 million previously.

Consumer product and service counters accounted for 278.38 million shares traded on the Main Market, followed by industrial products and services (610.34 million), construction (52.17 million), technology (365.74 million), special purpose acquisition companies (nil), financial services (63.04 million), property (141.83 million), plantation (35.69 million), real estate investment trusts (4.38 million), closed/funds (6,000), energy (289.59 million), healthcare (193.42 million), telecommunications and media (50.10 million), transportation and logistics (25.45 million), and utilities (24.88 million).

Source: The Edge

Comments

Post a Comment